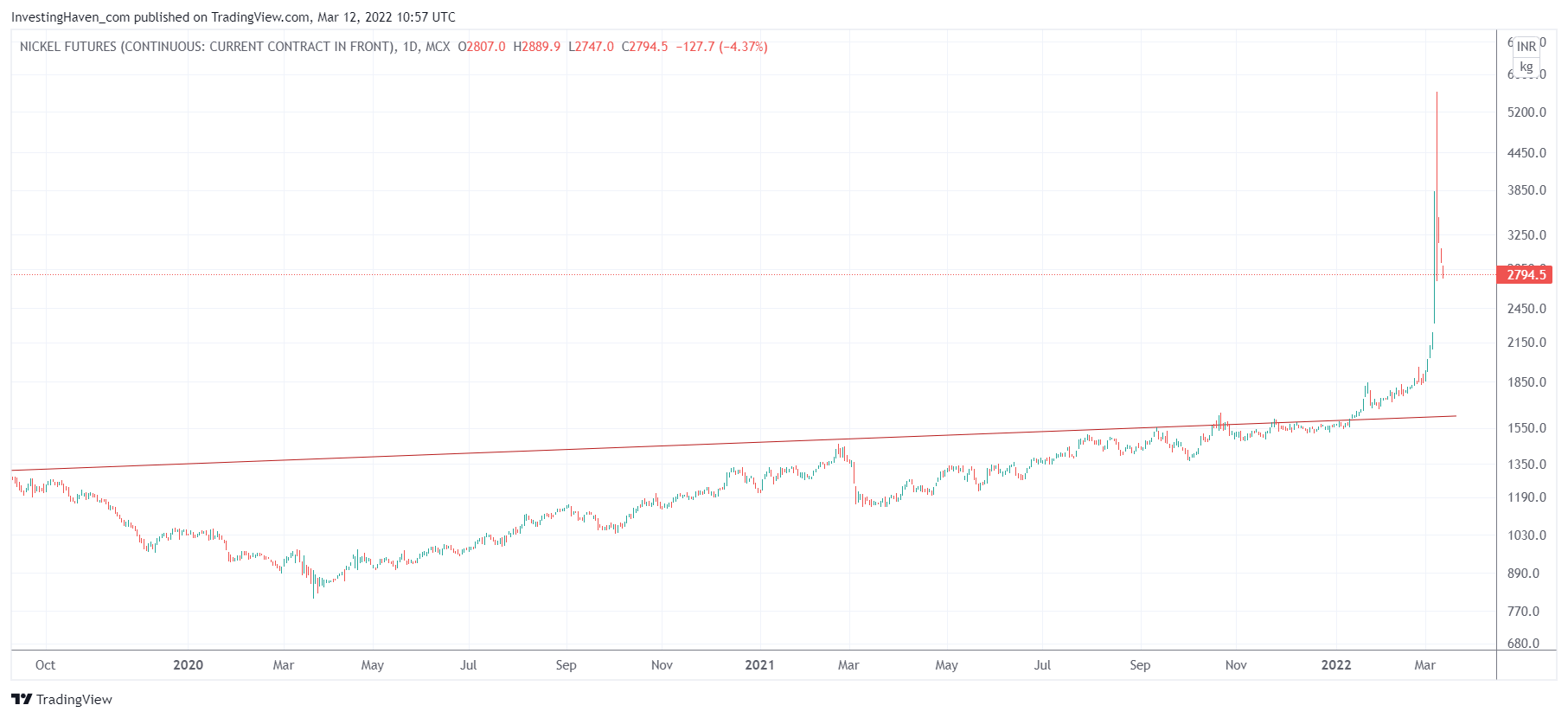

Last week, commodities went through the roof. However, on Tuesday, most, if not all, commodities started printing a topping pattern. The most extreme case is nickel. While one might think that every nickel miner is worth buying nothing is further from the truth!

Nickel is probably, by far, THE most astonishing chart of last week. With intraday moves that exceeded 60% it was a matter of time until it would come down.

What can go wrong with commodities like nickel, right? If you hold for the long term, even with the dramatic decline of the last few days in the price of nickel, there is no way you can get it wrong selecting a nickel miner?

Well, this is the stock chart of Norilsk Nickel, a giant nickel miner based in Russia. It came down some 95% in recent weeks. While anyone doing its due diligence would have understood that you don’t pick Russian stocks (certainly a company that has direct ties with Putin) it could have been not sufficiently clear how bad Russian nickel miners would get hit. Needless to say, this position is unrecoverable.

What’s the moral of the story?

What’s the moral of the story?

Very simple, as explained in our Green Battery Metals Forecast for 2022 we said that (a) not all green battery metal stocks are worth your capital (b) the green battery mega bull market is cyclical in nature.

Be careful picking stocks in sectors like lithium, graphite, cobalt, nickel. The chart can guide you, but fundamentals are equally important.

In our Momentum Investing green battery metals selection we did include a nickel miner a few weeks ago which is going through a very bullish reversal. For those that are fed with this market, its divergences and volatility, you might want to consider our automated trading services in which we trade the S&P 500 for our members (we have accumulated several profits which largely outweigh the few losses in recent months, largely outperforming our peers and indexes).