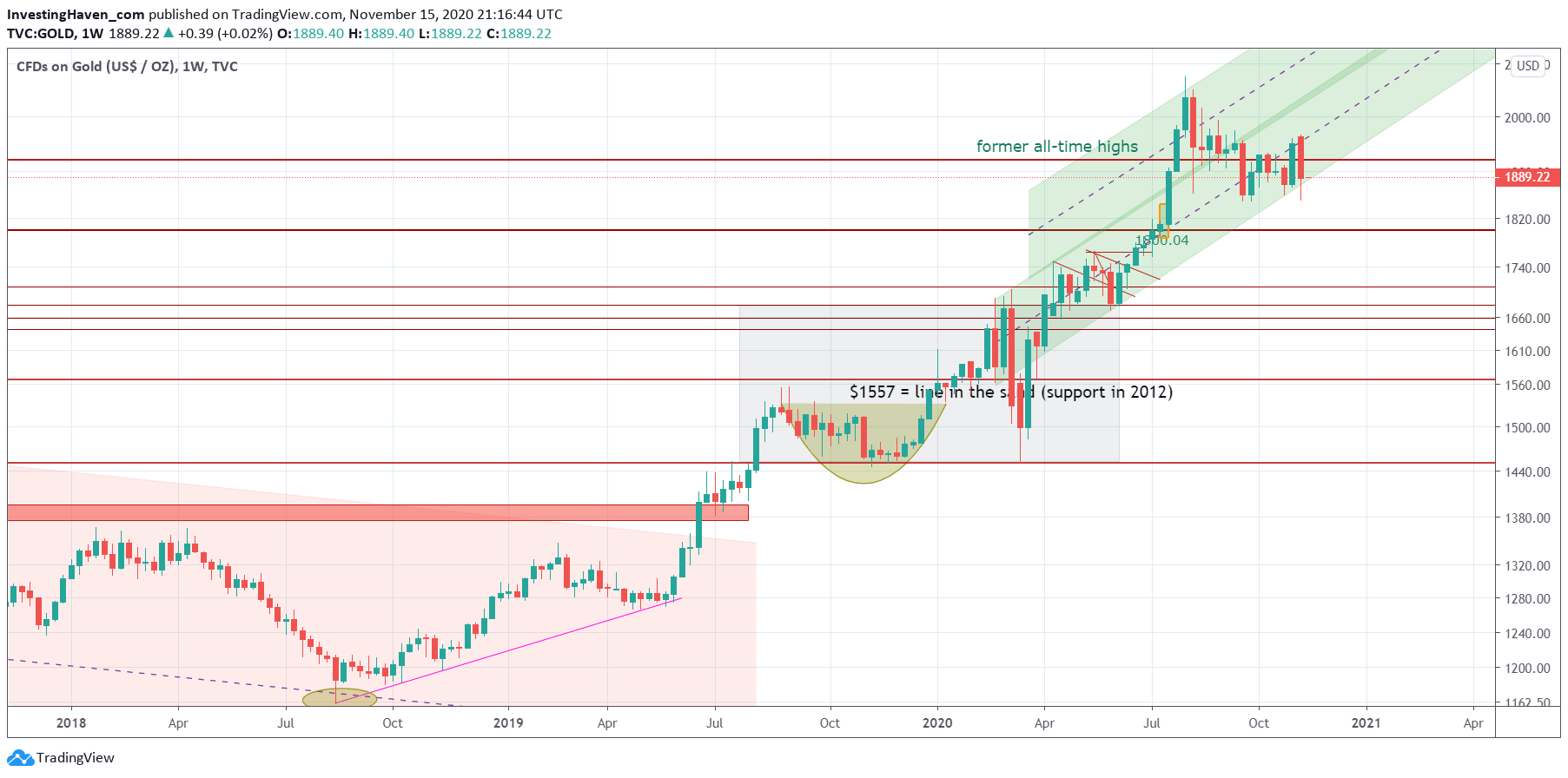

In one word: unclear. In three words: hanging on a cliff. No surprise, 10 year rates did shoot higher this week, gold went sharply lower this week. That’s how those intermarket dynamics work, and this week was no surprise. As per our gold forecast 2021 we expect new all time highs somewhere next year, but it will not be in the first part of the year according to our analysis.

The weekly gold price chart shows our point about gold ‘hanging on a cliff’.

It continues to play around with former all-time highs. We said this several times:

Gold Falling In Love With Former All Time Highs?

Gold Now In Love With Its Former All-Time Highs!

This a big ‘event’ for any market, and gold is not an exception to this. A break through former all-time highs which was set almost a decade ago is a long process, and it will take a few attempts. That’s why we believe gold will not set new highs in the foreseeable future.

Ultimately it will break higher though.

Ultimately it will break higher though.

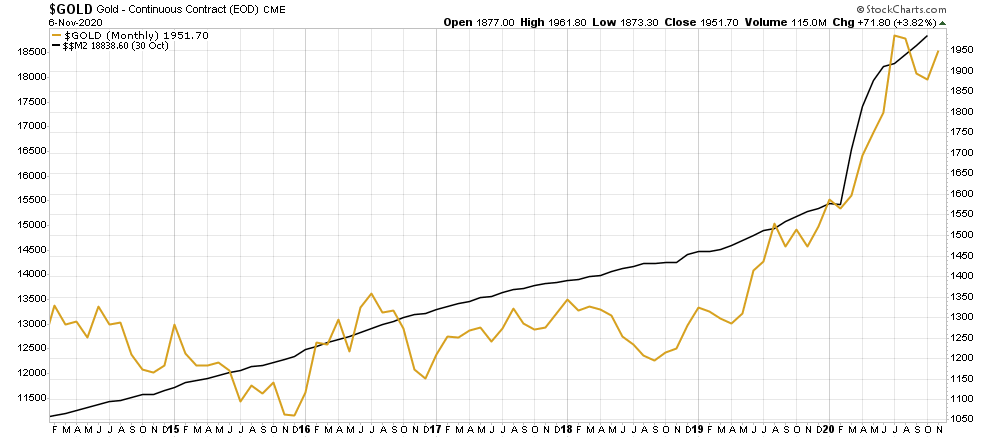

And the reason we think so is based on this data point, one of the leading indicators of gold’s price: monetary inflation.

We explained this in more detail in our annual gold forecast, see link in the intro of this article.

As policy makers help increase the money supply (M1, M2, M3) the gold price will ultimately track this trend, directionally.

This, combined with a stabilizing 10 year interest rate later in 2021 and the final break through former all-time highs on gold’s chart, is why we believe gold will ultimately make new highs somewhere in 2021.

Between now and then, we believe the gold market will be sideways and choppy.