A large 139M PI unlock could pressure price or fund on-chain growth. Watch unlocked supply and exchange liquidity closely.

The Pi Network faces a planned unlock of about 138 to 139 million PI tokens. This event will quickly increase sellable supply for holders, and short-term price moves will depend on how many tokens hit order books and how fast.

What The 139M PI Unlock Means

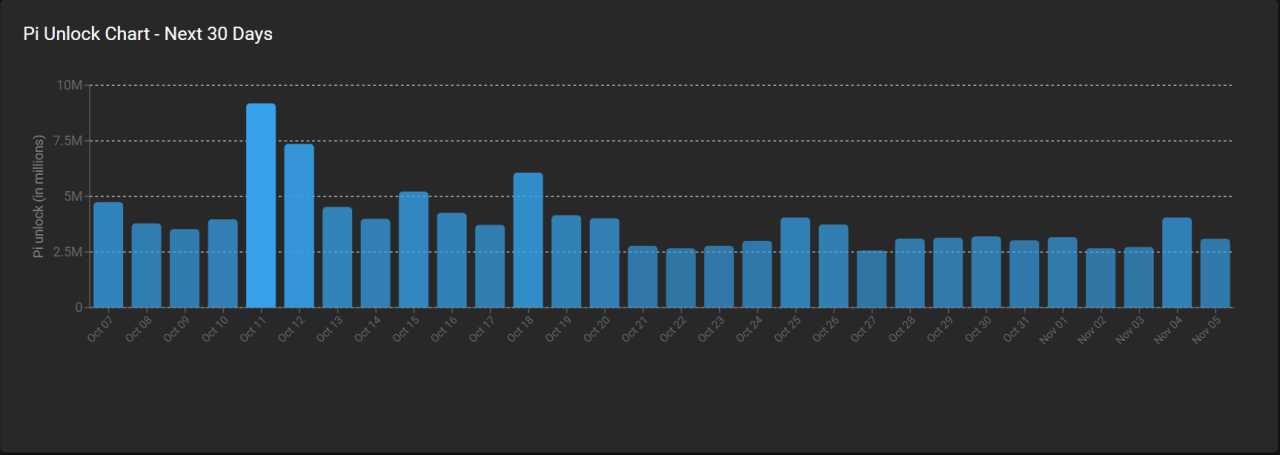

An unlock converts previously nontransferable, claimable PI into tokens users can trade. PiScan lists a single-month release around 138–139M PI and reports roughly 1.24B PI scheduled to unlock over the next 12 months.

Explorer data shows current Pi supply near 12.7B, and at a market price around $0.26 the 139M release equals about $36M of potential sellable value. These numbers come from onchain trackers, media coverage, and exchange snapshots that follow unlock schedules now.

Market Implications: Supply, Liquidity And Price Mechanics

When 139M PI becomes sellable, markets see an immediate rise in available tokens. If buyers and order books remain thin, selling pressure can push price down quickly.

Analysts cite past months when large unlocks coincided with price weakness, and they warn that monthly totals running into hundreds of millions raise short-term risk.

Some holders may instead use unlocked PI for payments, dApps, or hold it long term, which would temper immediate selling.

Exchanges may struggle to absorb large orders during low-liquidity sessions. This scenario often increases slippage and amplifies volatility during low-volume sessions and depth.

Network Health And Longer Term Outlook

Unlocks do not decide project fate alone. If unlocked PI funds real usage, developer activity, and reliable exchange listings, the network can absorb added supply without collapse.

Keep an eye on daily unlocked PI from explorers, active dApp transactions, and order-book depth on major venues. Protocol upgrades and roadmap delivery can also move sentiment and reuse rates, and community governance responses will matter.

Conclusion

The 139M PI unlock creates clear short-term downside risk to price, but it does not guarantee collapse. Monitor two metrics daily, unlocked volume and exchange liquidity, to judge whether the event becomes a sell-off or a healthy circulation of tokens.

The easiest way to buy Cryptocurrencies is through a trusted crypto exchange like Moonpay, Coinbase, or Uphold. These platforms allow users to purchase and trade crypto instantly from any device, including smartphones, tablets, and computers.

Buy Crypto NowCrypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here.

Wondering which crypto to focus on right now?

Our premium members already know.

Since 2017, InvestingHaven’s blockchain research service has been guiding investors through both bull runs and crypto winters.

What makes it different?

-

Proprietary 15-indicator methodology developed over 15+ years of market research.

-

Proven track record of spotting major turning points before markets move.

-

Focused alerts on only the key crypto assets that matter — no noise, no distractions.

Thousands of readers rely on InvestingHaven to stay ahead of the crowd. Now it’s your turn.

👉 Act today and join the original crypto research service — still live and stronger than ever since 2017.

This is how we are guiding our premium members (log in required):

- ATH in BTC = Alt Season 2025 Catalyst? (Oct 5th)

- Crypto Consolidation: When Will Bullish Momentum Return? (Sept 28)

- Is Meme Season Underway? (Sept 19th)

- Alt Season Is Brewing, In Silence. These 3 Charts Tell The Crypto 2025 Story. (Sept 10th)

- Is A Trendless Crypto Market Good or Bad? The Current and Emerging Winners Look Awesome. (Sept 7th)

- BTC Testing Long Term Trendline. Here Is Short and Long Term Guidance. (Aug 26th)

- Crypto – To Break Out Or Not To Break Out? (Aug 23rd)