Silver had some good momentum in the last 4 weeks. Investors are now waiting for this magic breakout moment to occur. When exactly will silver move above 30 USD, and start its move to 36 – 38 USD? According to our silver forecast 2021 we expected the second part of the year to be bullish for precious metals, and it’s happening almost exactly as expected. The million dollar question is how much more upside is there in the silver market?

RELATED – Silver Touched $30 an Ounce This Year. How Much Higher Can Silver Go? (added Sept 7th, 2024)

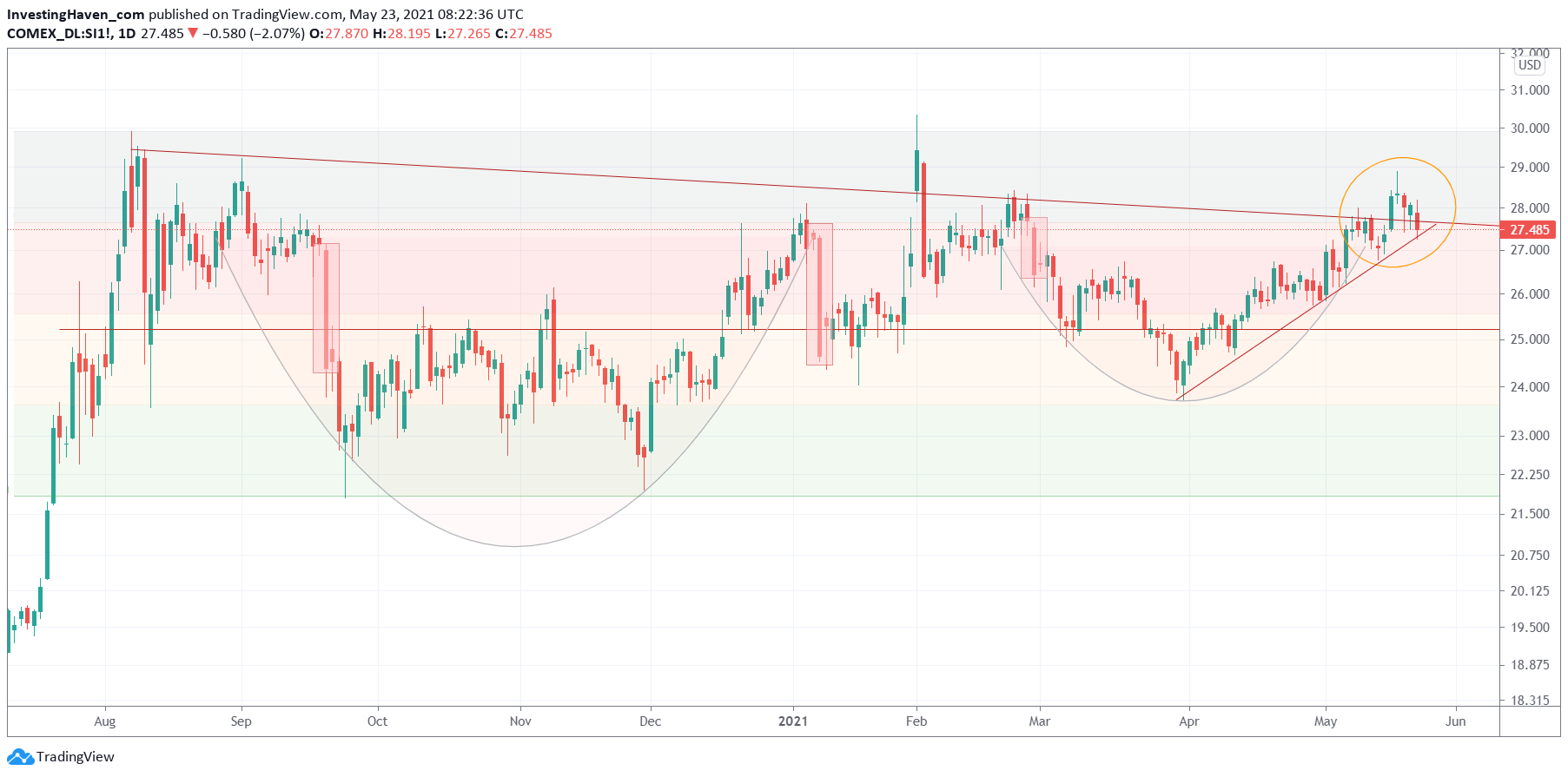

If anything, the silver price chart (4h chart) is now testing an utterly important level. 27.5 USD is important from 3 different perspectives, and this makes it an extremely important level:

- Short term rising trend that started in the first week of April (see red rising trendline).

- Longer term falling trend that started in the first week of August (see red falling trendline).

- Horizontal retracement level (see red/grey shaded area).

Whatever happens at this level will be really important, next week will be crucial for silver.

Silver’s leading indicators are supportive of higher silver prices:

- Gold is eager to move higher, for sure 2 to 3 pct. We explained this in Gold Eager To Test Its 2011 Highs Again.

- The Euro is so-so, bond yields are weak. Both combined should be supportive for the precious metals trend to continue even though a rising Euro would be ideal (it’s hitting resistance now).

- Silver’s chart setup looks good, but it must respect 26.4 USD on a 3 day closing basis.

All in all, there is a bullish bias in silver (and gold). If this results in a move higher in silver it will lead to a quick rise to 30 USD. The pattern between 27 and 30 USD will be crucial for silver’s potential breakout above 30 USD. We still need one or two weeks to assess a potential breakout, and gold’s setup in June will be important.