The major move in the natural gas price in November 2018 took many investors by surprise. As it traded more than 25% higher in November 2018, those who were on the right side of the trade made substantial profits. Although natgas was not part of our 5 Must-See Commodities Charts For 2019 it certainly is part of the most impressive commodities achievements in the month of November 2018!

Those who chose to short natural gas in November 2018 saw their accounts blow up. One hedge fund for instance lost it all and the investors ended up even owing money. A painful reminder of how hedging large positions is a must. Note: this is the hedge fund we just mentioned, and this is the tweet about the effect on its investors.

Natural gas price in November 2018: seasonality or sustainable move?

So what could have contributed to this notable move in natural gas price and most important? Moreover, is this move upwards sustainable?

Seasonality is in favor of a natural gas price rebound. Seasonal increase in demand for natural gas in the winter often leads to spikes in natural gas prices. The recent parabolic move upwards from last week was a particularly strong one. This spike however seems to be also fueled by concerns about winter supplies in the US as well and the possibility of natural gas shortage in British Columbia, following a pipeline explosion and what looks like the start of a harsh winter.

Natural gas price chart provides the ‘Why’ behind the move and what’s next

Natural gas provides yet another case and proof of the importance of always checking charts, both the short and the long term charts.

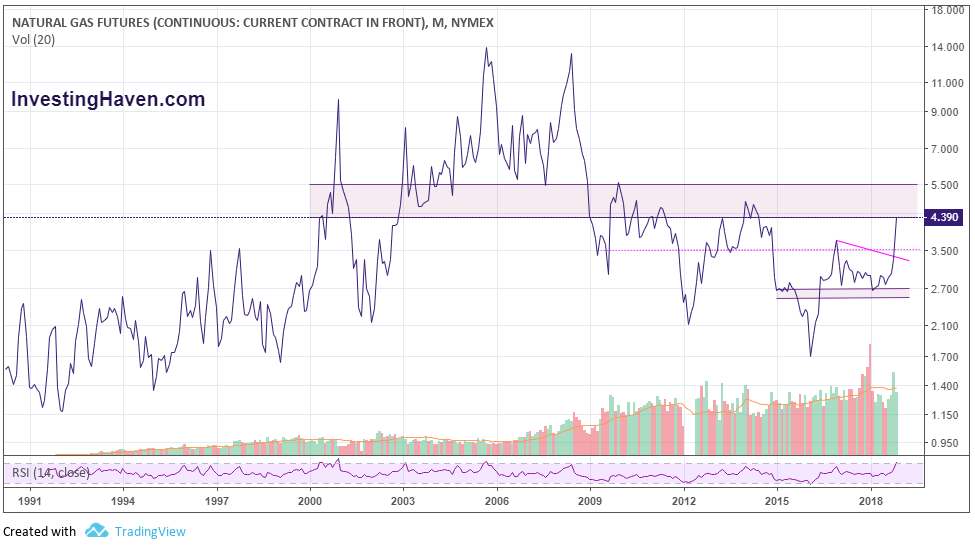

When you take a look at the natural gas price chart, you can clearly see that what happened this week was a break above an important resistance level from 2 years ago. Obviously, this break above resistance combined with the shortage news and what looks like a massive short squeeze fueled this run in natural gas price.

What investors need to watch now is the 3.5 USD level. This is an important level, as it was a multi year support turned resistance and the price just broke above it. So it is to be expected that it might revisit this level. Smart investors will be watching if this level holds as a support or if it fails, becoming therefore a strong resistance again. That’s what the confirmation or invalidation investors will be looking for.

So that would be the first thing to look for to confirm the sustainability of the move upwards or if this is a false breakout. The next very important thing is the very long term chart of natural gas as shown below. Natural gas Long term price chart (23 years) shows a heavy overhead resistance at current levels.

So to answer the sustainability of the move, we would recommend watching the price movement at the 3.5 level in the next few days. If it holds, there are chances for the price to continue in an upwards move and break above the 5.50 resistance. For that to happen, it will have to be in the next weeks as again, seasonality after the holidays will weight on the price as opposed to now.