Algorand delivers fast, low-energy settlement, a fixed supply, accessible staking rewards, a growing DeFi layer, and real use in payments that make it a compelling choice right now.

When considering whether or not to buy Algorand, I asked several questions: Can it settle transactions quickly? Is the token supply clear? Can holders earn returns? Does the ecosystem keep growing?

With its native token ALGO, the Algorand blockchain ticks all those boxes. With a hard cap of 10 billion ALGO and around 8.79 billion already circulating, you’re starting from a visible supply base.

In this article I’ll walk you through five reasons to buy Algorand now.

YOU MIGHT LIKE: Ripple (XRP) Veteran Moves to Algorand in Bold CTO Shake-Up

5 Reasons to Buy Algorand

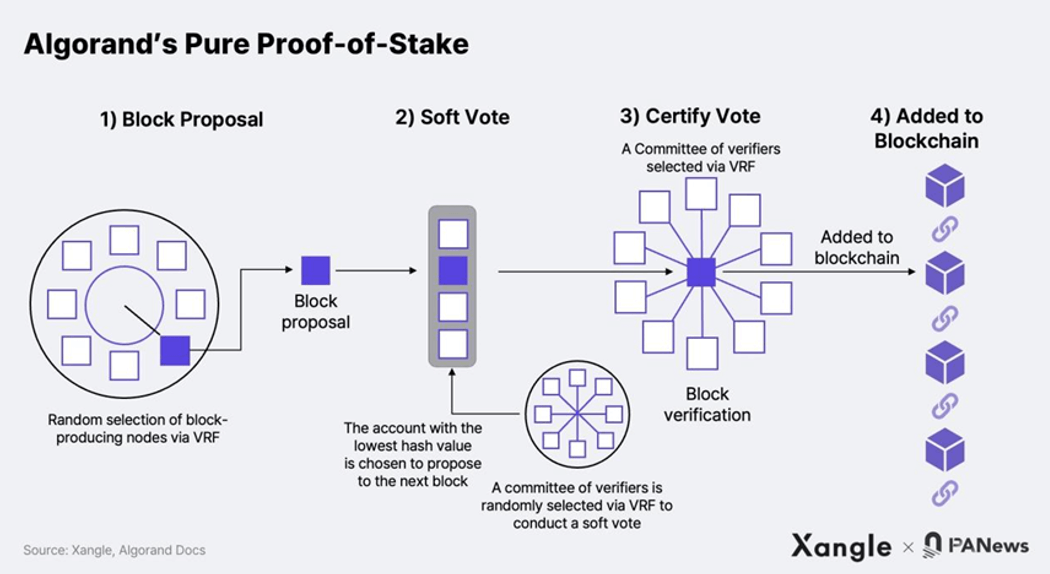

1. Pure Proof of Stake

Algorand’s consensus model – Pure Proof of Stake (PPoS) – lets it finalize blocks in seconds with low fees and minimal environmental footprint. This means ALGO is part of a settlement infrastructure you could reasonably use.

If you believe blockchain will increasingly support payments, tokenized assets, and enterprise workflows, then a chain with quick finality and low cost offers a compelling base.

In other words, I see this as foundational infrastructure value. And when infrastructure works quietly in the background, buying early can pay off.

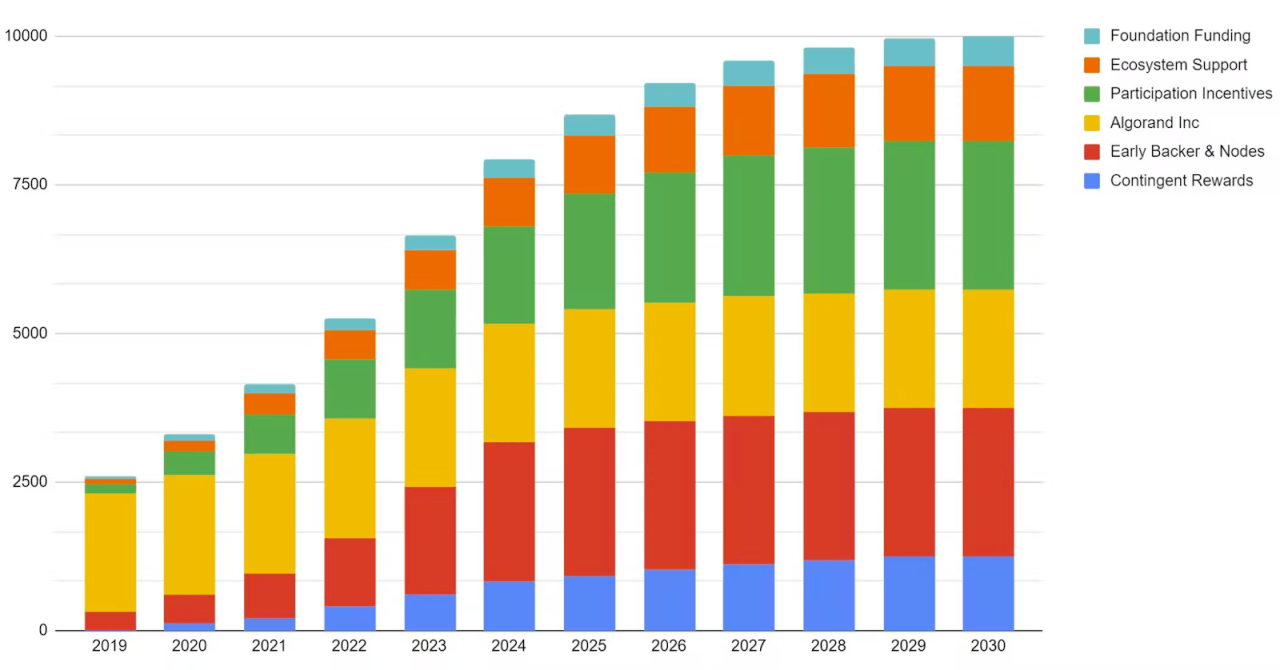

2. Capped Supply and Transparent Tokenomics

ALGO has a maximum supply of 10 billion with around 8.8 billion in circulation (and most unlocks scheduled or complete). The future dilution risk is much more visible than with many crypto tokens where unlocks or inflation are hidden. This clarity is a significant advantage.

When I allocate capital, I prefer assets where the “risk of surprise” is low. With Algorand, you don’t need to guess how many tokens might flood the market next year; it’s largely baked in.

That doesn’t guarantee upside, but it improves your risk-vs-reward assessment.

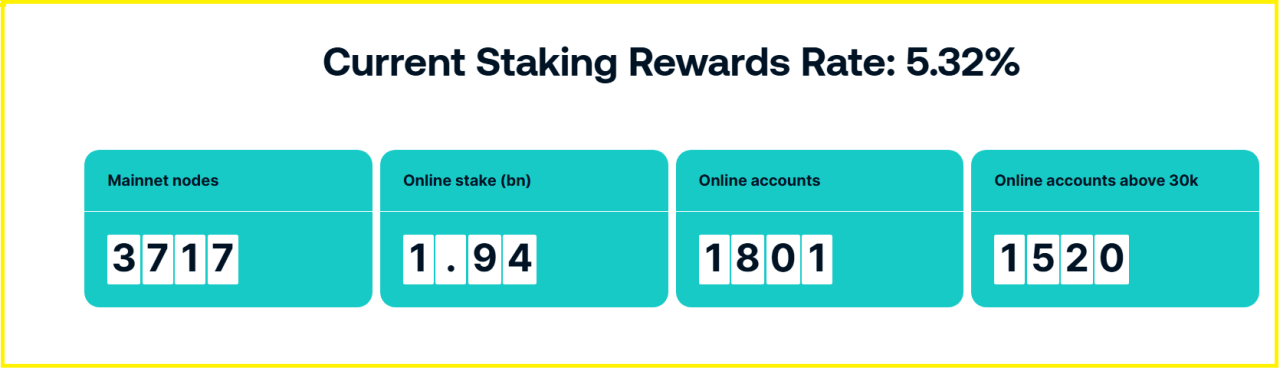

3. Earn While You Hold

Holding ALGO means you can participate in staking or governance and earn rewards. The network allows liquid staking for holders of any size, while solo staking requires around 30,000 ALGO.

This changes how you think about ownership. Rather than just buy and wait, you can actively deploy your holdings, earn yield, and vote on upgrades. If you’re planning to invest in Algorand for the long-term, that ability to compound returns matters.

4. A Maturing DeFi and dApp Ecosystem

It’s one thing to talk about speed and yield. It’s another when apps are live, users are active, and value is flowing. On Algorand, protocols like Folks Finance (lending + liquid staking), Tinyman (AMM), and Algofi (decentralised lending) are gaining traction.

This signals the chain is moving from theory into practice. If more value is locked on the chain, more transaction volume follows, and that increases utility for ALGO as a settlement token.

Keep an eye on active addresses, total value locked (TVL), and volume within these apps; if they rise, you may feel more confident increasing exposure.

5. Real-World Stablecoin and Payments Integrations

One of the strongest reasons to hold ALGO is the rising use of Algorand as a payments & stablecoin rail. For example, stablecoins such as USDC are supported on the chain, enabling low-fee, rapid transfers.

From a practical standpoint, infrastructure that supports real payment flows creates repeating demand for the native token: someone pays fees, moves assets, locks value. That kind of utility helps ALGO avoid being purely speculative.

So, if you believe stablecoin use and tokenised assets will grow, Algorithm offers a practical home for that growth, and holding ALGO is how you participate.

Conclusion

Algorand checks some key boxes to consider when investing in a blockchain: high-speed settlement, clear supply mechanics, deployable holdings, real apps, and payment-rail usage. It doesn’t guarantee big returns, but it gives a clearer path for long-term value than many projects.

Ensure your allocation matches your risk tolerance and make sure you are happy with the research you have conducted before investing.

Join eToro today and receive $10 in free crypto on your first deposit. Trade crypto, stocks, and ETFs with powerful tools and social investing features like CopyTrader™

Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here

Don’t Miss the Next Big Move – Access Alerts Instantly

Join the original blockchain-investing research service — live since 2017. Our alerts come from a proprietary 15‑indicator methodology built over 15+ years of market experience. You’re following the service that identified major turning points through crypto winters and bull runs alike

Act now and see why thousands trust us to deliver signals before markets move.