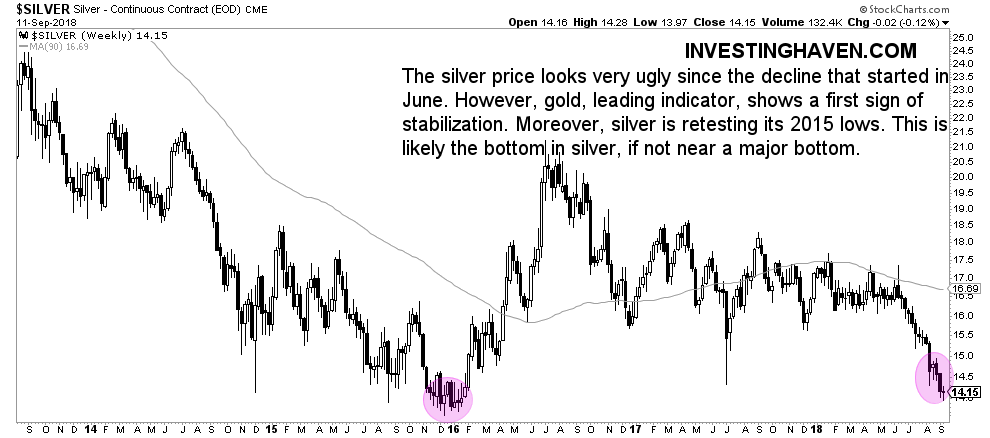

Our ultimate downside target from our Silver Price Forecast For 2018 is being hit. As the silver (SILVER) bear hits many investors we look at the silver market and conclude that all is good. At a time everyone panicks we remain focused on the chart and leading indicators, and conclude that silver investors should remain calm, this is why.

First, the silver market ‘feels’ scary, without any doubt.

However, a closer look reveals that things are under control.

The most important fact remains the futures market structure. As explained in Will The Silver Miners Crash Of 2018 Continue the silver futures market suggests a mega bottom is being set.

Moreover, by looking at the right timeframe of the silver chart we identify the potential of a double bottom against 2015. If, and that’s a big IF, this double bottom will be confirmed, it will be a very bullish signal!

There is more to say about the silver bear …

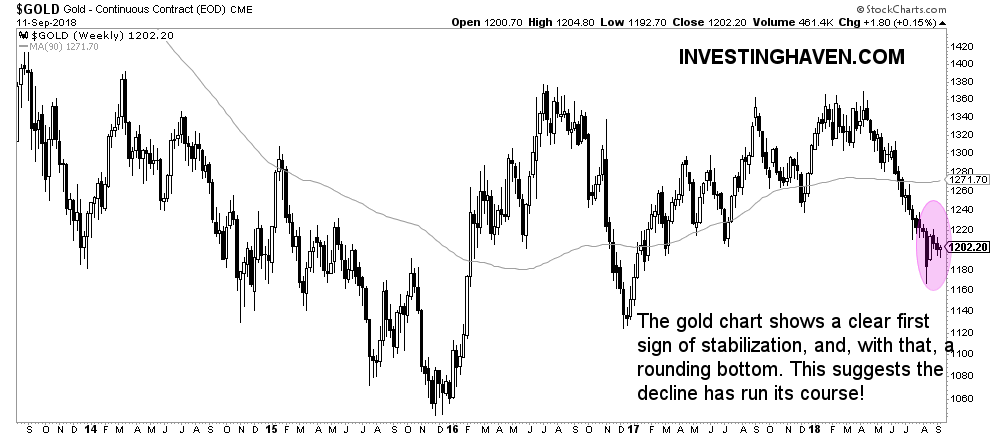

Moreover, most importantly, we should remain focused on gold. That’s because the gold market is the leading indicator in the precious metals market. Especially when precious metals sell off and/or set a blow off top (in both instances) silver tends to react in a more ’emotional’ way than gold. That’s why we keep on repeating that gold is the leading indicator!

The gold chart starts showing signs of selling exhaustion. We start seeing stabilization, and the first signs of a rounding bottom being set. Note that the aggressive shape of the recent decline is changing pattern. Smart investors pay attention to these early signals!

All in all, taking the futures market and the gold chart into account, we believe that the potential for a double bottom in silver is very high. That’s why we believe this is a buy opportunity to get into silver, as well as top silver miners like First Majestic Silver.