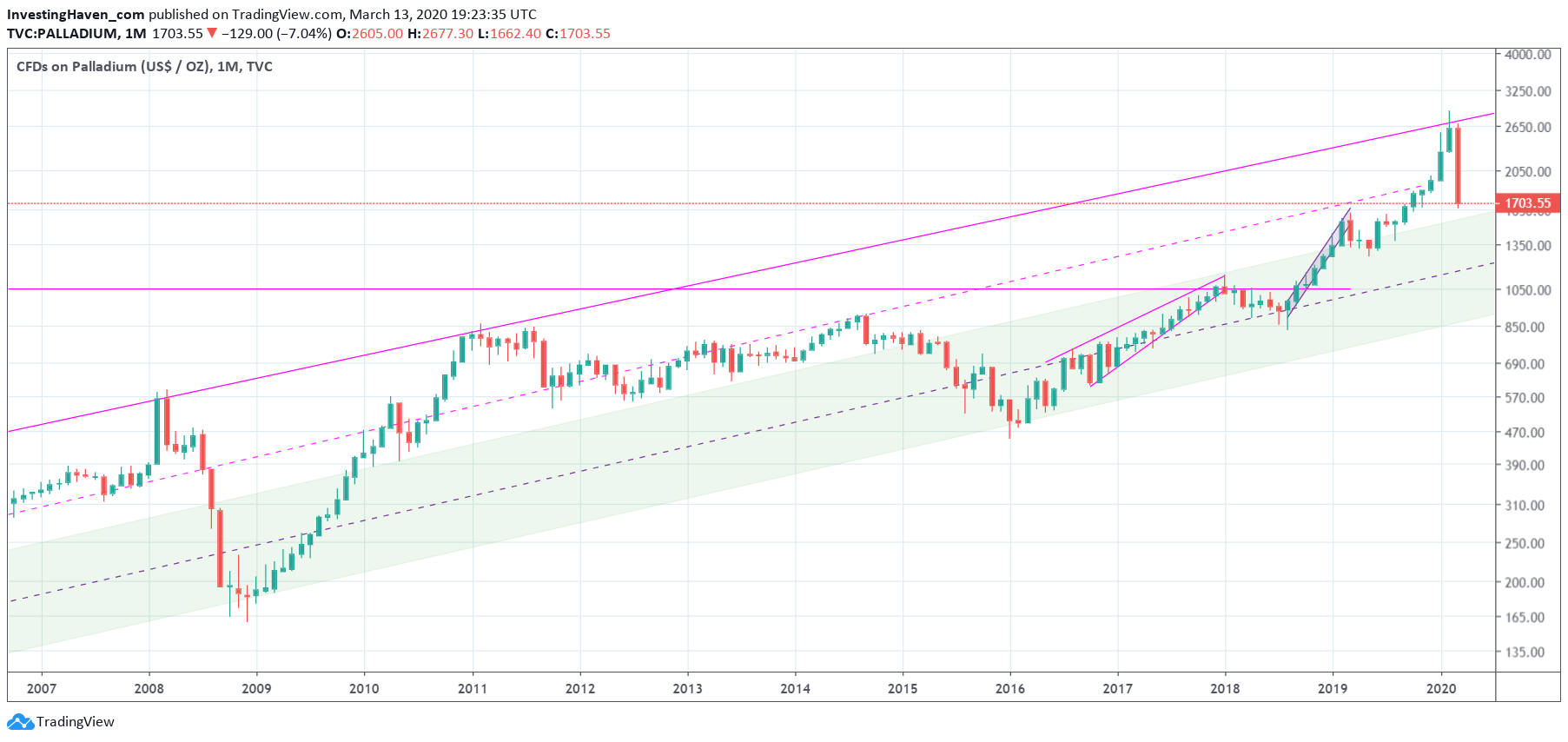

In the last 2 weeks literally each and every asset in financial markets got crushed. The only man standing is the Euro, even though it took a small beating of 4% in the 2nd part of this week. Palladium was the last asset to undergo a crash. On Friday February 13th, 2020 it sold of 18% on one single day. It dragged down the entire precious metals market, with unusual gold price of declines -3%. Our palladium price forecast of 2550 USD was met just one week earlier, and it came with a big sell off.

It was an historic week in financial markets in which all crash records were broken.

Not any asset was able to stand strong with the exception of the Euro. Continuous selling in broad indexes in the US (S&P 500, Dow Jones) with multiple declines of 10% is not exceptional, it is rather unique and may never occur again in our lifetimes.

Palladium was one of the few assets that was not hit by selling. But it did not last long, and on Friday it was the one but last asset to sell off with a similar magnitude as all other assets.

The 18% one day decline on Friday Feb 13th, 2020 brought the price of palladium back to its normal rising channel.

This is not a time to catch a falling knife. Those who missed the palladium rally should just wait, no reason to hasten to get in again. This asset needs time to recover. Moreover, as long as broad markets are ultra volatile we cannot reasonably expect any commodity to remain in a bull market.