A DOJ subpoena tied to the Fed rattled markets.

Crypto futures saw $21.25M in forced liquidations within an hour as risk appetite faded.

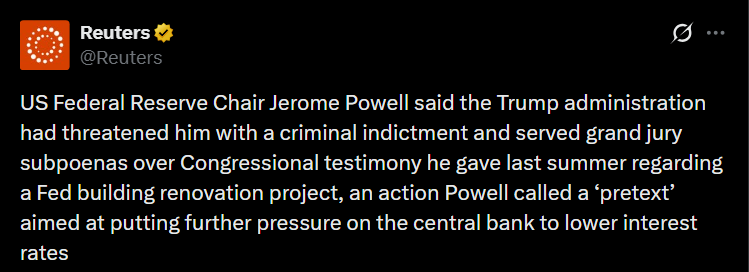

The Department Of Justice issued grand-jury subpoenas connected to Federal Reserve actions, and Fed Chair Jerome Powell said the move was politically motivated.

Within hours of those comments, crypto derivatives data showed about $21.25M in forced liquidations across Bitcoin, Ethereum, and Solana, representing a sharp but brief pullback in leveraged risk.

RECOMMENDED: U.S. Fed Could Soon Become A Buyer Of Bitcoin: Find Out More

What Triggered The Market Reaction

According to public filings and reports, U.S. prosecutors issued grand-jury subpoenas linked to Federal Reserve matters.

Powell responded publicly, saying the action was politically motivated.

The response quickly unsettled markets, with traders reacting to doubts around Fed independence rather than any shift in economic data.

How Crypto Markets Responded

Crypto felt the impact first because leverage remains high and liquidity can thin out quickly during surprise events.

Exchange and on-chain feeds estimate that roughly $21.25M in positions were liquidated within about an hour.

Most forced closures hit BTC, ETH, and SOL futures, where open interest is deepest and leverage use is common.

Prices moved quickly, then stabilized as liquidations slowed.

YOU MIGHT LIKE: Jerome Powell FED Chairman GreenLight On Crypto

Why Political Shocks Hit Crypto Faster

Crypto markets tend to react faster to sudden political news than stocks or bonds.

Higher leverage means stop losses trigger earlier, and thinner order books allow prices to gap more easily.

In this case, the liquidation total points to a short-term reset rather than a breakdown in market structure.

Once leveraged positions cleared, volatility cooled.

RECOMMENDED: Could Central Banks Quietly Be Testing XRP For Settlement?

Conclusion

The DOJ subpoena involving Fed Chair Jerome Powell created a short, sharp shock across risk assets.

In crypto, that translated into about $21.25M in forced liquidations within an hour.

This shows how political uncertainty can move leveraged markets quickly, even without changes in rates, inflation data, or Fed policy.

In our next Premium Members Crypto alert we will outline what we believe are the key Crypto assets to consider for 2026.