Aave combines deep liquidity, multi-chain access, strong community governance, active development, and real protocol revenue making it relevant and trusted in the fast-moving DeFi market.

Aave is one of the largest decentralized lending platforms in crypto. It allows anyone to lend, borrow, and earn interest without using banks or middlemen. Over the years, Aave has grown into a key part of the DeFi ecosystem, with billions locked in its markets and a strong community behind it.

Heading into 2026, Aave looks ready to take its position in the crypto market. If you are still on the fence, here are five reasons to buy AAVE heading into 2026.

Reasons to Buy AAVE Before 2026

1. Market Leadership And Deep Liquidity

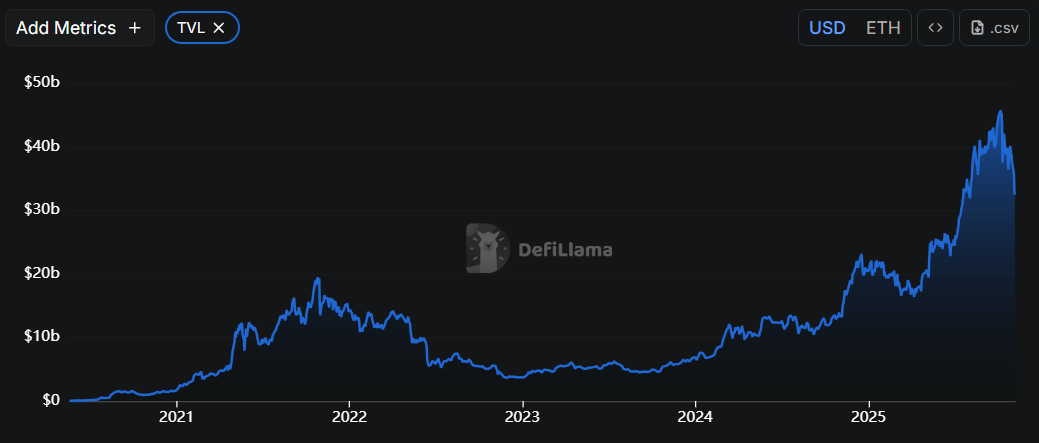

Aave consistently ranks among the top DeFi lending protocols, holding more than $35 billion in total value locked (TVL).

This high liquidity makes it easy for users to lend or borrow large amounts without major price changes. Deep liquidity also creates stable borrowing rates and supports healthy market activity.

The large capital base gives Aave a steady stream of fees, which are shared within its ecosystem. It also makes the platform reliable for institutions that need consistent lending conditions.

RECOMMENDED: Uniswap (UNI) Vs Aave (AAVE): Who Leads The Next DeFi Surge?

2. Multi-Chain And Layer-2 Expansion Reduces Costs

Aave operates on Ethereum and several other major networks, including Arbitrum, Optimism, Polygon, Avalanche, and Base. This wide reach allows users to choose networks with lower gas fees and faster transactions.

It also ensures that Aave remains accessible no matter which blockchain gains more adoption in the future. Developers and wallets can easily integrate Aave’s services across different chains, expanding its reach to millions of users.

This flexibility helps Aave stay ahead of competitors that are limited to a single chain. By lowering costs and improving accessibility, Aave continues to attract new users and keep existing ones active across networks.

3. Governance And Staking Give Holders Real Utility

Another powerful reason to invest in AAVE is that it gives holders voting power to influence the future of the protocol. Through Aave’s DAO, holders can propose and vote on changes, such as interest rate updates, treasury management, and new market launches.

Aave also includes a safety mechanism where holders can stake their tokens to help secure the protocol. The new Umbrella system allows more flexible staking with better risk management. In return, stakers earn rewards for contributing to protocol safety.

4. Active Development Keeps AAVE Competitive

Aave’s team and community developers continue to upgrade the protocol. The Aave V3 family brought new features such as higher capital efficiency, better risk controls, and stronger cross-chain compatibility.

Regular updates show that the project isn’t standing still but improving to match new market conditions. Developers also release SDKs and APIs that make it easier for apps and wallets to integrate Aave’s services.

This ongoing innovation attracts new integrations and Aave use cases. Consistent technical upgrades keep Aave secure, adaptable, and ready for future demand; traits that make it more likely to remain a top protocol for years to come.

5. Real Revenue And Token Buybacks Add Long-Term Value

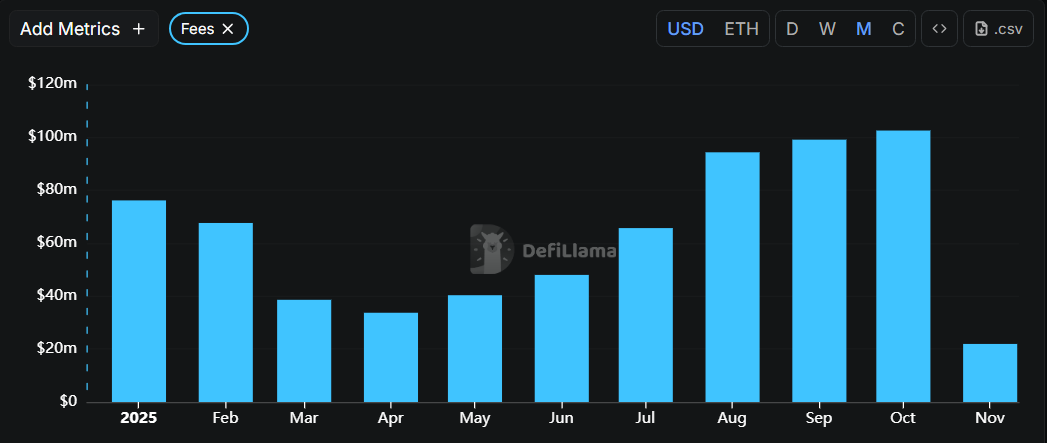

Aave generates real income from lending activity. In the past 30 days alone, the protocol earned about $12.6 million in revenue from nearly $100 million in total fees.

Unlike many crypto projects that rely on hype, Aave’s earnings come directly from user activity on the platform. Recently, the community approved a $50 million annual buyback plan, funded by protocol earnings, to repurchase AAVE from the market.

This creates consistent demand for Aave, tied to real business performance. When combined with its fee generation and growing user base, these measures give AAVE holders long-term value that connects the token to the protocol’s real economic success.

Conclusion

Aave’s strong fundamentals make it one of the most trusted names in DeFi. The deep liquidity, multi-chain access, active governance, continuous development, and real revenue are some of the few reasons to buy AAVE heading into 2026.

While crypto remains volatile and competition is intense, Aave’s combination of scale, innovation, and financial sustainability gives it a durable edge. As 2026 approaches, Aave is a great choice if you want exposure to the future of decentralized lending and borrowing.

Join eToro today and receive $10 in free crypto on your first deposit. Trade crypto, stocks, and ETFs with powerful tools and social investing features like CopyTrader™

Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here