Polkadot fell 8% this month. The dip creates a potential buying window.

DOT pulled back about 8% from this month’s high, offering a lower entry for patient growth investors. A DAO vote approved a 2.1 billion supply cap and Polkadot 2.0 rollout adds on chain upgrades that improve utility, for disciplined buyers.

READ: Polkadot (DOT) Price Prediction 2025 2026 2027 – 2030

Current Price and Pullback Facts

Polkadot current price is $4.13 with a market cap of about $6.7B and a circulating supply of roughly 1.62B. The token fell from $4.50 this month, a drop of 8%, after short term profit taking following the Polkadot 2.0 rollout.

Volume rose as traders rotated positions and markets digested the DAO referendum that set a 2.1B cap. That pullback created a defined support at $3.70 on recent charts. Short term indicators show oversold readings, favoring staged entries for risk aware buyers.

Next, let’s look at the reasons to buy Polkadot now.

Why This Could Be A Buying Opportunity

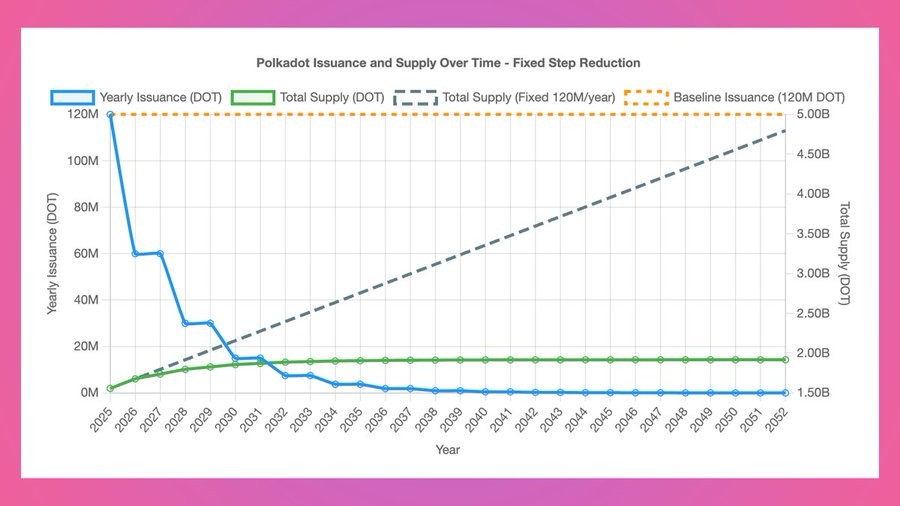

Referendum 1710 set a 2.1 billion hard cap after an 81% yes vote, which replaces the prior open issuance schedule and reduces future annual minting estimates. That change improves the long term supply path and changes DOT’s narrative toward scarcity.

Circulating supply stands at about 1.62 billion, so the cap leaves limited headroom for new issuance.

Polkadot 2.0 introduces Agile Coretime, asynchronous backing and elastic scaling, which increase blockspace efficiency and lower costs for parachains, encouraging developer activity and demand for parachain slots.

Parachain auctions and crowdloans still require bonding DOT, creating utility for holders. Together, a capped supply and meaningful network upgrades create an asymmetric risk reward for buyers who accept volatility.

The market priced in initial uncertainty, so today’s pullback offers an entry for staged buying while monitoring on chain metrics like bonded DOT and parachain slot uptake. Staged buys lower entry risk and limit downside on volatility.

RECOMMENDED: Avalanche (AVAX) vs. Polkadot (DOT)

Risks And Trade Plan

If you choose to buy DOT now, you should be aware of risks including macro shocks, delayed on chain benefits, and volatile price swings.

Ensure to focus on buying at levels of support, consider dollar cost averaging and focus on risk management not just potential upside gains.

Conclusion

A short pullback, supply cap and Polkadot 2.0 upgrades make DOT a buy for patient investors using staged entries today.

When Should YOu Buy DOT?

For key alerts on DOT identifying potential buying price points, you should consider Joining the original blockchain-investing research service — live since 2017.

InvestingHaven alerts come from a proprietary 15‑indicator methodology built over 15+ years of market experience.

You’ll be getting support from the service that identified major turning points through crypto winters and bull runs alike

Act now and see why thousands trust us to deliver signals before markets move.

This is how we are guiding our premium members (log in required):

- Is A Trendless Crypto Market Good or Bad? The Current and Emerging Winners Look Awesome. (Sept 7th)

- BTC Testing Long Term Trendline. Here Is Short and Long Term Guidance. (Aug 26th)

- Crypto – To Break Out Or Not To Break Out? (Aug 23rd)

- What Happened This Week? Leading Indicator Analysis and 7 Token Charts. (Aug 16th)

- Crypto Shows More Resilience Than Expected. A Bullish Impulse May Be Underway. (Aug 9th)

- Prepare To Buy The Dip In Crypto (Aug 2nd)

- Alt Season 2025 – Progress Update (July 26th)