We released our long awaited silver forecast 2023. We continue to be bullish on silver and believe that silver will hit 34.60 USD in the 2nd half of 2023. There is one really interesting leading indicator that we have to share in a dedicated post: the silver CoT report with trends going back 10 years in time!

When it comes to silver’s leading indicators in 2022 we noticed the following:

- Leading indicator Euro (positively correlated to silver) turned bearish in Q2/2022.

- Leading indicator inflation expectations turned bearish in Q2/2022.

- The silver CoT turned bullish, extremely bullish.

Consequently, once the Euro and inflation expectations start rising, we see silver taking off.

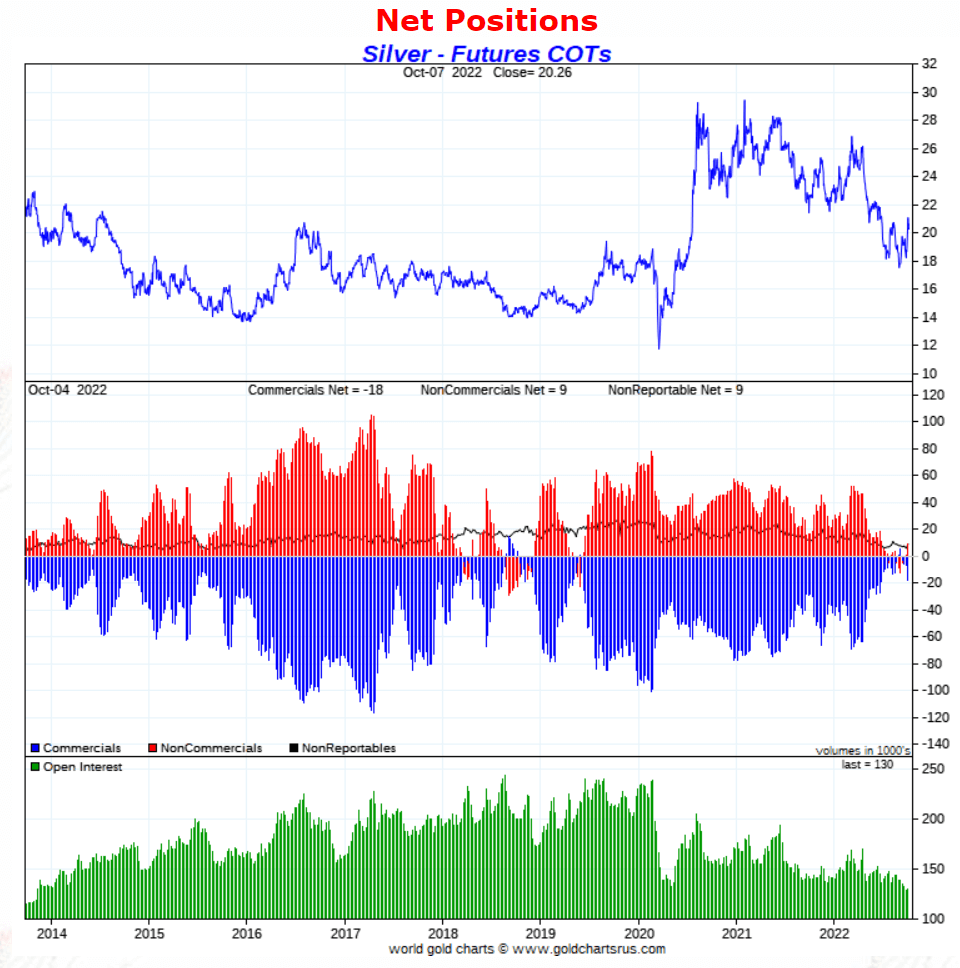

We want to hone in to the most bullish silver leading indicator: the silver CoT report. We explained the dynamics of the CoT report in the past. Essentially, it is a stretch indicator. Whenever commercials hold low net short positions, it means that the silver price has not a lot of downside; whenever they are heavily net short there is not a lot of upside to the silver price.

This is what we conclude, looking at the 10 year pattern of the silver CoT:

Right now, as per the data on the center pane (blue and red bars) we see that commercials and non-commercials have extremely low net positions, historically low. This is a setup that supports rising silver prices.

Moreover, as Ted Butler, leading expert in analyzing the gold/silver CoT reports, points out, there is extreme tightness in the physical silver market. He concludes this from the extremely high turnover in physical silver warehouses, a data point that goes unnoticed by other silver analysts.

The chart below is the fuel for the price of silver once the other silver leading indicators turn bullish in 2023.