The price of silver got hammered last week. After an 8 day losing streak it should be time for a break. But how concerning is the situation in silver? Also, do we still believe our silver forecast is valid? We look at the silver chart and the USD chart to answer this question.

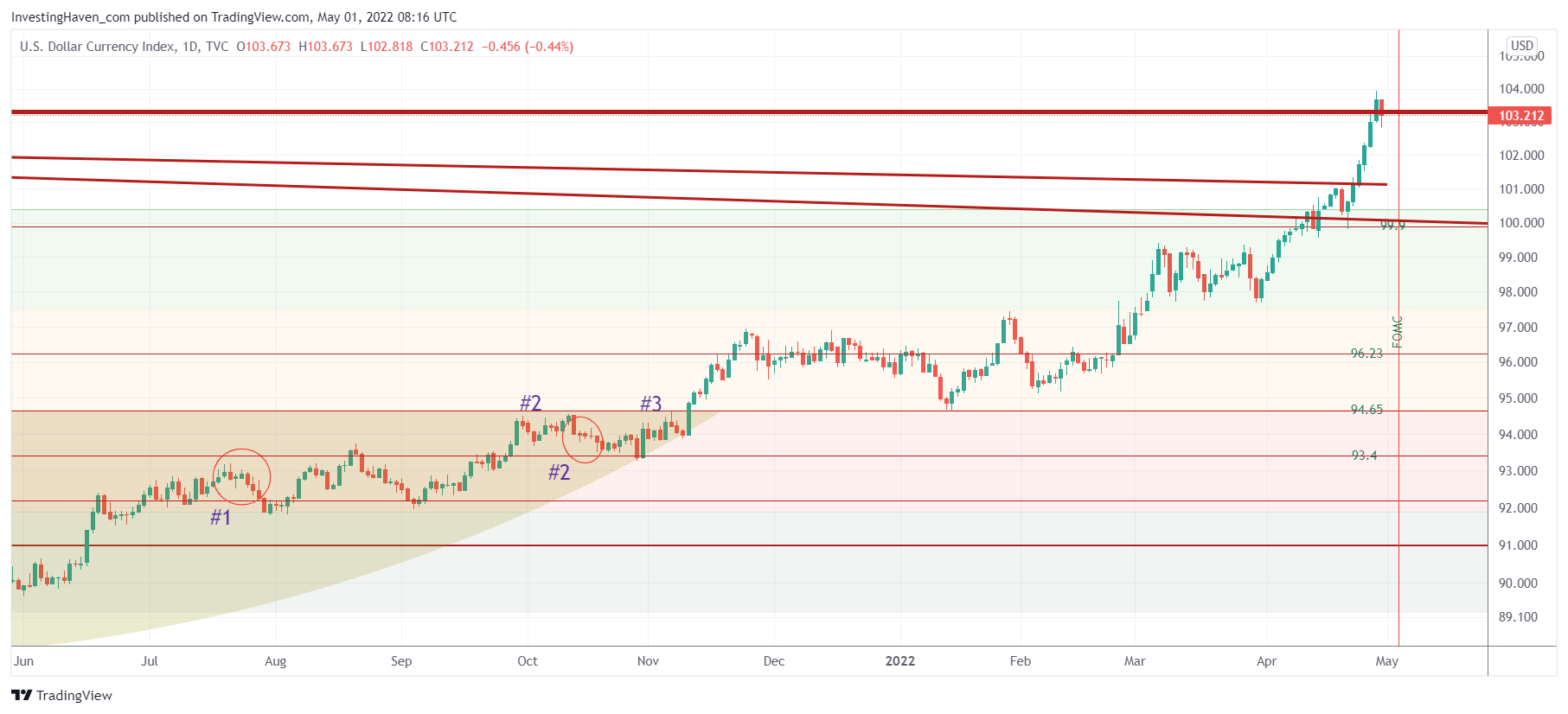

We will start with the USD chart as it’s the driver of weakness in precious metals. We notice a 7 day winning streak on the USD (7 green candles in a row), Friday was the first red candle.

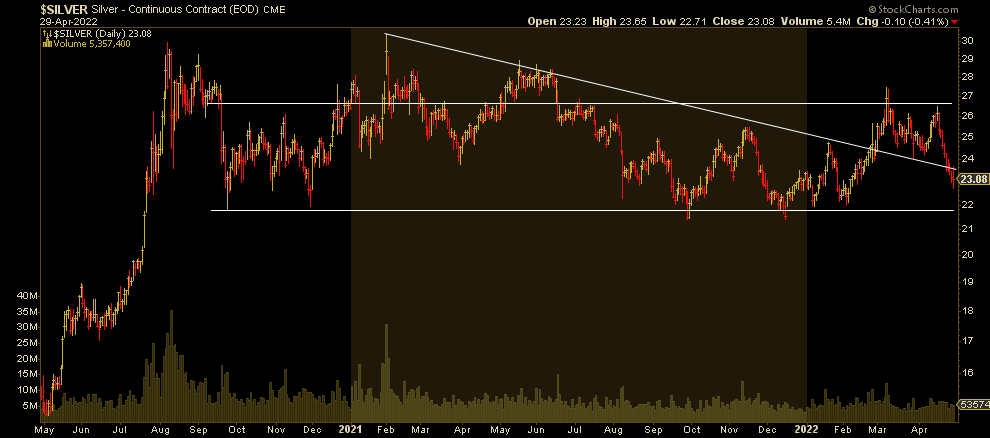

No surprise, silver has been losing ground for 8 straight days.

The USD arrived at the crucial 103-104 level. We marked 103.3 and said to our members that it’s the single most important price point on the USD chart. The USD should calm down here in order to let silver shine.

The silver price chart in the meantime does not show any structural damage, even after declining for 8 straight days. What we observe is resistance at 27 USD (spot silver) and big support right below 22 USD. Moreover, silver is right now testing a falling trendline, the one that originated from the ‘Reddit pump’ in February of 2021.

So, there is not a lot that we can learn from both charts, right?

Not that fast. We believe that there is one elephant in the room here: the USD is hitting multi-year highs while silver continues to consolidate. It even did not hit key support, not yet.

In other words, we believe that silver is showing relative strength in the light of an ultra-strong USD.

Stated differently, IF and WHEN the USD would decide to calm down it would open the door for a big run in silver. The one and only question is whether the USD will find resistance in the 103.3-104.0 area or whether it will clear this level (on a 3 week closing basis). We will know soon, and the attractiveness of silver as an investment (also if our silver forecast will be in play) will become clear very soon! Our best bet is that silver support will be respected.