PEPE shows strong technical momentum and deflationary tokenomics, but high volatility and whale activity make it a risky investment.

PEPE, the internet’s meme-frog-turned-crypto, has captured speculative attention with its viral community, deflationary tokenomics, and technical setups that hint at more upside.

Below are three compelling reasons to consider buying—and one cautionary point to weigh.

1. Technical Momentum & On‑Chain Signals

PEPE is forming classic bullish patterns—a cup‑and‑handle breakout above ~$0.000012 with a target up to ~$0.000015, and a falling‑wedge breakout signaling potential to ~$0.000019. A golden cross (50‑day MA crossing above 200‑day MA), rising MACD, and neutral RSI (~45–55) support further upside.

On‑chain, whales have been active—over $27 M in PEPE moved off exchange to wallets, signaling accumulation. Combined, chart structure and whale moves suggest a high-probability breakout.

2. Bullish Forecasts & Community Engagement

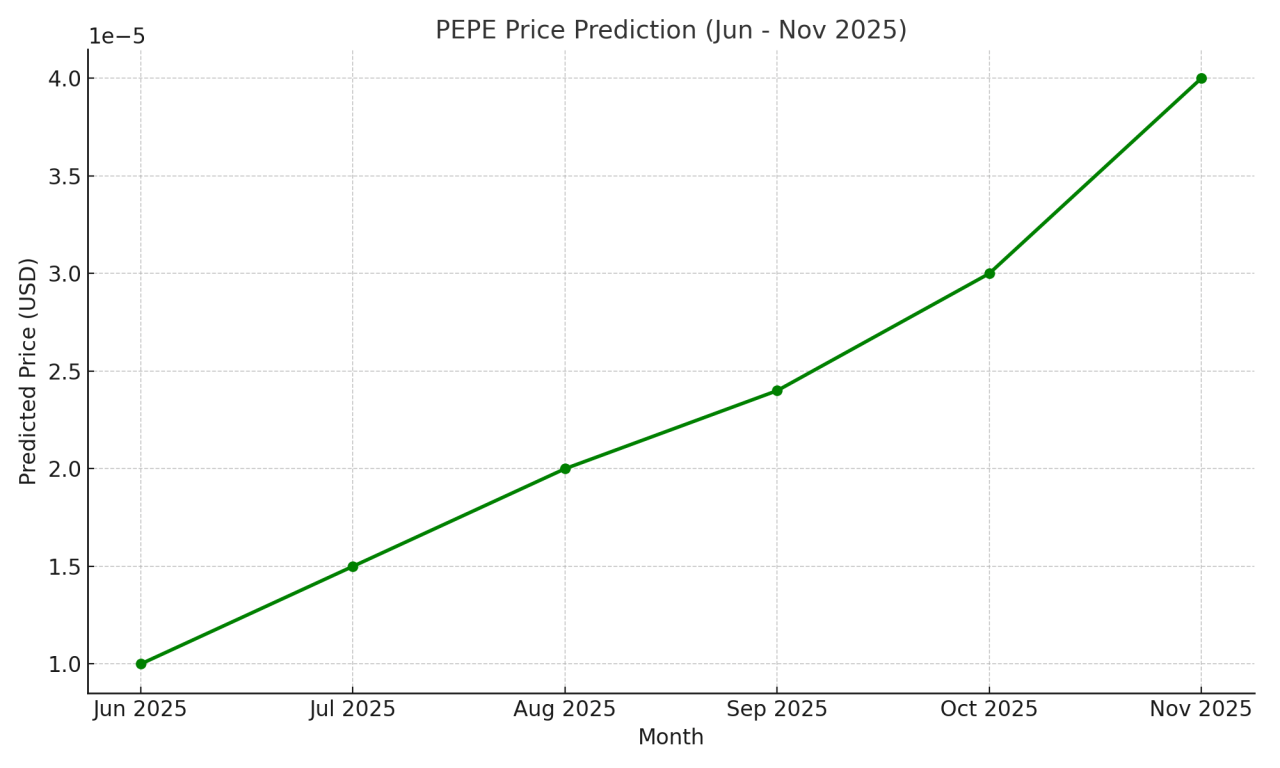

Analysts anticipate a rally to $0.000027–$0.000046 in Q3 2025 if momentum continues past key resistance levels.

Community participation remains strong: 93 % of supply locked via LP burn, no-tax transactions, and frequent deflationary burns—including an initial 210 trillion token burn in April 2023 and further burns like 6.9 trillion in October 2023.

This scarcity-building model, along with a passionate holder base, supports meme-driven rallies.

3. Deflationary Supply & Trustworthy Tokenomics

PEPE’s tokenomics are intentionally designed for scarcity: ownership renounced, liquidity locked and burned (93 % LP tokens), and embedded burn per transaction.

With a max supply of 420 trillion but ongoing burns, supply pressure continues to work in holders’ favor. Transparency and redistribution reward hold behavior.

Reason Not to Buy: Volatility & Whale Risk

Meme coins lack real utility and remain sentiment-dependent. Whales can trigger rapid sell-offs, and despite accumulation, large holders might still dump positions—leading to 50 %+ crashes.

This high volatility means while upside is possible, losses can be swift.

Conclusion

PEPE offers strong technical setups, bullish predictions, deflationary mechanics, and a vibrant community—ideal for speculative traders. Yet it carries classic meme-coin risks: no fundamentals and high volatility. If you’re nimble, PEPE may reward—but only risk capital you’re ready to lose.

Our latest crypto alerts – instantly accessible

This is how we are guiding our premium members (log in required):

- Another Test of 106.1k, Is This THE Big One? (June 8th)

- How Much Longer Do We Have To Wait For Alt Season 2025? (June 1st)

- The Bitcoin vs. Altcoin Divergence (May 24th)

- Is A Massive Breakout Coming? (May 17th)

- Top Altcoin Picks in the Strongest Emerging Narrative (May 9th)