Emerging precious metals are gaining investor attention due to their unique industrial applications, constrained supplies, and favorable price forecasts.

As traditional precious metals like gold and silver continue to dominate investment portfolios, a trio of lesser-known metals—rhodium, ruthenium, and iridium—are capturing the attention of savvy investors in May 2025.

These metals offer unique industrial applications, supply constraints, and compelling price dynamics that make them noteworthy additions for diversification.

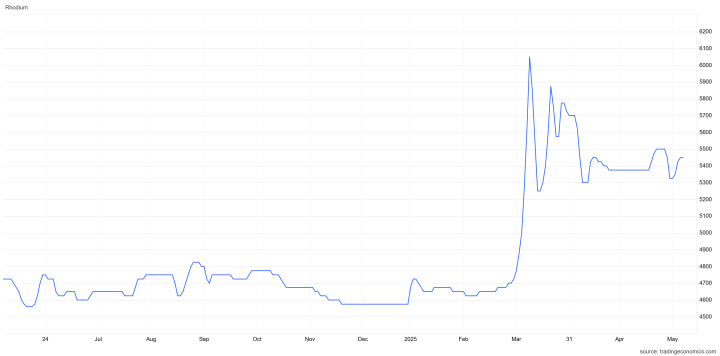

1. Rhodium: Emission Control Catalyst with Supply Constraints

Rhodium, primarily used in automotive catalytic converters to reduce harmful emissions, remains a critical component in meeting stringent environmental regulations. Despite the rise of electric vehicles, the demand for rhodium persists due to its effectiveness in emission control technologies.

Heraeus forecasts rhodium prices to fluctuate between $4,400 and $5,400 per ounce in 2025, influenced by a small market deficit and potential supply disruptions from major producers like South Africa.

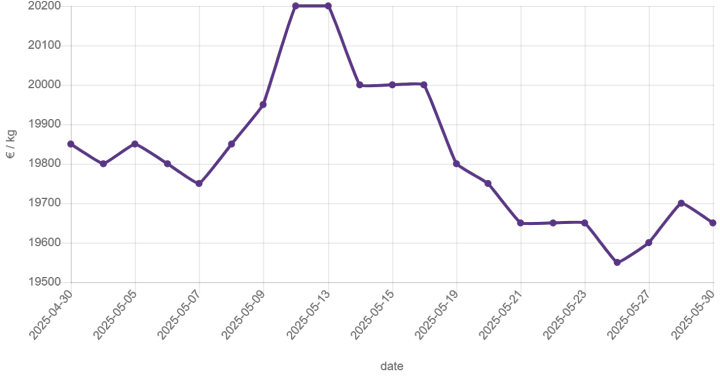

2. Ruthenium: Rising Star in Electronics and Catalysis

Ruthenium is gaining prominence in the electronics industry, particularly in chip resistors and electrical contacts, due to its durability and cost-effectiveness compared to other platinum group metals.

The global ruthenium market is projected to grow from USD 632.7 million in 2025 to USD 903.2 million by 2032, exhibiting a CAGR of 5.2%.

Heraeus anticipates ruthenium prices to range between $425 and $575 per ounce in 2025, driven by increasing demand and a shrinking market surplus.

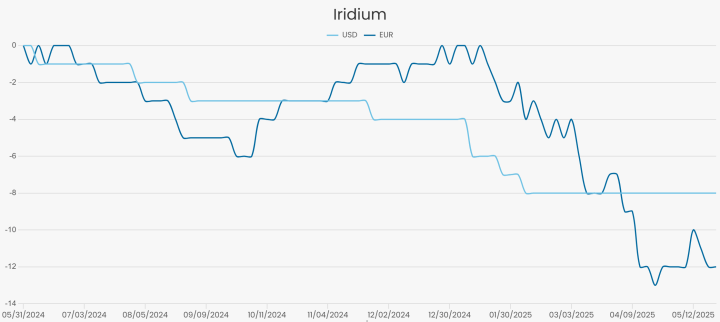

3. Iridium: Niche Applications with Growing Demand

Iridium’s exceptional resistance to corrosion and high melting point make it invaluable in high-performance spark plugs, crucibles for semiconductor production, and electrodes for chlorine production.

Despite its rarity, with an estimated annual production of only 15,000 pounds in 2023, iridium’s demand is expected to rise. Heraeus projects iridium prices to range between $4,900 and $5,600 per ounce in 2025, reflecting its growing industrial applications and limited supply.

Conclusion

While gold and silver continue to be mainstays in precious metal investments, rhodium, ruthenium, and iridium present compelling opportunities for diversification in May 2025.

Their unique industrial applications, coupled with supply constraints and favorable price forecasts, position them as attractive options for investors seeking to broaden their portfolios beyond traditional metals.

Join Our Premium Research on S&P 500, Gold & Silver — Trusted Insights Backed by 15 Years of Proven Market Forecasting

Unlock exclusive access to InvestingHaven’s leading market analysis, powered by our proprietary 15-indicator methodology. Whether it’s spotting trend reversals in the S&P 500 or forecasting gold and silver price breakouts, our premium service helps serious investors cut through the noise and stay ahead of major moves.

- Precious Metals: The Long-Term Outlook Looks Profitable, Here Is Why (May 31)

- [Must-Read] Spot Silver – This Is What The Charts Suggest (May 24)

- Gold Close To Hitting Our First Downside Target. Silver Remains Undervalued. (May 18)

- A Divergence In The Precious Metals Universe (May 10)

- Gold Retracing, Silver and Miners at a Critical Level (May 4)

- The Precious Metals Charts That Bring Clarity Through Noise (April 27)