We featured rare earth metal stocks as part of our annual 2021 forecasts. We had a bullish stance rare earth metal stocks forecast 2021, and still have a bullish outlook. The REMX ETF representing the rare earth sector is close to completion of a 7 year bullish reversal pattern, now THAT is a powerful setup.

As said many times investors should start assessing an investing opportunity by looking at the the big picture.

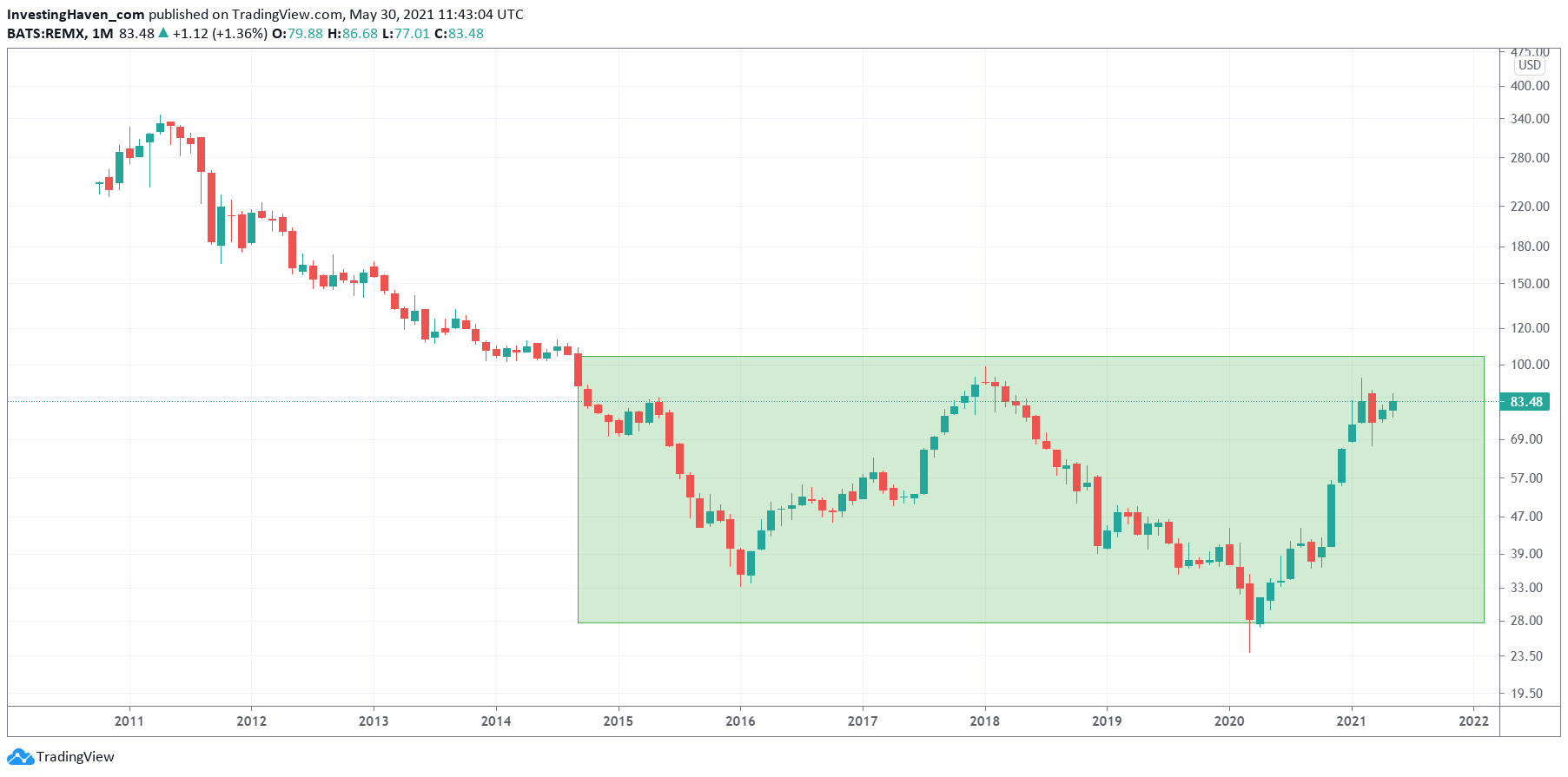

When it comes to rare earth metals stocks we look at REMX ETF. Its monthly chart has a clear setup:

- A bullish reversal that is for 7 years in progress.

- The first leg took 2.5 years to complete.

- The second leg is in progress, and it close to completion after 3 years.

- Notice how the setup near the end of the first leg is different compared to the one in the last few months.

The real secular breakout level is 100 points (approx.), REMX ETF currently trades around 83 points. We can reasonably expect some hesitation around 100 points. Once 100 points is cleared we would not be surprised to see this instrument move to the 220 level. That’s an almost 3-fold rise against current levels.

Why would rare earth metals such as dysprosium, neodymium, terbium, europium and yttrium have a great outlook? Because of their utility in green energy which is unfolding as the renewable energy revolution:

The usage of these [rare earth] metals in our most advanced technologies and which form a critical part of the renewable energy revolution should be handled with careful, sincere and cleaner measures if the way forward has to be greener and environment-friendly.