Our focus since mid-May has been on silver. In our portfolios we added silver positions. We firmly believe silver is preparing a secular breakout. It is a matter of when, not if. The daily silver chart has this double cup and handle, over nearly one year. Explosive! We firmly believe that our silver forecast for 2021 which we published 9 months ago is underway, with a price target of 37 USD. Interestingly, silver miners lost value in recent weeks, and because of this they are now in an area which we consider ‘historically cheap’.

In this article we feature one more silver chart: silver miners relative to the silver price.

In other words, how expensive or cheap are silver miners when expressed in the price of silver? And what can we see if we plot this ratio on a 10 year chart?

We clearly expect the price of silver to move higher starting this summer (any moment, essentially). This should push silver miners higher, and silver miners have a track record of moving with leverage against the silver price.

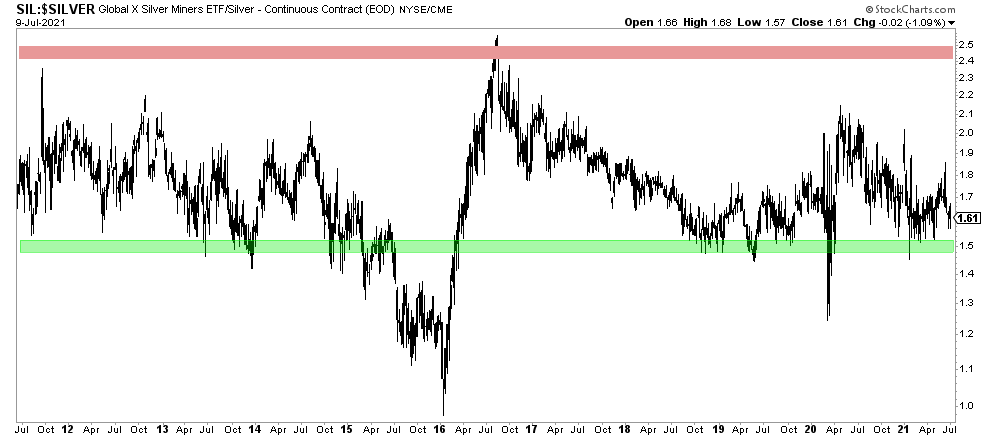

Below is a pretty interesting chart: the 10 year silver miners price (SIL ETF) relative to the price of silver. We did annotate in green the area which we consider ‘relatively cheap’ and in red ‘really expensive’ as per this ratio.

With a reading of 1.61 (Friday’s close of the market) one can clearly see that this ratio is very close to the green bar. In other words, historical standards suggest that silver miners are now really low valued relative to the silver price. IF (and that’s a big IF) silver is going to break out (3 daily closes above 28.25 USD) it will push silver miners much higher.

We believe this one more chart that suggests that silver miners are worth buying.