Quant connects different blockchain systems in a way that makes practical sense for real businesses. Its technology links to actual use cases and measurable activity.

Blockchain adoption has grown, but many systems still operate in silos. This limits how companies can use the technology.

Quant is currently trading around 0 USD and solves the above mentioned limitations by providing a single layer that lets different blockchains interact with each other and with existing IT systems.

QNT, the token, has a fixed supply and is required for accessing parts of the platform. Here are five clear reasons to buy Quant today.

Reasons To Buy Quant Today

If you’ve done some research on Quant but you are still not sure, below are five reasons to consider when investing in Quant.

1. Interoperability-First Infrastructure

Overledger works as an operating system that allows apps to connect across different blockchains. It does not compete with other networks. Instead, it sits above them and enables developers to build applications that use several chains at once.

This setup helps companies avoid getting locked into a single blockchain. It makes the system adaptable even if new technologies appear. Businesses can use it for tasks like cross-chain asset transfers, secure data exchange, and linking blockchain solutions to cloud tools.

2. Enterprise And Institutional Traction

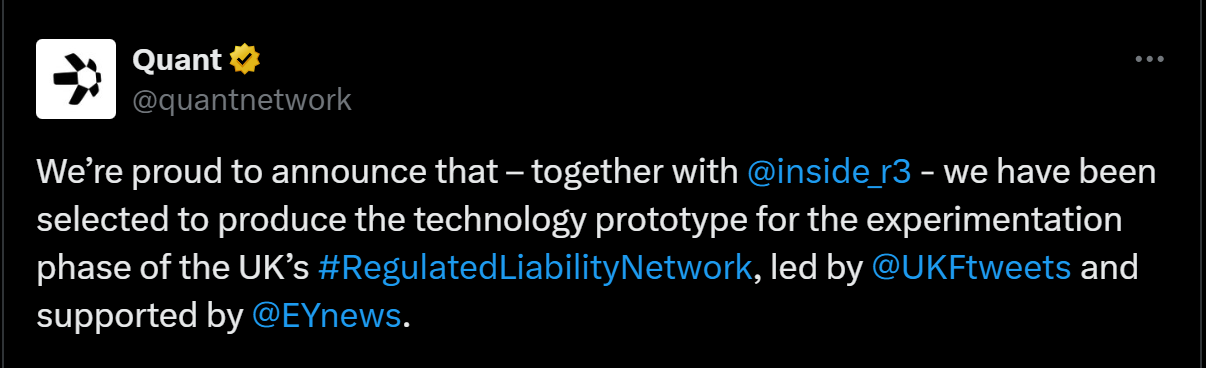

Quant has been selected for tests with central banks and major financial institutions. For example, it has taken part in digital currency innovation programs, which shows its technology is being considered for advanced use cases.

Banks and lenders have already trialed programmable payments and tokenized deposits using Quant software.

These tests relate to how money actually moves and how settlements happen. That increases the chances of long-term adoption, as companies usually convert successful pilots into commercial deals once the technology proves stable and compliant.

3. Strategic Technology Partnerships

Quant works with large technology providers that already serve business clients. These collaborations make it easier for enterprises to adopt Overledger without rebuilding their systems.

When blockchain solutions are offered through known partners, adoption speeds up because companies prefer tested technology with proven integration paths. This reduces resistance and helps Quant reach more organizations.

The partnerships also give the platform credibility, which matters when dealing with companies that require high standards before committing to new technology.

4. Token Utility And Structural Scarcity

QNT is used for licensing and access within the Quant ecosystem. Companies need it when using certain platform features, including API services and multi-chain applications.

Since the supply of QNT is limited, any increase in platform use creates increased demand. This makes QNT more tied to real-world usage instead of speculation. If more enterprises adopt the technology, token usage grows alongside.

Before you invest in Quant, however, take time to review supply numbers, check how licensing works, and understand how businesses acquire tokens.

5. Real-World Pilots Target Financial Systems With Proven Demand

Quant is not focused on experimental projects. Its pilots address core financial operations such as payments, settlements, and asset handling. These are processes that banks rely on daily, which means the potential for future integration is high if results remain positive.

Businesses are more likely to commit when technology improves efficiency, reduces friction, and fits into existing workflows. Because these pilots link to active financial systems, they signal long-term relevance instead of short-lived excitement.

Conclusion

Quant provides interoperability, proven pilot results, enterprise partnerships, and a token model linked to platform use. These strengths offer real value for investors who focus on infrastructure projects.

However, adoption may take time. Procurement can be slow, regulations could shift, and companies may prefer different licensing methods.

So, when you buy Quant, track enterprise contract updates, token activity, and circulating supply to stay informed. Approach QNT as a long-term speculative position, size it carefully, and watch for usage growth rather than short-term price moves.

How much will your Quant be worth?

Based on your prediction that the price of Quant will change at a rate of 8% every year, calculate your price prediction return on investment below.

Join eToro today and receive $10 in free crypto on your first deposit. Trade crypto, stocks, and ETFs with powerful tools and social investing features like CopyTrader™

Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here

Wondering which crypto to focus on right now?

Our premium members already know.

Since 2017, InvestingHaven’s blockchain research service has been guiding investors through both bull runs and crypto winters.

What makes it different?

-

Proprietary 15-indicator methodology developed over 15+ years of market research.

-

Proven track record of spotting major turning points before markets move.

-

Focused alerts on only the key crypto assets that matter — no noise, no distractions.

Thousands of readers rely on InvestingHaven to stay ahead of the crowd. Now it’s your turn.

Act today and join the original crypto research service — still live and stronger than ever since 2017.