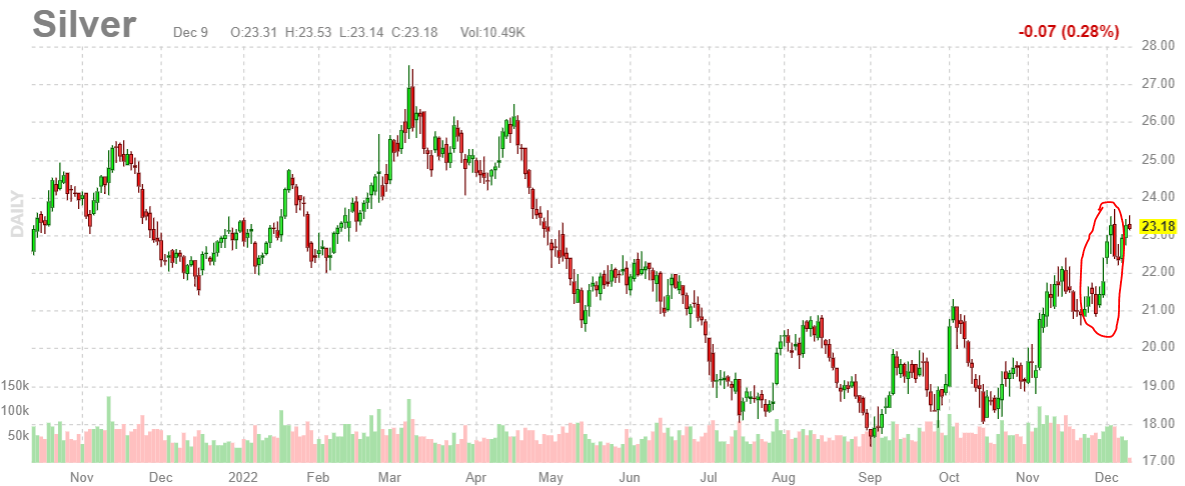

Silver is in a great shape. It went from 18 to 23 USD/oz in less than 2 months. This chart setup, combined with leading indicators, is clearly confirming our bullish silver forecast for 2023 and beyond. The question is whether this is the right time to enter. The answer to this question is about on the Silver Chart Bullish Reversal Structure which was almost complete two weeks ago (now complete).

Before looking at the silver chart we want to emphasize the two most important articles we recently wrote (many more silver articles here):

One Silver Chart Justifies ‘Buy The Dip’ For Long Term Positions (written almost on the day that silver dipped):

The gold to silver ratio says that silver is a screaming buy: the gold to silver ratio over 50 years. Readings above or near 100 (gold price : silver price) are long term buy opportunities. It happened 2 times in history, a few weeks ago was the 3d time.

We followed up a few weeks ago with news from the physical silver market in the article entitled Silver: A Divergence Of Epic And Historic Proportions:

This physical market imbalance (supply shortage) is historic, it’s not just a big supply shortage jump of 4x against last year. Sooner or later, price should adjust to this reality, is what we are thinking, even though the physical silver market may not be the ultimate catalyst of the silver price. The catalyst is (unfortunately) the silver futures market, but then again the silver CoT report remains very bullish.

Indeed, sooner or later the silver price should adjust to the physical market reality.

Let’s go back to the question about a good entry in silver. In order to answer the question about a silver entry, we will use the daily chart without annotations.

Our view is that the silver price chart is now confirming but also completing a bullish reversal. It is now finding resistance in the 23 to 24 area. We believe that silver is not a runaway market, the most acceptable outcome is a consolidation.

Where will silver consolidate?

We believe the 4 green consecutive candles are the perfect spot for a consolidation, see red annotation on the chart. Those 4 candles are printed in the area 21.2 – 23.2 USD/oz. We can reasonably expect a consolidation in this area.

Let’s put it differently: IF (which is a big IF) silver is going to consolidate and find decent support around 21 USD/oz, it will be an outrageous, aggressive, strong BUY for the long term. It might even be the last chance to get in after which silver will not look back for many years to come.