Crypto adoption in 2025 is surging globally, thanks to retail users, institutions, and stablecoin growth—fueling a major market boom.

Global crypto adoption is hitting a pivotal milestone in 2025, setting the stage for a powerful market surge. With both retail users and institutions increasing their exposure—and stablecoins now rivaling traditional currency in scale—the structural conditions for a crypto boom have firmly taken hold.

Adoption at Tipping Point

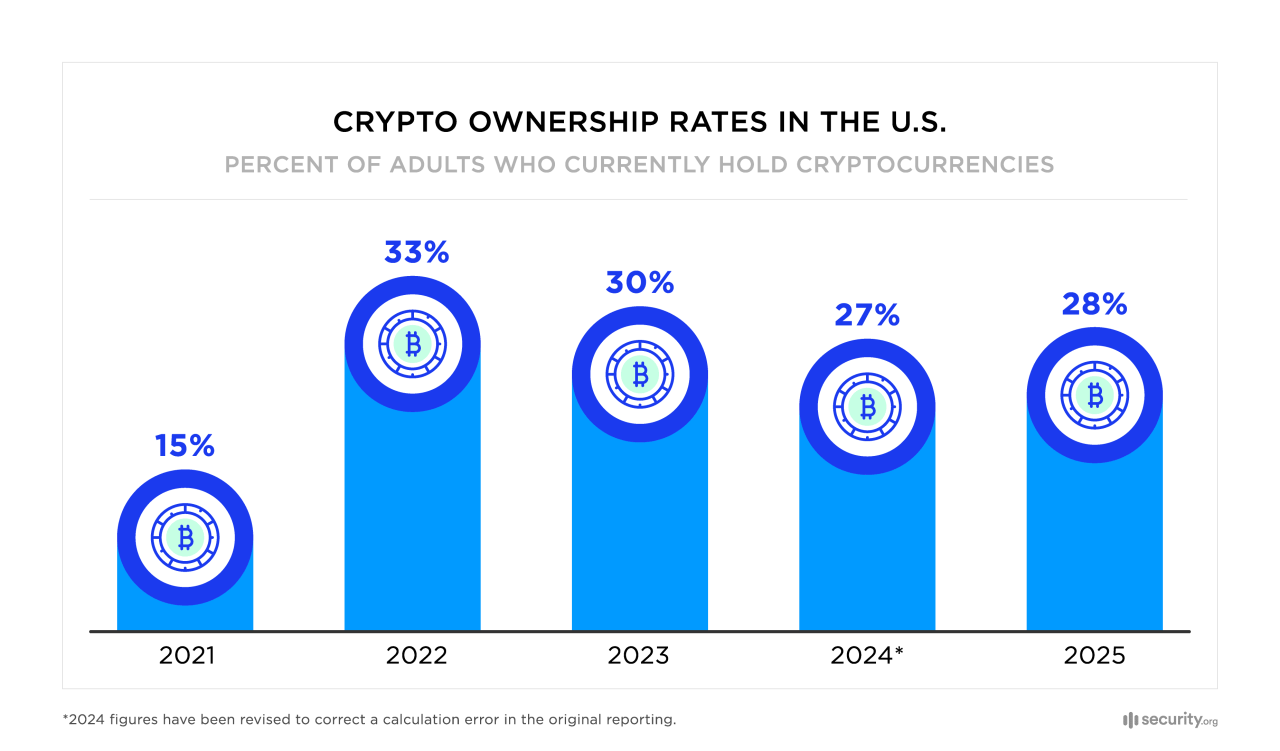

In the U.S., roughly 28% of adults—about 65 million people—own cryptocurrencies, up from 15% in 202, according to a report by Security.org.

Among non‑owners, 14% plan to jump in this year, and 67% of current owners intend to expand their holdings.

This increase in penetration estimates global crypto users reaching approximately 11% of the population, crossing the critical mass threshold needed to support sustained mainstream growth.

Institutional & Corporate Capital Inflows

Institutions are stepping in big time: a Coinbase/EY-Parthenon survey found 83% of institutional investors plan to increase crypto allocation in 2025. Crypto‑fund assets hit a record $167 billion in May—driven by $7 billion in net inflows—outperforming global equity and gold funds.

On the corporate front, over 80 public companies now hold Bitcoin on their balance sheets—totaling about 3.4% of global BTC supply. Notably, U.S. corporations have collectively deployed $11.3 billion into crypto treasuries since April.

Stablecoins & Payment Utility

The stablecoin market has reached $247 billion in May—nearly 10% of all U.S. physical currency, according to Marketwatch. Though 88% of usage supports crypto trading, cross-border transfers ($6 trillion in 2024) are growing fast, with projections suggesting stablecoins will handle up to 20% of global B2B payments soon.

Regulatory progress is accelerating: the U.S. Senate just passed the GENIUS Act (68–30), paving the way for standardized stablecoin frameworks to improve consumer trust and expand adoption.

Conclusion

With retail adoption at record highs, institutions and corporations allocating capital en masse, and stablecoins integrating into real-world payments—all under clearer regulation—2025 is shaping up to be a crypto market boom year.

Expect bullish price action (e.g. Bitcoin hovering around $110K–$112K), increased DeFi and payment infrastructure usage, and continued maturation. Volatility will persist, but the broader structural momentum signals sustained upside.

Our latest crypto alerts – instantly accessible

This is how we are guiding our premium members (log in required):

- Another Test of 106.1k, Is This THE Big One? (June 8th)

- How Much Longer Do We Have To Wait For Alt Season 2025? (June 1st)

- The Bitcoin vs. Altcoin Divergence (May 24th)

- Is A Massive Breakout Coming? (May 17th)

- Top Altcoin Picks in the Strongest Emerging Narrative (May 9th)

- Bitcoin’s Must-Watch Chart Structure, What It Means For Top Altcoins (May 6th)