Our palladium price forecast 2019 published 3 months ago was spot-on. Palladium (PALLADIUM) has risen from $1100 per oz to $1282 yesterday. It is now at all-time highs. Is this a time to buy or sell palladium?

Not only did we discuss palladium in our annual forecast. We also features it as one of our top 5 commodities in ou 5 Charts Reveal Our Commodities Outlook for 2019.

That’s where we depicted a number of factors which were the basis for our bullish palladium forecast:

- A supply deficit which is building up for 5 years.

- A massive physical palladium exodus from ETFs which is reaching its limits.

- A gold friendly environment as per our Gold Price Forecast 2019.

This is the quote from 3 months ago: “InvestingHaven’s research team is on record with a palladium price forecast for 2019 of $1375 which likely will be a medium to long term top. It certainly is a profit taking price level if and once it gets there.”

As a market becomes very bullish it is instrumental to stay focused on the chart. As per our 100 Tips For Successful Long Term Investing:

Entering a position is not the toughest part. Exiting a position in time to ensure an investor take profits but also protects its risk is, by far, the toughest part. The most important way to determine exit positions is to look for horizontal and diagonal resistance points on long term charts.

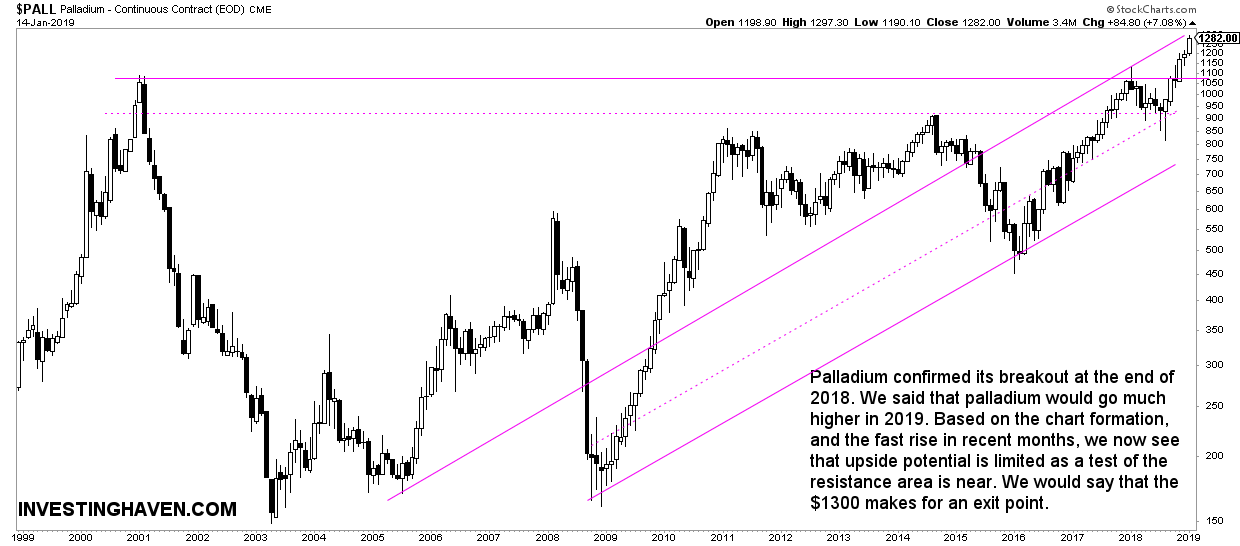

So the million dollar question for any palladium investor is which exit point to consider on the monthly chart of palladium. Forget the news at this point in time, it is a lagging indicator. As expected Bloomberg is there with a palladium update that its price will go much higher, which it may, but at this point in its rise it is the chart (not the news) that matters to investors!

Based on the up-to-date chart formation, and the fast rise in recent months, we now see that upside potential is limited as a test of resistance in the rising channel is near. This is a resistance point investors better not ignore.

We would say that the $1300 to $1350 area makes for an exit point assuming it will be when palladium’s price touches resistance of its rising channel.

The most likely path after this is that palladium will backtest the breakout point at $1075. This will be the most important event on the palladium chart in 2019. A successful backtest of $1075 in 2019 would make this precious metal much more precious than it already is!

[Ed. note: As of this week we will provide in-depth analysis to our ‘free newsletter’ subscribers. We will bring premium content with specific (gold and silver) investing tips on a weekly basis, mid-week, free of charge. We will do this for 4 to 6 months. Subscribe to our free newsletter and get premium (gold and silver) investing insights in 2019 for free. Sign up >> ]