We may continue to believe that precious metals miners have some 50% upside potential it does not mean though that all gold and silver stocks are worth buying. There are only some of them which are worth your capital. This article looks at 2 charts which give the answer to our questions “which gold and silver stocks are worth buying”. The short answer to this question: only the established names, especially large and mid cap gold and silver stocks are worth buying!

We have been shouting from the roofs that the gold market would become bullish, and that it would rise significantly.

Even Barron’s picked up our gold forecast, and featured our forecast on May 3d, 2019: How Gold Could Stage a 20% Rally This Year

We wrote our forecast in September of 2018 (!), you read this correctly. MarketWatch published in May of this year our forecast Why gold’s a ‘bargain’ at less than $1,300 an ounce. So many months later gold is becoming a crowded trade which is we urge our followers to start working on their exit plan!

That said, the precious metals sector is one of the best performing lately.

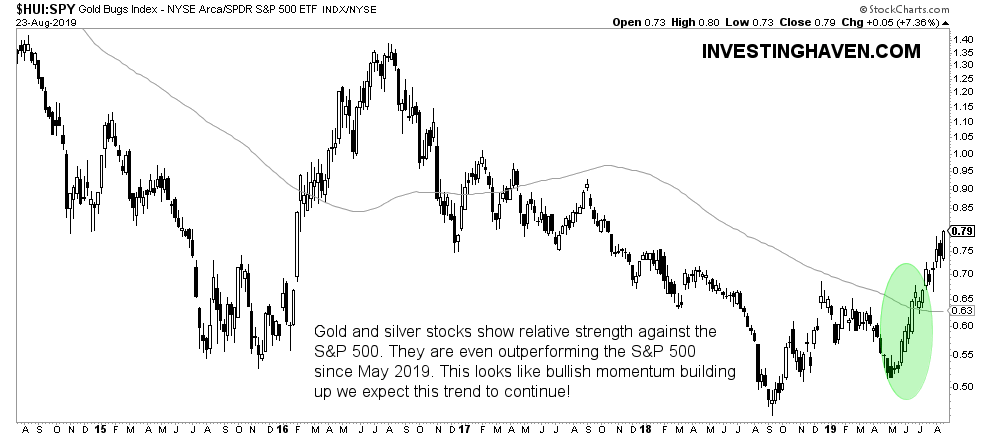

The first chart makes the point. The HUI index to the S&P 500 index. What a beautiful breakout this is, we even don’t need to draw any pattern or trendline on this chart.

This chart also suggests there is quite some upside potential. It is additional evidence of our point there is 50% upside potential.

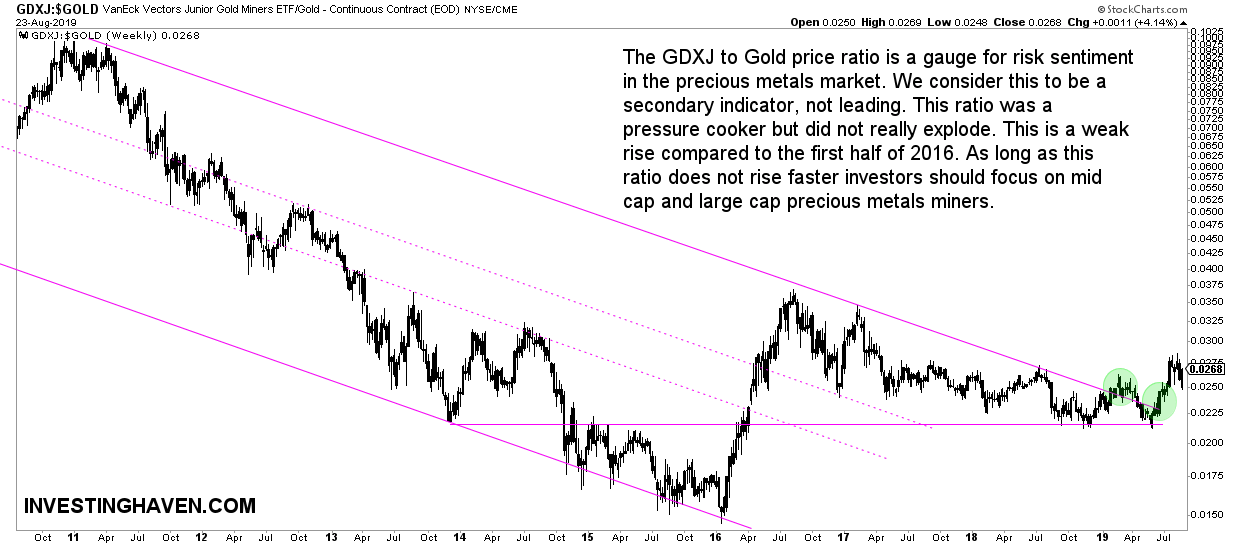

The second chart is much more insightful.

In the end the conclusion from the first chart is something we knew though this relative chart above was useful as an additional confirmation.

What we see on the next chart is the ratio between junior gold miners and the price of gold. Surprisingly, with gold’s breakout, we have not seen any significant inflow into junior gold miners.

So far, even though the rise in precious metals miners was substantial, it was primarily not the junior miners benefiting from this.

What may this imply?

On the one hand this may mean that junior gold miners will follow next. First the majors, then the juniors, is what may make sense.

On the other hand we may also consider the scenario in which gold is rising because of ‘risk off’ vibe sent through global markets. Junior gold miners are the opposite, they are as riskful as anyone can imagine.

In both scenarios we know that the top tier precious metals miners get a bid right now, and in the foreseeable future. That’s why it’s recommended to stick primarily with them, and only start catching the juniors if and when they start showing signs of strength.

Note that we came to this conclusion already 6 months ago when we wrote Best 3 Gold Stocks for 2019.

[Ed. note: As of August of 2019 we provide in-depth analysis to our ‘free newsletter’ subscribers. We will bring premium content with specific investing tips on a weekly basis, mid-week, free of charge. We do this for 4 months. Subscribe to our free newsletter and get premium investing insights in 2019 for free.]