Trends, trends, trends. It really is all about trends when investing or trading markets. Being in synch with the trends is what it’s all about, and being open minded to change as soon as a trend changes. As said before in January 2020 we saw a few trend changes. Based on the current state of things it looks like we have one crucially important chart that suggests a powerful new trend is coming up, and it might be THE trend in February of 2020. After this week’s sell off in many markets you might feel like there is no trend at all (other than in the boring Treasuries market). Think twice, “there is always a bull market somewhere” is our mantra.

It was just a week ago when we wrote this article: Watch These 2 Charts For The Continuation Of The Gold Bull Market.

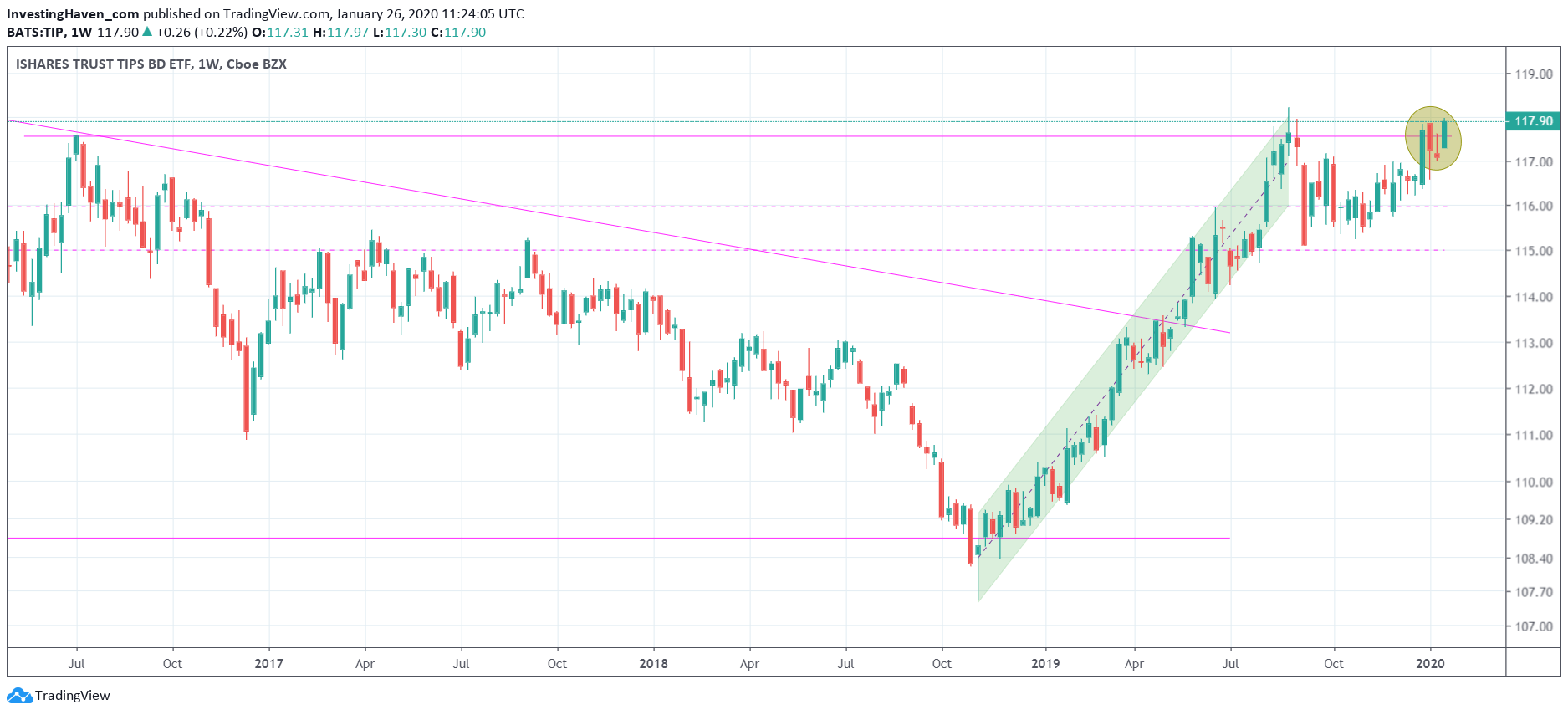

In that article we featured 2 important influencers for the gold market. The first one was the Euro chart, the 2nd one was the inflation expectations chart. We use TIP ETF to help us understand the state of inflation expectations.

The other leading influencer is inflation expectations. In all fairness the real inflation reading is sometimes influencing the gold market as well but not as often as inflation expectations. As said reading the gold market is challenging, but we want to keep it as simple as possible in this article.

We noticed that the test of its highs at 118 points got rejected (see also on below chart), and it happened exactly the same time as the Euro failed to continue its breakout (above chart). That was for us the confirmation that the gold market needed a pause.

However, we see a potential counter trend now. One day does not make a market, admittedly, but an important evolution in one week is something we do not ignore.

TIP ETF was on the move this week together with many assets in the precious metals space. We see a very, very clear direction in the gold market.