Interchain liquidity, appchain flexibility, and staking yield support long-term demand for ATOM. IBC and the SDK keep the network active.

Cosmos focuses on connecting independent blockchains so they can exchange assets and messages through IBC, a secure and efficient communication protocol. ATOM is the token that secures the Hub, supports governance, and plays a central role in network activity.

If you value interoperability, developer adoption, and on-chain participation, ATOM remains a strong candidate for the long term. Below are reasons to buy ATOM today.

RECOMMENDED: Polkadot vs Cosmos: Who’s Better Positioned For Growth?

Reasons to Buy ATOM Before 2026

1. Interoperability You Can Actually Use

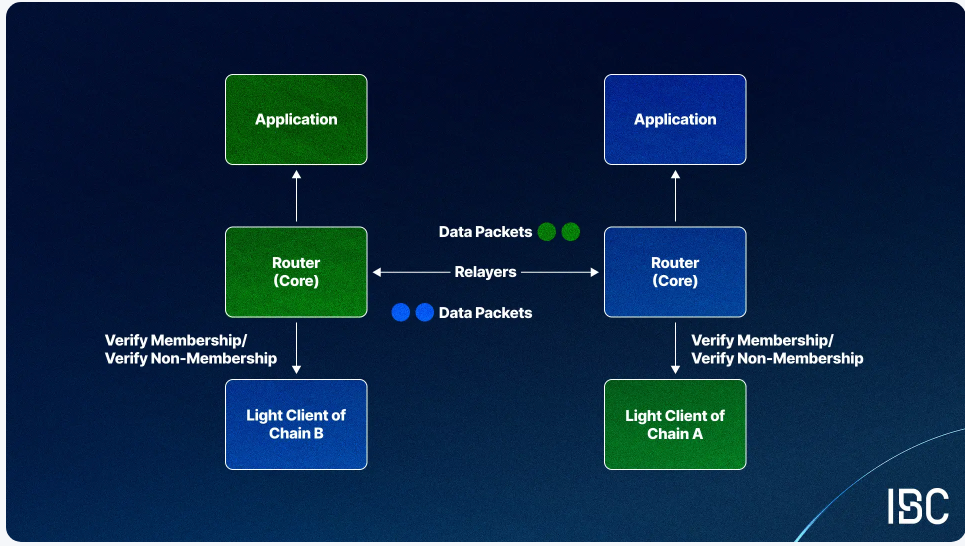

Inter-Blockchain Communication Protocol (IBC) makes it possible for individual blockchains to talk to each other and move assets without creating wrapped versions. This reduces risk, removes unnecessary middle layers, and improves the user experience.

More than 115 chains connect through IBC today, and the network moves over $1 billion in monthly cross-chain volume. These flows show that people use the system regularly, not just in theory.

Developers get reliable cross-chain messaging, while users gain simple and secure transfers between chains. This improves liquidity routing for DEXs, lending apps, and wallets, and helps reduce fragmentation across the ecosystem.

2. A Modular, Developer-Friendly Stack

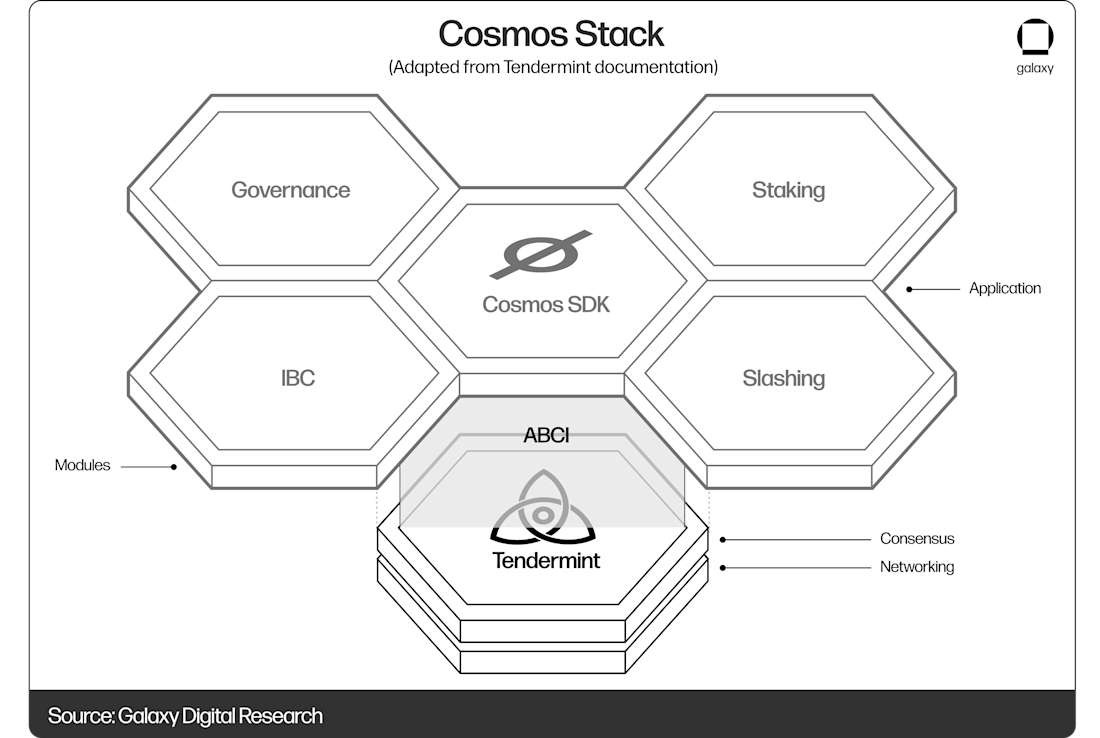

The Cosmos SDK gives teams a simple and flexible way to build application-specific blockchains. Developers can choose the modules they need, customize features, and avoid the congestion that often affects shared networks.

This approach shortens development time and makes upgrades easier. More than 200 production chains use the Cosmos SDK, and hundreds of projects continue to build with this stack. This consistent adoption shows strong developer confidence.

Appchains can also plug into IBC for liquidity and messaging while keeping full control over fees, governance, and performance. This model works well for DeFi, infrastructure, and real-world asset projects that require predictable operations.

3. Economic Security, Staking Yield, And Governance Participation

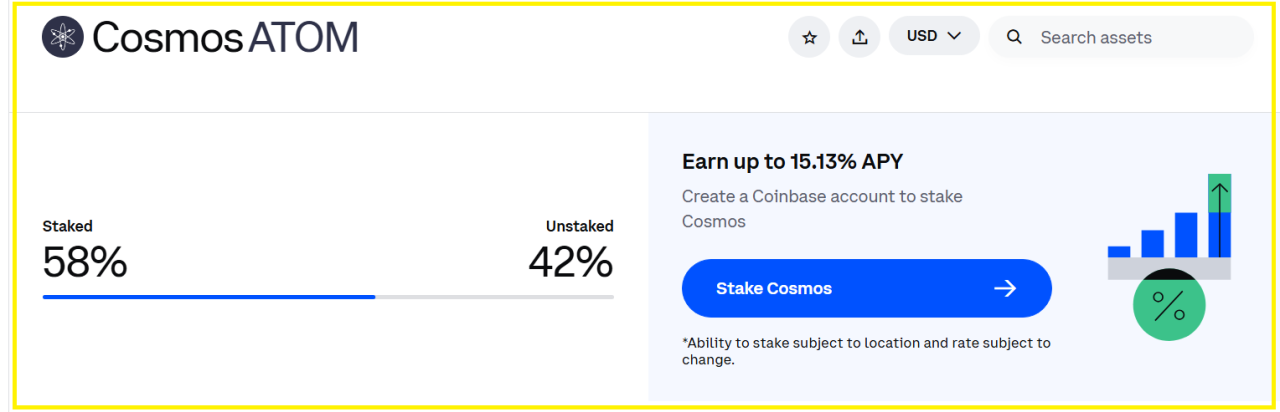

ATOM secures the Cosmos Hub through staking. Holders who delegate ATOM to validators help protect the network and earn staking rewards. Many platforms list around 15% APY today.

Staking reduces liquid supply and keeps holders engaged through both yield and governance. Delegators vote on network upgrades and proposals, giving them direct influence over the Hub’s direction. While staking offers steady rewards, it also comes with responsibilities.

Holders should choose validators carefully and monitor commission rates, because slashing and reward changes can affect returns. Still, the ability to earn yield and participate in governance adds long-term value for committed holders.

4. Sovereign Scalability

Cosmos uses a design where each project can launch its own sovereign chain while still connecting to the broader ecosystem through IBC. This gives teams full control over fees, upgrades, and policies without relying on a single, congested network.

It also lets the ecosystem scale horizontally by adding more chains instead of pushing all activity onto one base layer. New security options help smaller chains borrow economic security from larger hubs without giving up independence.

This structure allows projects to build exactly what they need while still accessing shared liquidity. It supports diverse Polkadot use cases in finance, infrastructure, and real-world applications.

5. Real-World Liquidity And Active Apps

Cosmos hosts several active apps that attract users and capital. Platforms like Osmosis offer steady liquidity and trading activity, while infrastructure products such as Akash and widely used wallets like Keplr form key parts of the ecosystem.

Osmosis alone holds tens of millions of dollars in TVL and records millions in weekly trading volume. These are clear signs of real usage. This activity increases demand for IBC transfers and for ATOM-secured messaging through the Hub.

If you invest in ATOM, keep in mind that liquidity can shift with market cycles, so position sizing still matters.

Conclusion

Cosmos provides stable and practical reasons to buy ATOM through real interoperability, a flexible development framework, staking rewards, sovereign scaling, and active on-chain applications.

These strengths create steady demand from developers, stakers, and users who rely on cross-chain messaging and liquidity.

If you plan to invest, consider the risks of PoS systems and validator selection, and use staking and governance tools to stay engaged. With thoughtful participation and proper risk control, ATOM can be a solid addition to a multi-chain focused portfolio.

Join eToro today and receive $10 in free crypto on your first deposit. Trade crypto, stocks, and ETFs with powerful tools and social investing features like CopyTrader™

Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here

Wondering which crypto to focus on right now?

Our premium members already know.

Since 2017, InvestingHaven’s blockchain research service has been guiding investors through both bull runs and crypto winters.

What makes it different?

-

Proprietary 15-indicator methodology developed over 15+ years of market research.

-

Proven track record of spotting major turning points before markets move.

-

Focused alerts on only the key crypto assets that matter — no noise, no distractions.

Thousands of readers rely on InvestingHaven to stay ahead of the crowd. Now it’s your turn.

Act today and join the original crypto research service — still live and stronger than ever since 2017.

- Why This Bounce Matters (30 Crypto Charts) (Nov 23rd)

- What’s Going On With Bitcoin & Alts?(Nov 16th)

- This Is What We Want To See The Next 72 Hours(Nov 9th)

- The Next 2 To 3 Weeks …(Nov 2nd)

- A Successful Test of Bitcoin’s 200 dma? (Oct 26th)

What Our Readers Say

“I got to tell you, you guys and your charting and your predictions are AMAZING! I don't know how people can even give you a hard time when you make pullback predictions. Markets cannot go up forever!”

“I LOVE how you talk about the ‘buy the dips’ times vs the ‘sell for profit’ times to get more free coins. You have been right sooo many times — it’s actually amazing!”

— Newsletter Subscriber

“Your team puts a huge amount of work into the newsletters and the analyses. You’ve been doing this for so many years already, and the passion is still there. Respect.”

“Because of your research, I’ve become a much more patient investor. And ‘more patient’ basically means ‘better.’ Over the past few years, my capital has often just stayed unused rather than constantly invested — and it has paid off.”

“Now that my perspective is strictly long term, I have far more peace in my life. Nothing is more stressful than constantly wondering what your crypto might do the next day. After seeing firsthand that long-term investing outperforms trading, the difference is night and day.”

— Crypto Research Subscriber

“As a faithful follower, I really miss the commentaries — the wisdom, the thoughts, the analysis. Truly appreciate the knowledge you share.”

— Long-Time Follower