This week we worked closely with the MarketWatch team to explain our gold price forecast. We are grateful that both MarketWatch and Barron’s featured our work, primarily because it eventually became a more detailed gold price (GOLD) analysis piece. We summarize the key thoughts and some additional depth to it.

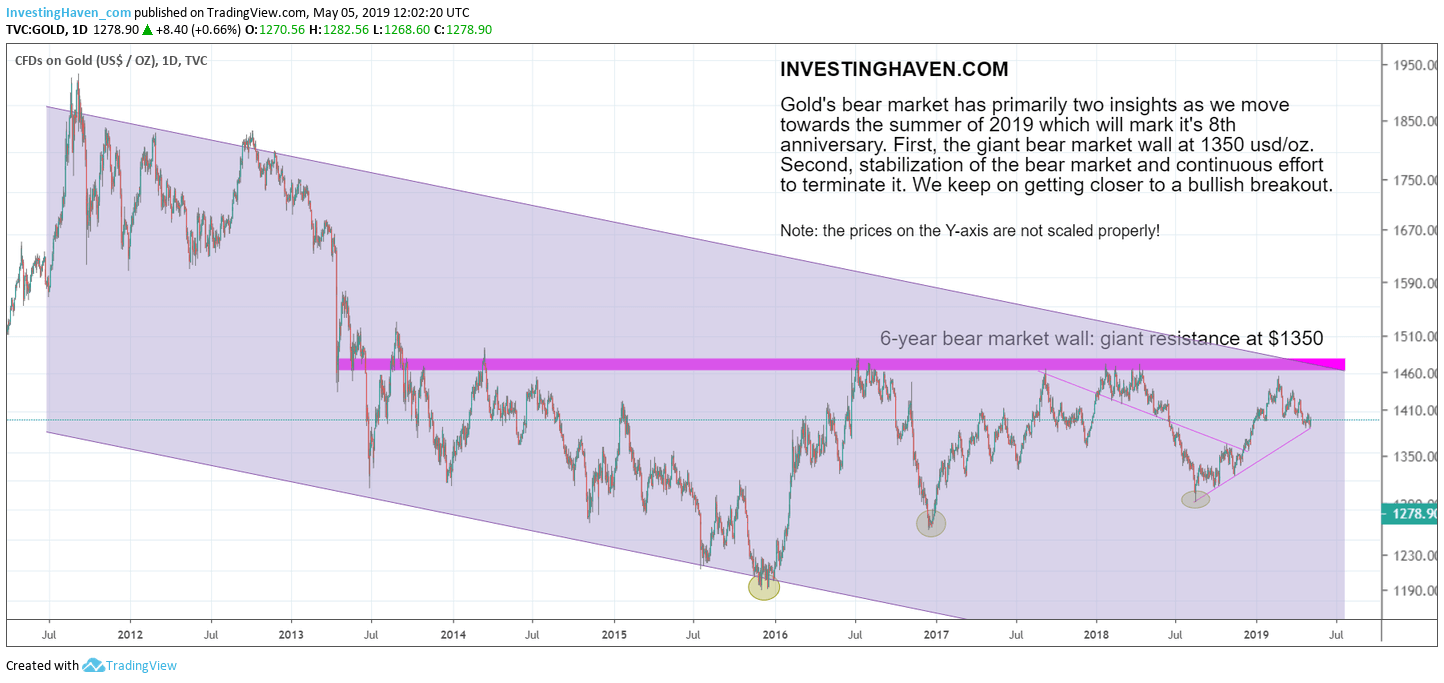

Our long standing forecast is for gold’s price to reach $1550 by the end of 2019. The most important obstacle is the giant and stubborn bear market wall at $1375 as explained in great detail in Gold Prepares 6th Attempt To Break Its Stubborn Bear Market Wall.

This forecast was featured both on Barron’s and MarketWatch this week:

- MarketWatch article: Why gold’s a ‘bargain’ at less than $1,300 an ounce

- Barron’s article: How Gold Could Stage a 20% Rally This Year

We worked closely with MarketWatch commodities reporter Myra Saefong in explaining our viewpoint and investing thesis.

We are grateful especially because financial media mostly are way too short term focused. Because of this they bring financial news in a way that may be misleading for investors to draw conclusions that are inaccurate.

As an example think of headlines like ‘stock market declines on weak jobs report’. As if there is always a direct link between both.

Gold is an ultra complex asset. This is how we framed it to MarketWatch:

Gold is one of the most complex financial assets. It may or may not move in an inflationary environment, it may or may not get a bid as a fear trade, it may or may not get left behind during a stock bull run. It moves on influencers but in an inconsistent way. Gold is consistent in medium term intermarket trends but is inconsistent in what drives its price.

Gold has not gained in 2019 amid political tensions and economic uncertainty because it tends to move inconsistently on influencers. It may or may not get a bid as a fear trade. Fundamentally, in 2019 capital has been flowing into stocks, U.S. Treasuries and recently the U.S. Dollar. When gold got a bid earlier this year investors bumped into gold’s bear market wall. This bear market wall proved to be too stubborn, so capital found its way to other defensive asset classes.

That said, the one and only thing to watch at this point in time is the next attempt of gold to break through $1375. Gold’s COT is evolving to extremes again (Gold Non-Commercial Speculator Net Positions are declining to an extreme level, so it is a matter of time until this group increases their bullish bets again, driving gold’s price again to $1375). Inflation indicators are near a decade long low.

Once these conditions become just a little bit more favorable we will see gold move to $1375. If they become significantly more favorable we will see the long-awaited turn from gold out of its 8-year long bear market into a nascent bull market.