For our bullish silver forecast 2022 to materialize we need silver to respect current levels. In this short post we look at the longest and current timeframes. It is interesting how the current (medium term oriented) timeframe may inform the direction of the longest timeframe.

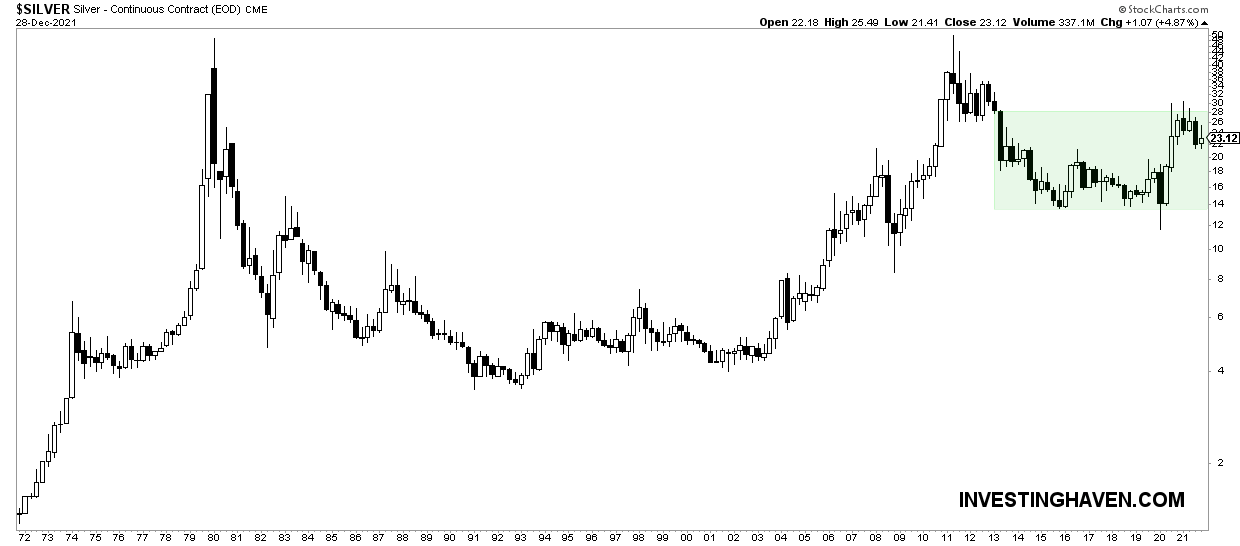

Long term, really long term, we believe silver will go back to former ATH and at a certain point it will clear it. It won’t happen in the short to medium term, but it is clear that it will happen long term, say 12 to 24 months out. As said in this article which we published on Medium.com: Silver Has The Longest And Strongest Chart Reversal In History Of Markets.

The above chart is insanely powerful, however it is a quarterly chart so it might take several more quarters before this wildly bullish reversal resolves to the upside.

We think of the bullish long term silver outcome in terms of ongoing price action.

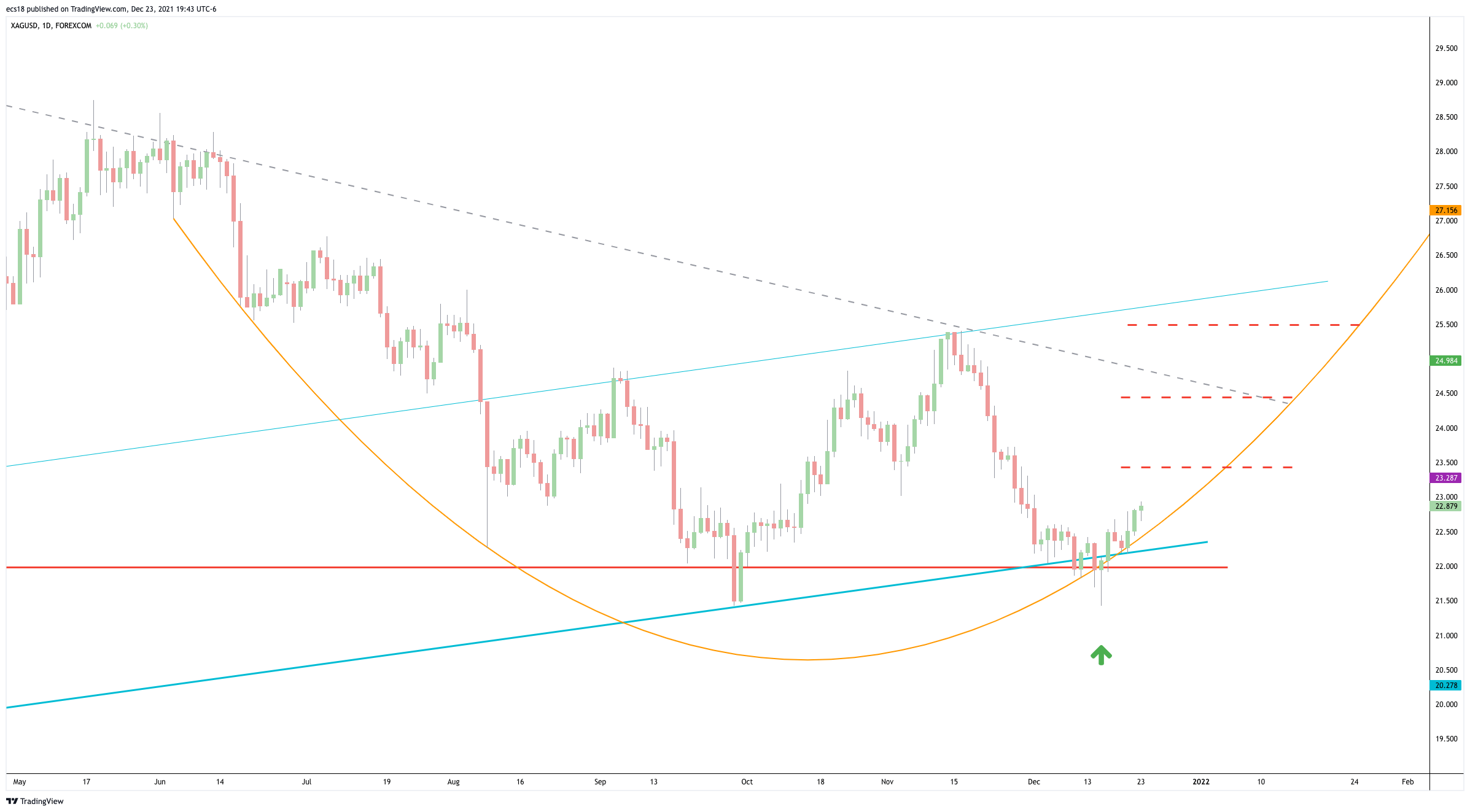

- Lower timeframes can flash reliable entry signals for higher timeframes.

- This requires support levels on the lower timeframes to hold which is happening as per below chart.

The silver market is in a unique position, and the combination of both silver charts in this article make the point. Below is a close-up of a 16 month reversal. This is huge, and we don’t see similar setups often. This comes with implications on the higher timeframes.

Something tells us that both the daily silver chart suggests that long term positions can be established in silver. The pre-requisite is that recent lows hold, in essence the 2021 lows will be crucial for the long term pattern and when the long term bullish outcome will materialize.