Bitcoin’s struggle below the critical resistance level has sparked debate among traders – is this a sign of exhaustion or calm before a historic Bitcoin rally?

Since falling off the $100k after being spooked by the fed meeting in late January 2025, Bitcoin has struggled to get above this price level.

This has sparked an intense debate in the crypto community with a section of investors fearing that it could have lost momentum.

The majority, however, are convinced the legacy digital currency is on the brink of a massive breakout that will trigger a market-wide bull run.

2 Markets Signals to a New Bitcoin High and Start of Bull Run

First is the undying optimism towards a second Trump presidency. Crypto investors and analysts are upbeat about Trump’s presidency because he and his family have not only created, promoted, and invested in cryptocurrencies.

The president has also handpicked several pro-crypto individuals to head crucial departments and government agencies – including the Treasury, SEC, and CFTC. Equally important, he has pledged to deregulation of the finance industry.

All these have fueled speculation that Bitcoin and the market will reach new heights under Trump.

Standard Chartered analysts, for example, are confident that BTC will rally to $200K before the end of 2025 before adding $100 for every other year that Trump remains president.

Secondly, the anticipation of a bull run has resulted in massive buying pressure that has sent Bitcoin reserves on exchanges and miner pools to historic lows.

Interestingly, the low reserves coincide with heightened demand from states that are setting up reserves, institutional investors via ETFs, and corporations looking to add BTC to their balance sheets.

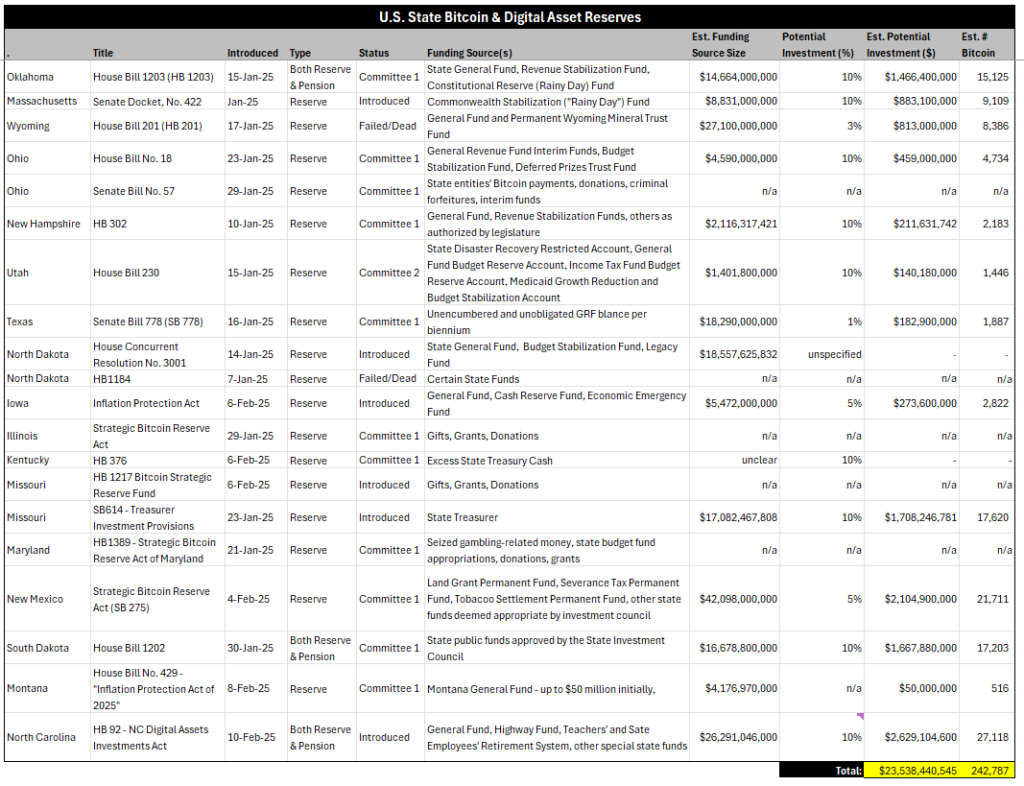

A recent report by VanEck indicates that States will absorb as much as $23 Billion worth of BTC into their Bitcoin Reserves.

Technical Indicators Suggest a Bitcoin Breakout Is Imminent

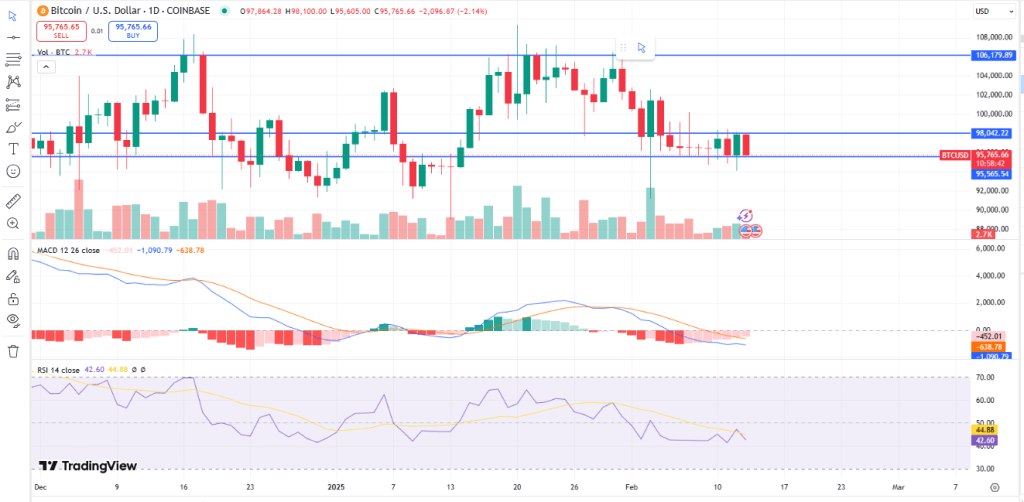

At the time of writing, Bitcoin is trading at around $95,800, with a strong resistance level of around $98,000 and key support of $95,500. Several indicators, however, suggest that a bullish reversal is imminent.

On the daily BTC/USD chart, the MACD, though still in the negative territory, is rising and heading to a convergence with the MACD line, crossing the signal line from the bottom. The MACD histograms are getting lighter. And these two signal a trend reversal.

The Relative Strength Index (RSI) is at 44, hovering in neutral territory for the past 10 days, indicating that Bitcoin is neither overbought nor oversold—leaving room for a strong move upwards.

Volume trends also suggest the market is in the accumulation phase – which typically precedes explosive rallies.

Despite the short-term volatility, Bitcoin remains one of the best cryptos to buy right now.

Traders and investors should, therefore, keep a close eye on key resistance levels at $98K and $106K. A breakout above these levels could confirm Bitcoin’s next leg toward $120K and beyond.

🚀 Don’t Miss the Next Big Crypto Move!

Our premium members received real-time alerts on major crypto plays before they happened. Will you be ready for the next one?

🔴 Latest Insider Alerts:

- 📢 When Will This Market Finally Start Moving? (Feb 9th)

- 📢 Top 5 Tokens for 2025 – Key Insights (Jan 31st)

- 📢 If You Missed XRP, Here’s Your Next Play (Jan 16th)

- 📢 Jan 15th, 2025: A Key Date for Crypto (Jan 5th)

⏳ Limited Spots Available – Secure Yours Now!