Seven large‑cap cryptocurrencies—led by Bitcoin and Ethereum—have outpaced the broader crypto market in 2025 thanks to strong YTD gains, major upgrades, and growing institutional and regulatory momentum.

The first half of 2025 has proven that cryptocurrency is not just surviving but maturing into a serious asset class.

With the total global crypto market capitalization stabilizing around $3.3 trillion, investors are seeing both traditional blue-chip coins and innovative altcoins weather volatility and regulatory scrutiny better than ever.

Institutional adoption through spot ETFs, government reserves, and clearer legal frameworks have brought a new level of confidence to top-tier digital assets.

This article highlights seven of the best-performing cryptocurrencies with high market caps so far this year—coins that combine market dominance, technological development, and real-world use cases to stand out in an increasingly competitive space.

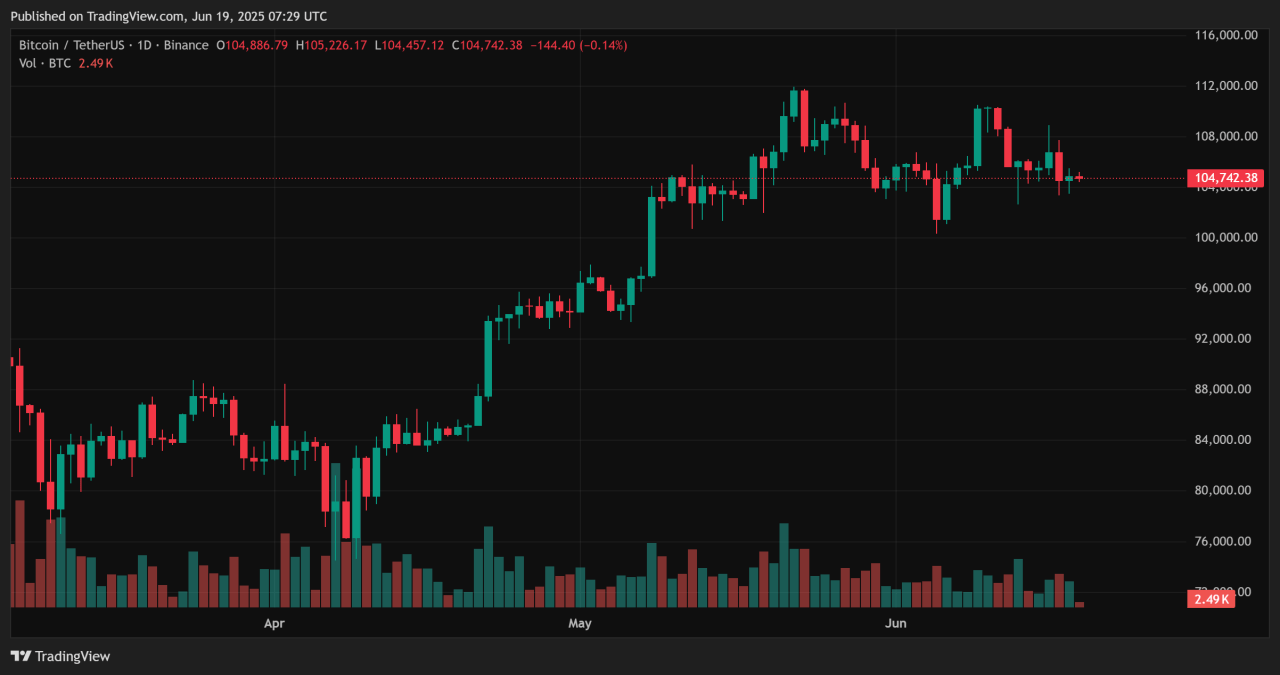

1. Bitcoin (BTC)

Rebounding above $100,000 for six straight weeks, Bitcoin leads large-cap assets with a stellar ~12–16% YTD gain. Its all-time high of $111,970 on May 22 sets critical resistance around the $112 K mark, while grammatical retracement zones lie at $107K and $100 K .

What’s fueling this surge? Rising inflows into Bitcoin ETFs (now totaling ~$132 B in assets), strong institutional correlation with equities, and talk of a U.S. strategic crypto reserve have lifted sentiment.

2. Ethereum (ETH)

Trading around $2,500, Ethereum remains the second‑largest crypto but is down roughly 24–25% YTD. That said, ETH is gaining recent momentum, outperforming BTC and SOL in the past week amid its rising role in stablecoins, DeFi, and tokenized assets.

Additionally, the upcoming “Pectra” upgrade aimed at faster, cheaper transactions is strengthening its fundamentals.

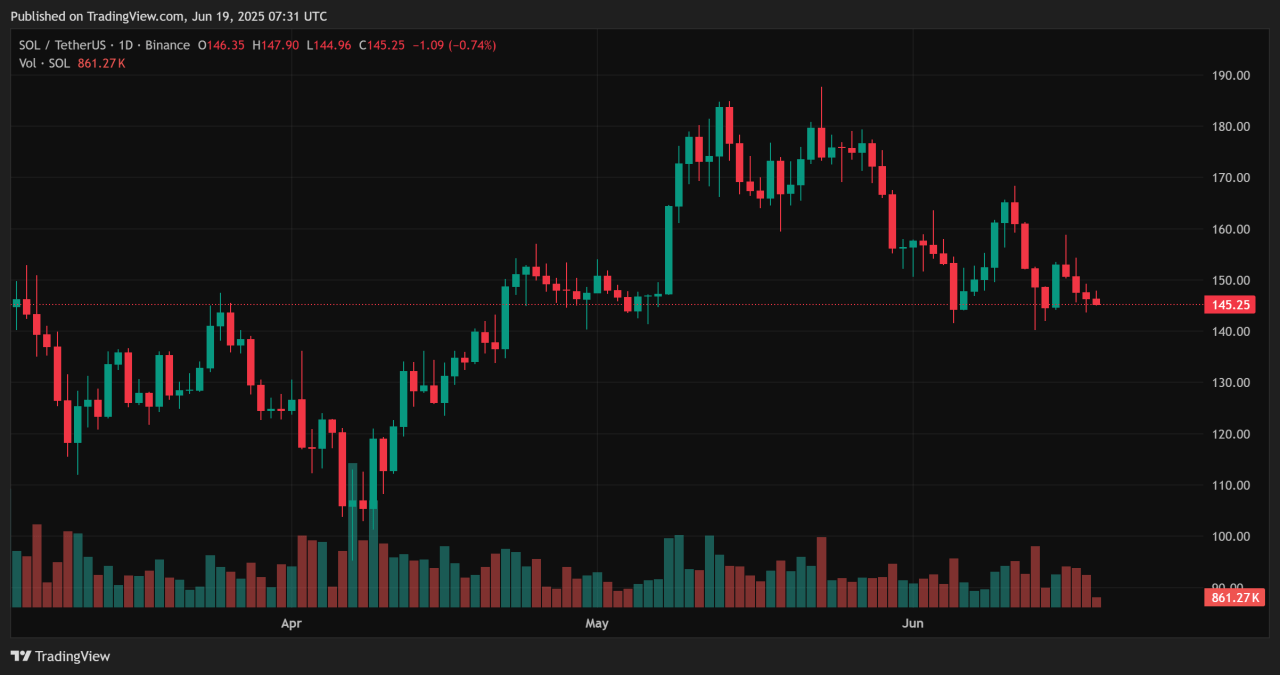

3. Solana (SOL)

Currently trading at about $145, Solana’s YTD return stands at around –21%. Despite volatility and occasional outages, SOL remains a top‑10 coin by market cap (~$82–94 B) and a favorite in Smart‑Contract and Web3 ecosystems.

Regulatory tailwinds—including potential Spot SOL ETFs and inclusion in the proposed U.S. digital asset reserve—are key catalysts ahead, making it a top choice for investors.

4. Ripple (XRP)

At around $2.15, XRP has surged back as a top performer, currently posting a ~3.9% YTD gain and leading large‑cap coins last week with +5.5% . Its market cap surpasses $128 B.

Network statistics paint a picture of robust adoption: +142% active daily addresses, +210% new addresses, and a growing XRPL EVM sidechain ahead of recall launch.

Plus, XRP is lined up as a recipient of increased institutional favor, following its newfound non-security classification and a nod from Nasdaq to include it in benchmark indices.

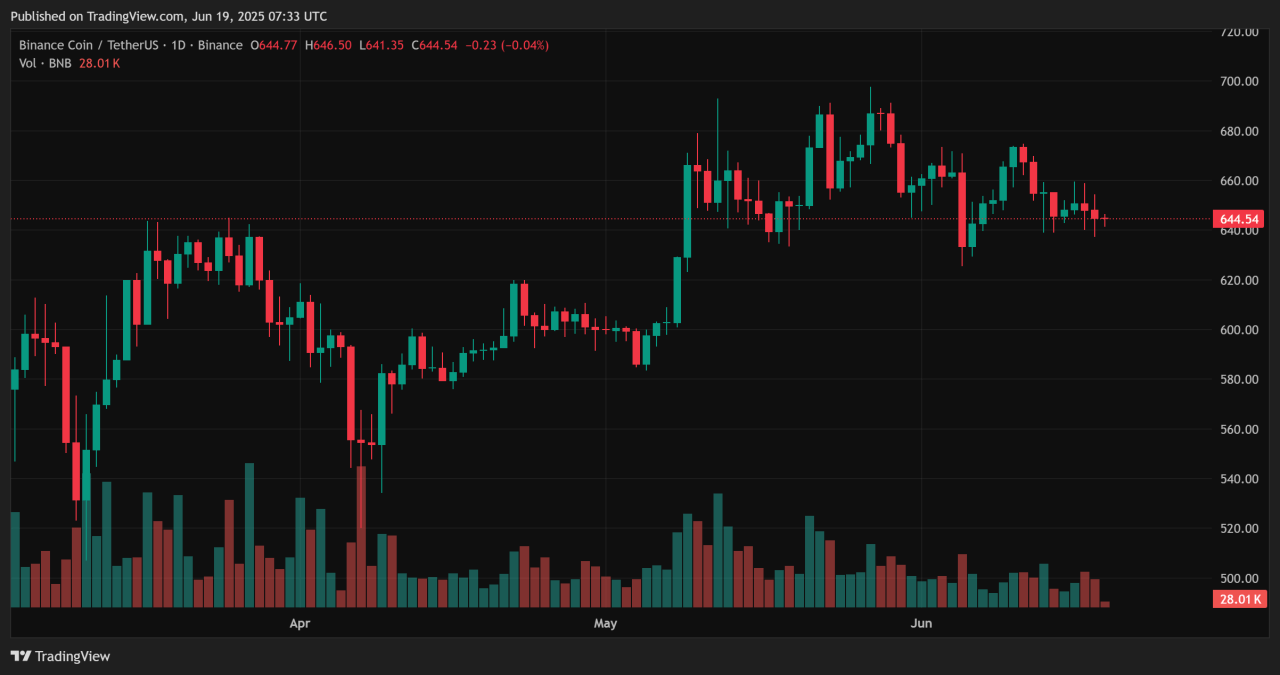

5. Binance Coin (BNB)

Binance Coin sits at roughly $644 with a market cap near $92 B . BNB’s YTD performance is slightly negative, around –6% to –7%, but its resilience reflects strong real‑world utility.

As the fuel powering Binance’s trading ecosystem, launchpad projects, and gas fees, BNB remains crucial in crypto pipelines.

6. Cardano (ADA)

Trading roughly at $0.60 with a market cap near $23 B, Cardano is slightly down for the year (–22.9% YTD). In fact, it has dropped more than 4% in the last 24 hours alone and close to 16% in the last week, according to price data from CoinMarketCap.

Still, investors are bullish: its peer-reviewed technology, eco‑friendly PoS structure, layer‑2 developments, and prospective access via the U.S. strategic reserve and Nasdaq index inclusion support a strong future outlook.

7. Dogecoin (DOGE)

Finally, no high‑cap list is complete without Dogecoin, trading near $0.17 with a market cap of $26–27 B. While YTD gains are modest, DOGE remains one of the only top 10 coins with double‑digit annual returns, drawing consistent retail interest and speculative volume.

With talk of Dogecoin ETFs under the Trump‑era crypto framework, its meme‑coin identity is evolving into mainstream recognition .

Conclusion

Amid a strengthening institutional backdrop—from Bitcoin and Ether ETFs to major banks like BBVA recommending crypto allocations—and fresh regulatory frameworks such as the U.S. Senate’s stablecoin legislation and Trump-era crypto policies, these top seven large‑cap tokens have delivered resiliency and upside in 2025.

While renewed macro momentum—softer inflation, potential Fed easing, and expanding public‑company treasury strategies—bolsters confidence, crypto’s inherent volatility remains, and investors should stay diversified, disciplined, and prepared for short-term swings.

Our latest crypto alerts – instantly accessible

This is how we are guiding our premium members (log in required):

- The Alt Season Charts (June 15th)

- Another Test of 106.1k, Is This THE Big One? (June 8th)

- How Much Longer Do We Have To Wait For Alt Season 2025? (June 1st)

- The Bitcoin vs. Altcoin Divergence (May 24th)

- Is A Massive Breakout Coming? (May 17th)