Bitcoin wants to move higher. In this post we will include a chart that we feature to premium crypto members. This closeup which is enriched with our annotations has a clear setup, and we dissect it the way we do for our premium crypto members. At the time of writing this BTC chart suggests that Bitcoin will move higher, but it also helps us understand the underlying conditions.

Before we look at the current BTC chart we want to refresh your with the crypto market insights and predictions we shared in the last 3 weeks.

On March 7th we featured a forecast we did at the end of February, suggesting that March 4th + 72h will be decision time Bitcoin Wants To Resolve Higher.

There you have it: March 4th + 36h and Bitcoin (leading indicator for the crypto market) starts what we call a ‘break up’.

The consolidation area which was potentially a bearish topping pattern is now invalidating. We need 72h to confirm this. Moreover, and more importantly, the market may create a larger such topping pattern in which case the counting process starts all over again.

All we do know, for now, is this: BTC wants to resolve higher, and as long as 43k USD is respected on a 3 day open + closing basis it will likely resolve higher.

It happened exactly in the time window we laid out, and BTC went higher 36h after March 4th.

Last week we wrote Bitcoin Eager To Accelerate Its Rising Trend

The 72h cycles show a breakout in the cycle starting 03.13.

It happened exactly as expected: last week was bullish for BTC, and most of the coins we tipped in our monthly update went higher, some of them doubled or are in the process of rising +50%.

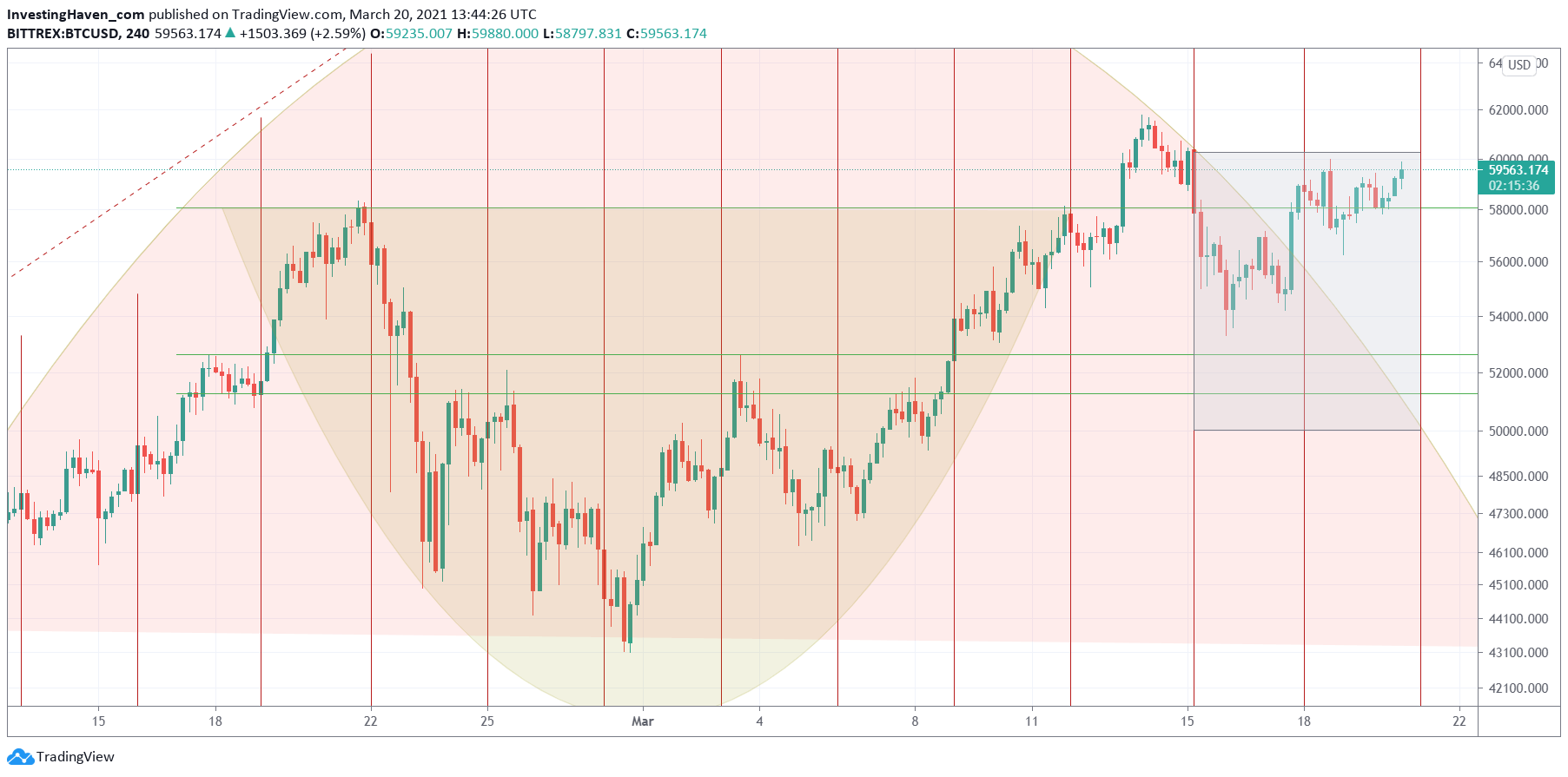

Today, we feature this BTC chart which shows the 72h windows which is one of the ‘tools’ in our methodology to do accurate predictions.

The way to read below chart:

- A bearish topping pattern was invalidated on March 17th when BTC break above of the red topping pattern.

- The subsequent 72h window (current one) is the one which should confirm that BTC continues to move higher.

- Combine this with the horizontal green line (58k) for additional confirmation of a move higher … and you have the perfect chart to understand when BTC confirms that it wants to resolve higher.

Moreover, this entire setup, at this point in time, is a bullish cup and handle formation.

In other words if BTC respects 58k in the next 72h time window (March 21st till 23d) it will be strongly bullish next week. If it falls below 58k on Saturday March 20th, and opens + closes below 58k before March 24th, it might invalidate its short to medium term bullish setup.

Do you enjoy our crypto investing research work? Why don’t you become a premium crypto member? We send several crypto alerts per week with plenty of coin tips and crypto market analysis.