We said two weeks ago that silver would be the next play field for the Reddit WallStreetBets crowd, and we got a huge pump followed by the inevitable pump, both in line with expectations. Fast forward, two weeks later, and we finally see a more orderly setup in silver. Yes, it’s ready for a breakout. Our bullish silver forecast might be underway now, faster than expected, who knows. Our best guess prediction is that silver is trying to start a normal, structured breakout. And we see price action that we like.

RELATED – Silver Is Now Officially In A New Secular Uptrend(added on Sept 7th, 2024)

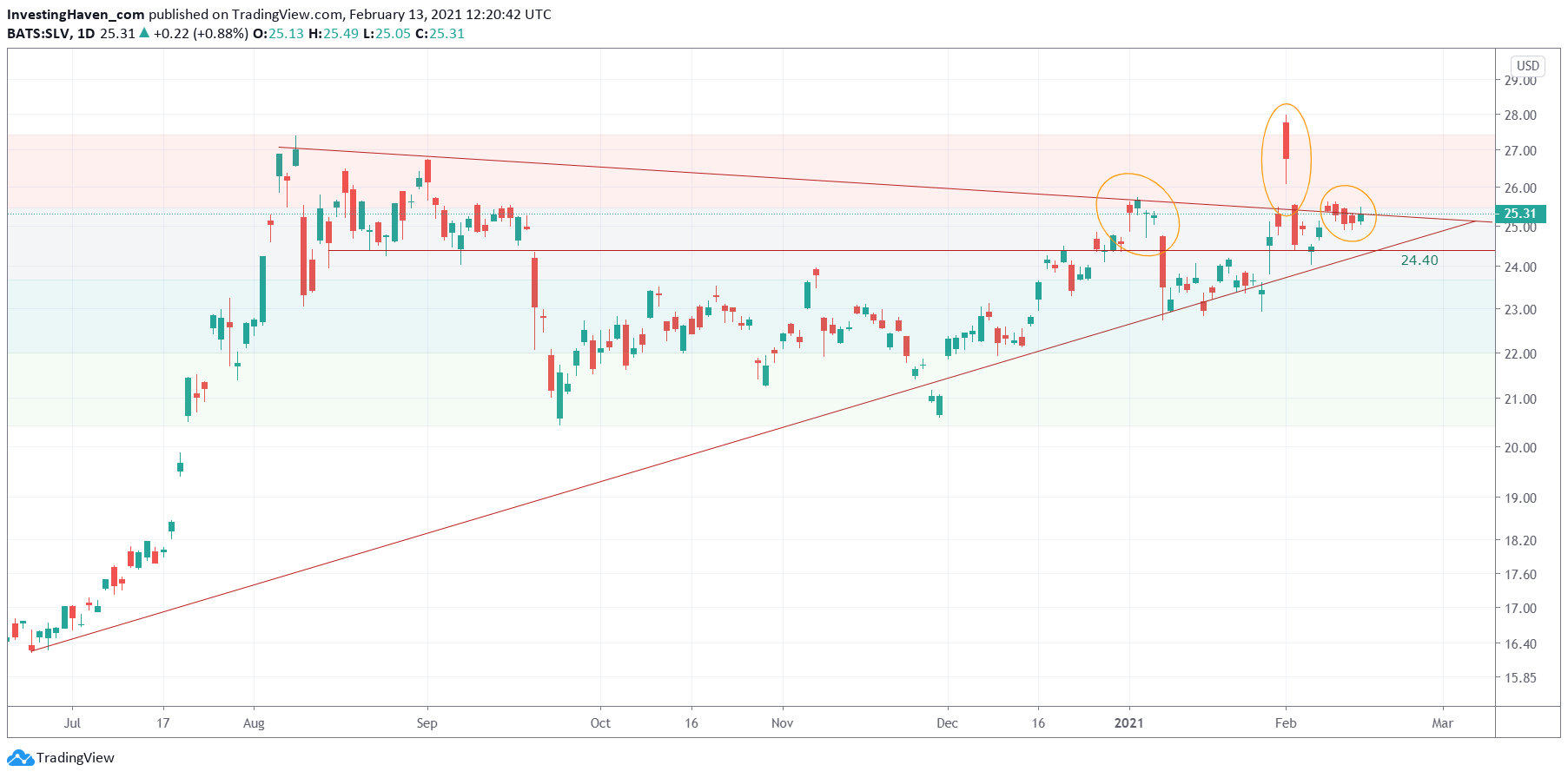

SLV shows 3 breakout attempts over a period of 6 weeks. We did indicate them on below chart with the 3 circles:

- Circle #1 was the first week of January. Silver wasn’t successful in moving higher, and the reason was that the USD was powerful on Jan 7th as well as Treasuries breaking down (yields up) on that same day. Very bad for gold and silver, but silver did a bullish backtest a few weeks later … not a breakdown.

- Circle #2 was presumably the Reddit-induced frenziness. Remember: extreme trading activity is never sustainable, and finding the right exit in such conditions is harder than you think.

- Circle #3 is really different. Yes, we believe this time is different. We see 5 full candles testing the breakout level. This is solid price action, we like this a lot. It gives us confidence, for sure if we consider that the bodies of the candles are side-by-side, without gaps in between them.

The message of this chart is very clear: once SLV succeeds in showing at least 3 daily candles that print an open + closing price above 25.40 USD it will be a confirmed breakout.

Moreover, the first target of this setup is 27.50 USD, the second one between 30 and the mid-30ies.

Is SLV able to move to its previous all time highs? In other words is silver spot able to move to 50 USD? Not likely, but never say never. There is a reason why silver is called the restless metal.