Filecoin is proving that decentralized storage is real infrastructure with rising usage, improving economics, and a long-term role in Web3 data.

I’ve been following Filecoin closely for years, and what I see today looks very different from the hype cycle of 2021. Filecoin has quietly matured into a large-scale storage network with measurable adoption, not just potential.

It’s storing real client data, improving retrieval speeds, and tightening its token economics.

If you’re looking at crypto projects that solve real problems, here are five reasons to buy Filecoin as we step into 2026.

Reasons to To Buy Filecoin Before 2026

1. The Largest Decentralized Storage Network

Filecoin isn’t a small experiment anymore. It has grown into the world’s largest decentralized storage network, with over 14 exbibytes of committed capacity from more than 3,600 storage providers around the globe.

That’s a massive amount of distributed storage, far beyond what most competitors can offer. Why does this matter? Because scale equals reliability. The more providers and locations involved, the more resilient the network becomes.

Businesses and developers can choose where to store their data, balancing cost, speed, and redundancy. That kind of optionality is something only a large, well-established network can provide.

2. Real Demand Is Growing

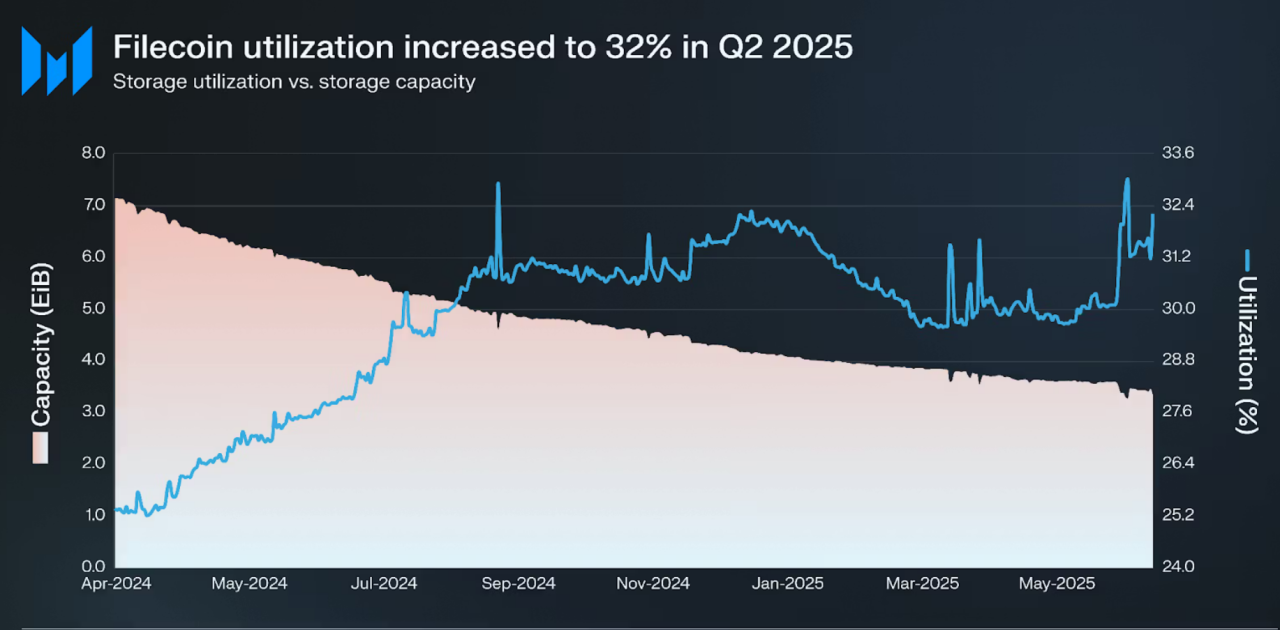

A few years ago, one of Filecoin’s biggest criticisms was that most of its capacity sat unused. That’s no longer true. In 2025, utilization reached about 32%, up significantly from the low single digits two years earlier.

That means almost one-third of all available storage space is being used for real deals by actual clients.

That shift is important because it signals real demand for Filecoin in 2026 and beyond. I see more AI startups, scientific institutions, and decentralized apps using Filecoin for archiving and dataset storage.

As utilization rises, storage providers earn more, which strengthens the whole ecosystem. Higher utilization also tends to tighten token supply over time, since more FIL gets locked into storage contracts.

3. Solid Tokenomics With Real Utility

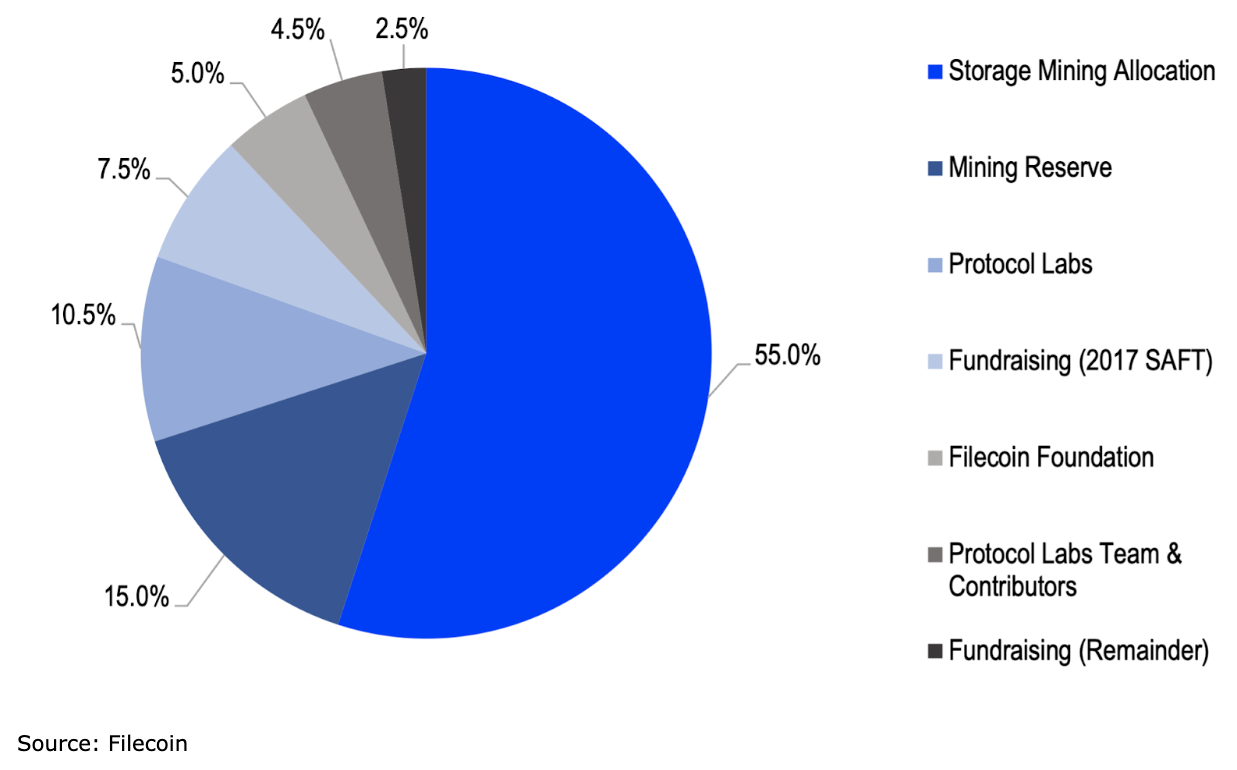

I often remind investors that a good network is only half the story. The token must have meaningful use within that network, and FIL does. Users need FIL to pay for storage and retrieval.

Providers stake it to participate and face penalties if they fail to deliver data, which helps maintain network integrity.

Currently, the circulating supply is around 710 million FIL, while the total cap is set at 2 billion. Filecoin’s reward and burn system continuously removes small amounts from circulation through transaction fees and penalties. This gives the token built-in supply pressure as adoption grows.

I see these as healthy mechanics. I don’t expect FIL to behave like a quick 10x coin, but rather as a utility asset with real-world cash flows and long-term appreciation potential. For long-term investors, that’s a far more sustainable story.

4. A Stronger, Smarter Network

Another reason I believe you should invest in Filecoin is the constant improvement in its tech stack. The Filecoin Virtual Machine (FVM) made it programmable, allowing developers to build on-chain apps that interact directly with stored data.

This opens up new use cases like decentralized marketplaces, automated storage deals, and data monetization models.

Filecoin has also improved its retrieval performance, added developer SDKs, and is expanding tools for content delivery (FilCDN). These upgrades make it much easier for businesses and developers to integrate Filecoin into their systems.

When I look at these improvements, I see a project that’s not standing still. It’s evolving into a full data economy layer, not just a passive storage system. That’s a strong signal for growth and a solid argument for a Filecoin investment in 2026.

5. Expanding Market And DePIN Momentum

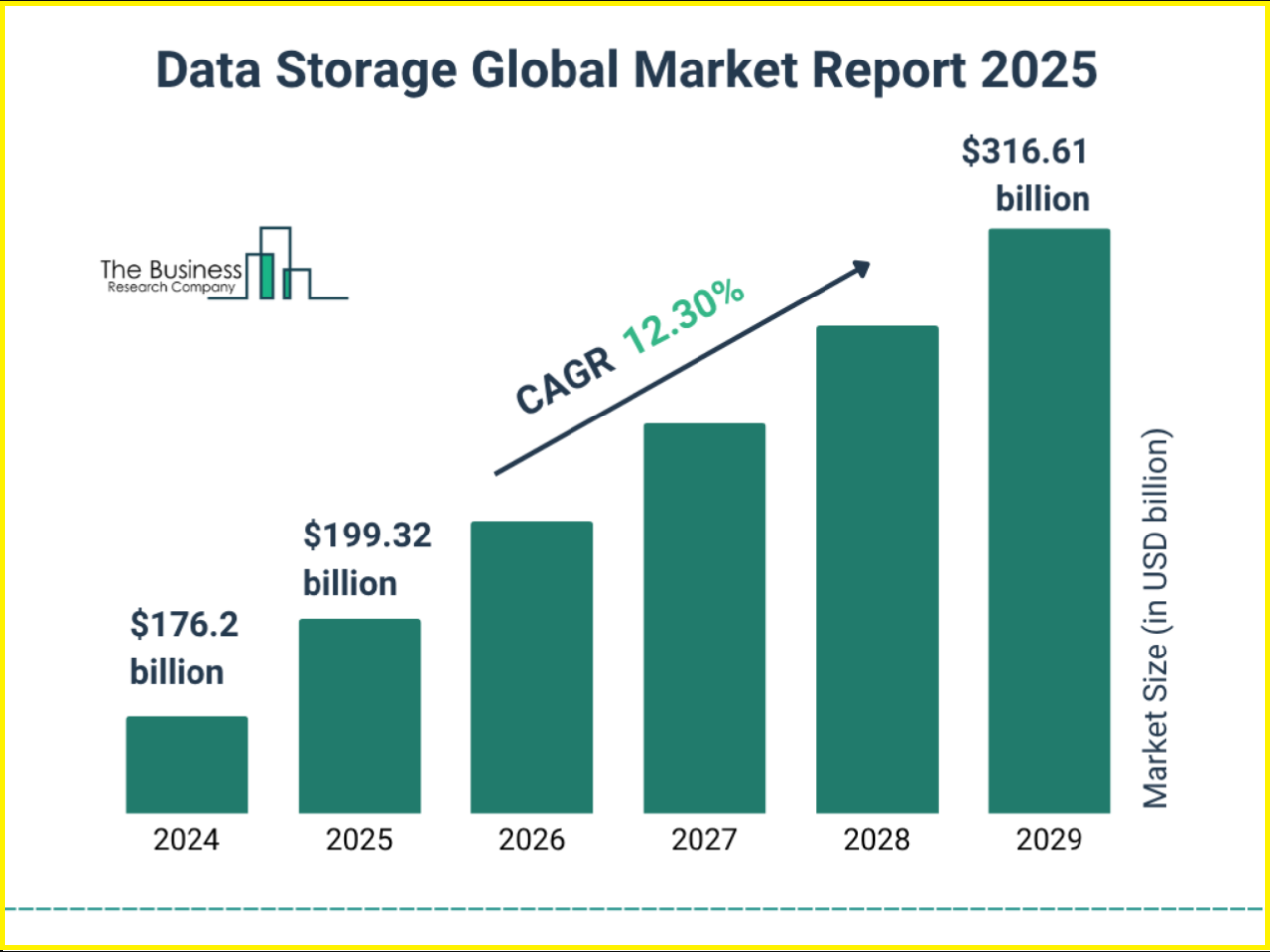

The global data storage market is expanding fast. Analysts project it will reach around $199 billion in 2025, growing at a double-digit rate. Every company is producing and storing more data than ever; from AI models to video content to corporate backups.

Filecoin is perfectly positioned to capture part of this. Its model offers cost efficiency, transparency, and verifiable storage, which centralized providers can’t easily match.

And because it’s decentralized, it fits perfectly with the rise of DePIN (Decentralized Physical Infrastructure Networks), a major Web3 trend that connects real-world resources like compute, bandwidth, and storage to blockchain systems.

Conclusion

Filecoin’s story is simple: it’s big, it’s useful, and it’s getting stronger. The network’s scale gives it credibility, rising utilization proves real demand, tokenomics support long-term value, and continuous improvements make it more practical every year.

If you’re building a portfolio for the next few years, you need to buy Filecoin now. My approach would be to accumulate gradually, track utilization and network upgrades, and think long-term.

Join eToro today and receive $10 in free crypto on your first deposit. Trade crypto, stocks, and ETFs with powerful tools and social investing features like CopyTrader™

Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here

Don’t Miss the Next Big Move – Access Alerts Instantly

Join the original blockchain-investing research service — live since 2017. Our alerts come from a proprietary 15‑indicator methodology built over 15+ years of market experience. You’re following the service that identified major turning points through crypto winters and bull runs alike

Act now and see why thousands trust us to deliver signals before markets move.