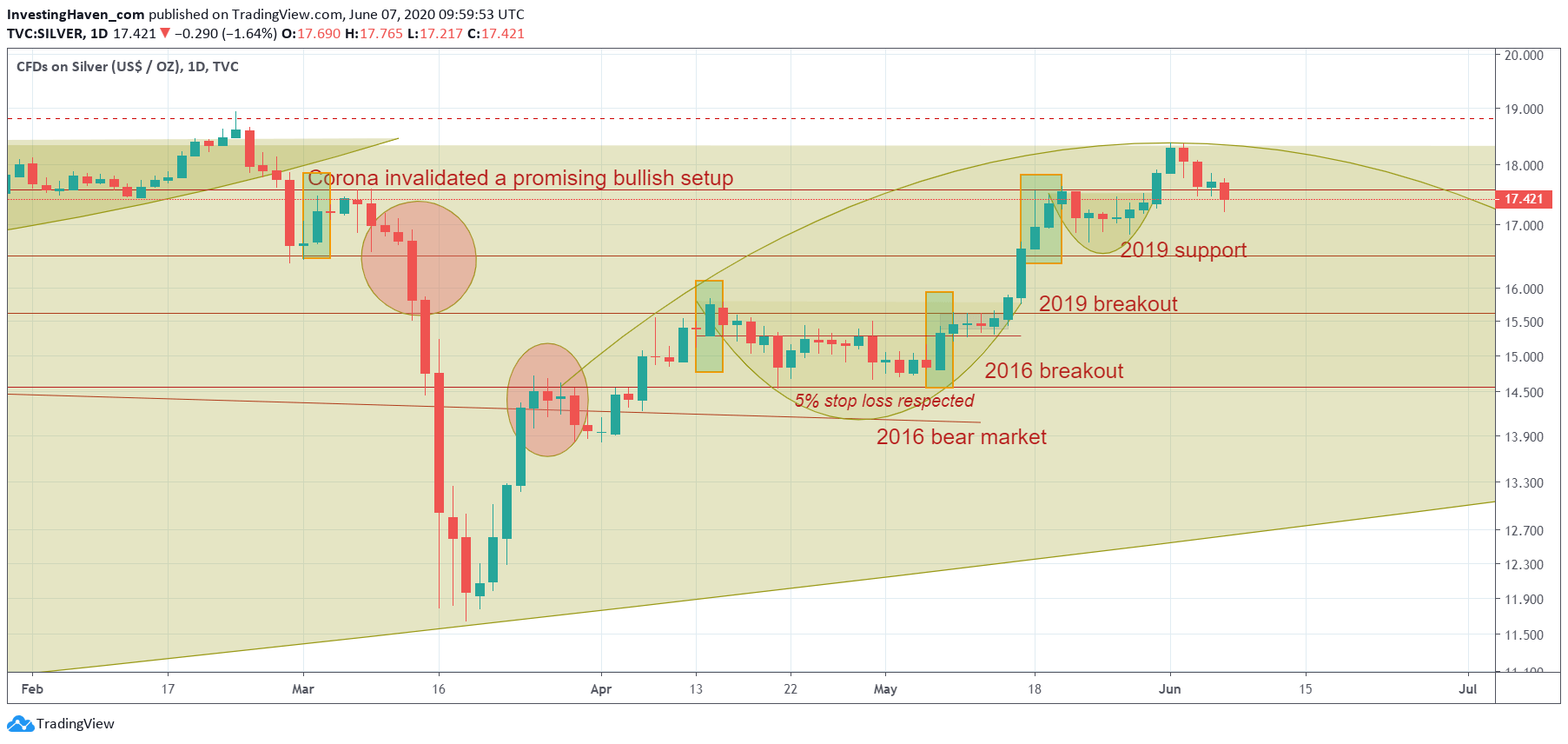

Silver was looking really, really good last week. But it got stopped cold by strongly rising interest rates this week. That’s what we explained earlier today in Gold Miners Struggling, Prepare To Pick Up Quality Gold Stocks With A Discount Later In 2020. Did silver peak for the year? Or is this a temporary retracement before breaking out? We’ll address this question in this short article, and we’ll use the insights from our silver price forecast as background.

Yes, last week we had a hidden signal, a strongly bullish one, when we wrote this: Hidden Signal: Can Silver Break Out At This Decisive Point?

We said that we believed the silver rally had legs, for these 2 reasons:

- Our hidden signal occurred right at the short term breakout level right below 17.5. This suggests this short term breakout is powerful, and will bring silver to 18.5 to 19.0 USD.

- Moreover, as gold tends to lead silver higher, as said above (from our previous article(s)) we see good upside potential in gold. Most likely when silver hits 18.5 – 19.0 gold will still be rising. It will be the decisive push higher for silver.

And concluded with: “The end of the silver uptrend is not in sight, on the contrary, this silver bull run has legs.”

So then what happened this week? Why did silver’s rally stall, and is it time to exit the silver market?

There are a few answers to these questions:

- The gold market got a beating this week because of strongly rising rates. Never good for gold and silver.

- However, this may be a short term move, and rates may not have much more upside potential.

- In other words, the market needs to prove how much upside rates have, and how much downside gold and silver have.

- Between now and then we’ll assess strength and pace of the retracement in gold, silver, miners. This will lead our investing decisions for our medium term portfolio.

- Long term positions in gold and silver should not be closed, but partial profit taking may be a good idea.

Regarding point 5 it is crucial to distinguish timeframes when making investing decisions. Precious metals look good for the long term, but short to medium there *may* be more downside.

Pick your timeframe, be consistent in your analysis and decisions.

In our Momentum Investing research we focus extensively on precious metals. We held one precious metals stock with a very promising setup, but when we saw the signs of this topping formation shown on below chart. We are very closely watching gold and silver miners to buy quality miners at a discount later in 2020.