The price of uranium exploded in recent weeks. A rise of 30 pct in a matter of weeks raised the question whether this is a major breakout that could and should be bought. A recent article published on Marketwatch did bring the clarity that we needed, and the chart helps us understand potential strength in the uranium mining market as a medium term investment, potentially supported by a new commodities trend: Commodities Setting A Major Bottom, Ending A Long Term Downtrend

The article we just referenced is this one:

Why uranium has rallied, defying a drop in the energy sector

And the quote that stands out is this one:

The crisis was a “black swan event” that pushed supply-demand fundamentals into a “structural shortfall. Substantial global uranium mine disruptions” due to Covid-19 health and safety precautions provided a “tipping point” for a market that went through years of rebalancing in the wake of depressed prices, says Scott Melbye, executive vice president at Uranium Energy Corp.

Going into 2020, global nuclear utilities were expected to require roughly 182 million pounds of uranium concentrate to run reactors for the year, while expected global mine production was seen at 142 million pounds, he says. The pandemic has affected 50% of global uranium mine supply, or over six million pounds a month, so even a three-month loss would push production down to just over 120 million pounds this year, he says. The expected supply shortfall led to a price rally.

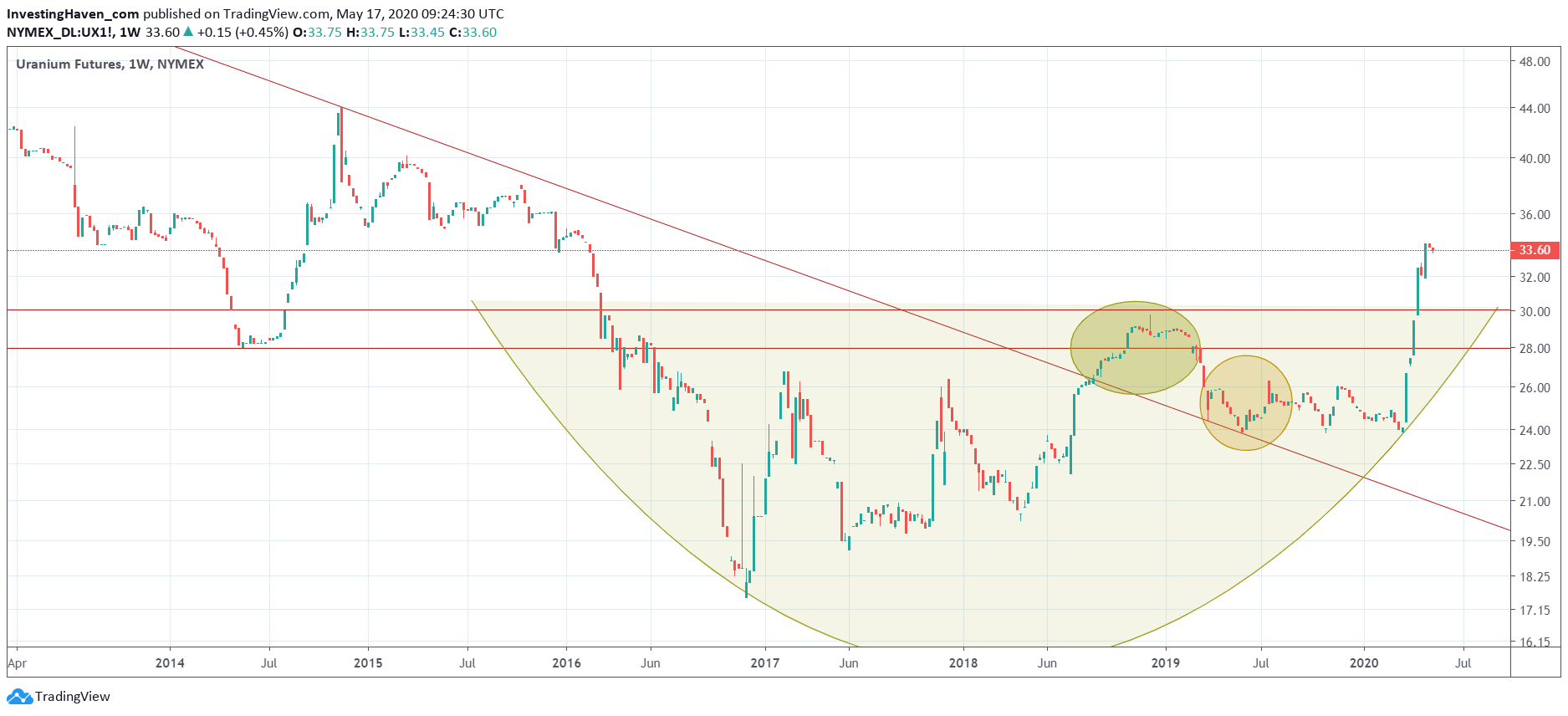

This is more or less reflected in the long term uranium price chart.

Uranium broke out (breakout level 30 USD). Its rally stalled at 34 USD.

Visibly, this rally is hitting resistance (also look at the structure at the left of the chart). Is a continuation of this rally coming or not?

As per Marketwatch, this is the fundamental picture:

Still, supplies overall are getting tighter, with inventories drawn down more rapidly because of the production suspensions, and utility demand remaining mostly steady, he says. Spot uranium prices have already seen a “rapid increase,” so it is possible the market won’t see the same quick rise in the coming months. But “as long as producers continue to purchase uranium to cover supply shortfall, the price will remain on an upward trajectory.”

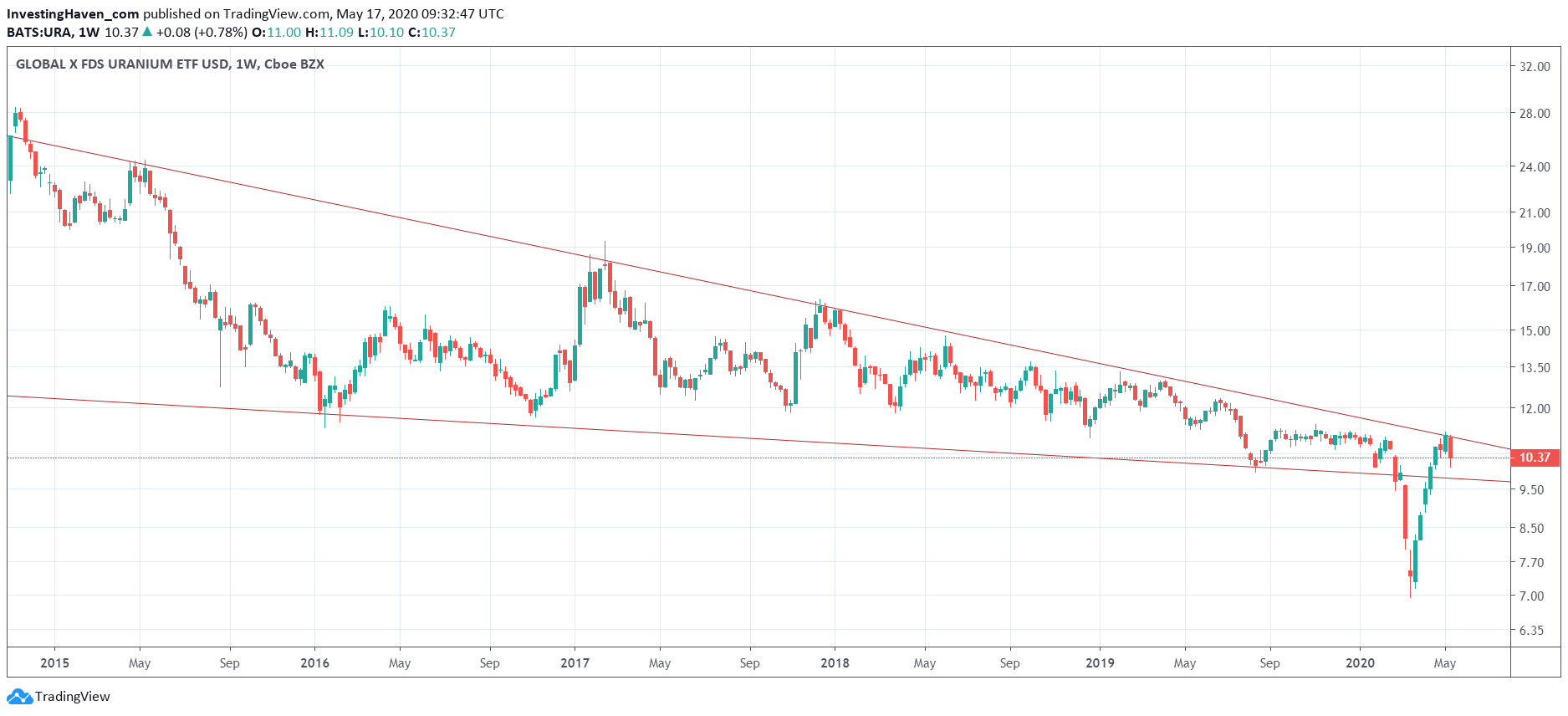

When we turn our attention to the uranium miners which is the only way to play the uranium markets for retail investors we see a falling wedge on URA ETF.

It’s not the type of chart setup that makes you smile, on the contrary.

We keep on tracking uranium miners closely, and will only flash a buy on this sector if we are really convinced of its upward potential given the high risk involved in this market. It does not look like uranium is buy in the foreseeable future, but commodities are subject to rapid change so we have to keep a very close eye on this sector.