Institutional inflows, major upgrades, and powerful on-chain momentum make Ethereum a top crypto buy with long-term upside.

Ethereum isn’t just one of the best-performing cryptocurrencies by market cap, it’s becoming the backbone of the modern decentralized economy. With its price currently holding above $3,000 and a growing list of bullish fundamentals, now may be one of the best times to consider buying Ethereum.

So, whether you’re a long-term investor or looking to position for the next wave of growth, here are five compelling reasons to buy Ethereum today.

1. Institutional Inflows Are Accelerating

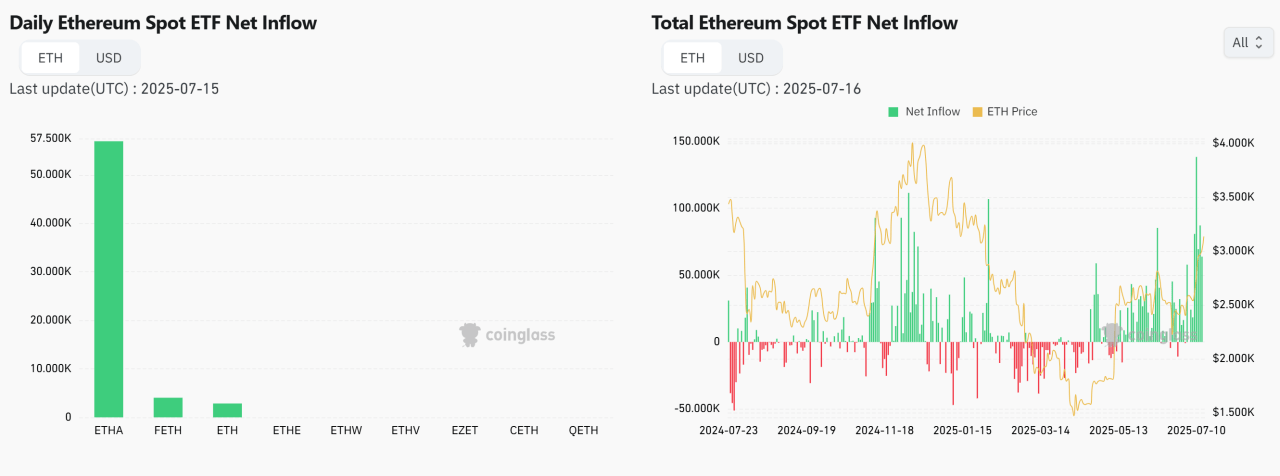

Ethereum is no longer just a favorite of retail investors, it’s rapidly being embraced by Wall Street. On July 15 alone, Ethereum spot ETFs pulled in over $192 million in net inflows, with BlackRock’s ETHA product responsible for nearly 90% of that.

That marked the eighth straight day of positive ETF flows, a trend signaling growing institutional confidence.

BlackRock’s combined spot Bitcoin and Ethereum ETFs brought in a staggering $14.1 billion in Q2 2025. Since July 9, estimates suggest over $1 billion has flowed into Ethereum ETFs, while corporate treasuries and crypto mining firms have added more than 545,000 ETH to their holdings.

And there’s yield too; Ethereum staking is currently offering 3–4% annually, making it attractive to conservative institutions looking for passive income. With regulated ETF access, income potential, and asset legitimacy, Ethereum is a great pick for modern diversified portfolios.

2. Bullish Technicals and On-Chain Strength

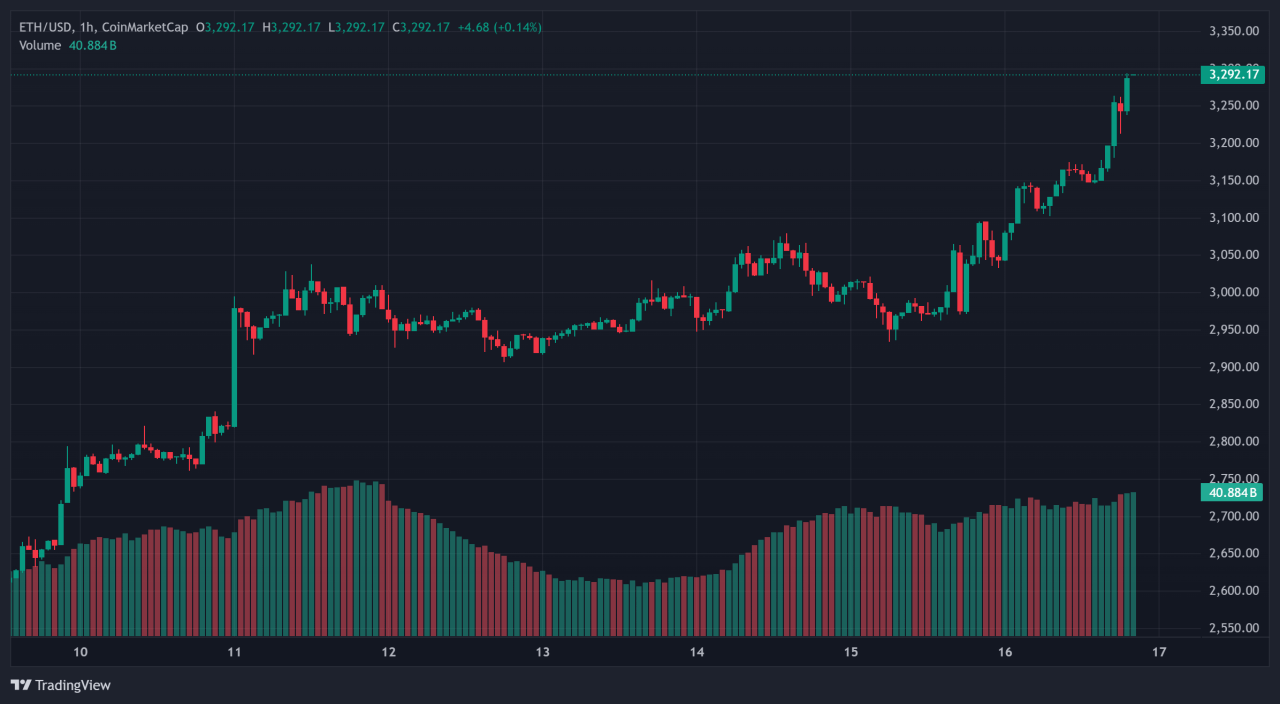

Ethereum’s recent price action shows real strength. It’s reclaiming key levels (like the $3,000 level) and also breaking through long-term resistance levels, including the 200-day moving average and important RSI fractals.

Many analysts see a potential push toward $4,000 to $4,500, with even higher targets possible if momentum holds.

On-chain data confirms the trend. Inflows into spot ETFs hit a record 225,857 ETH and it’s now 12 consecutive weeks of positive ETF demand.

Cumulatively, that’s over $4 billion in 2025 alone. Combine that with staking and HODLer behavior, and you’re looking at a tightening supply dynamic – one that may push Ethereum toward deflation.

What does this mean? Ethereum’s technical and on-chain signals align in rare fashion, making this a powerful entry point for new and seasoned investors alike.

3. Major Upgrades and Scalable Infrastructure

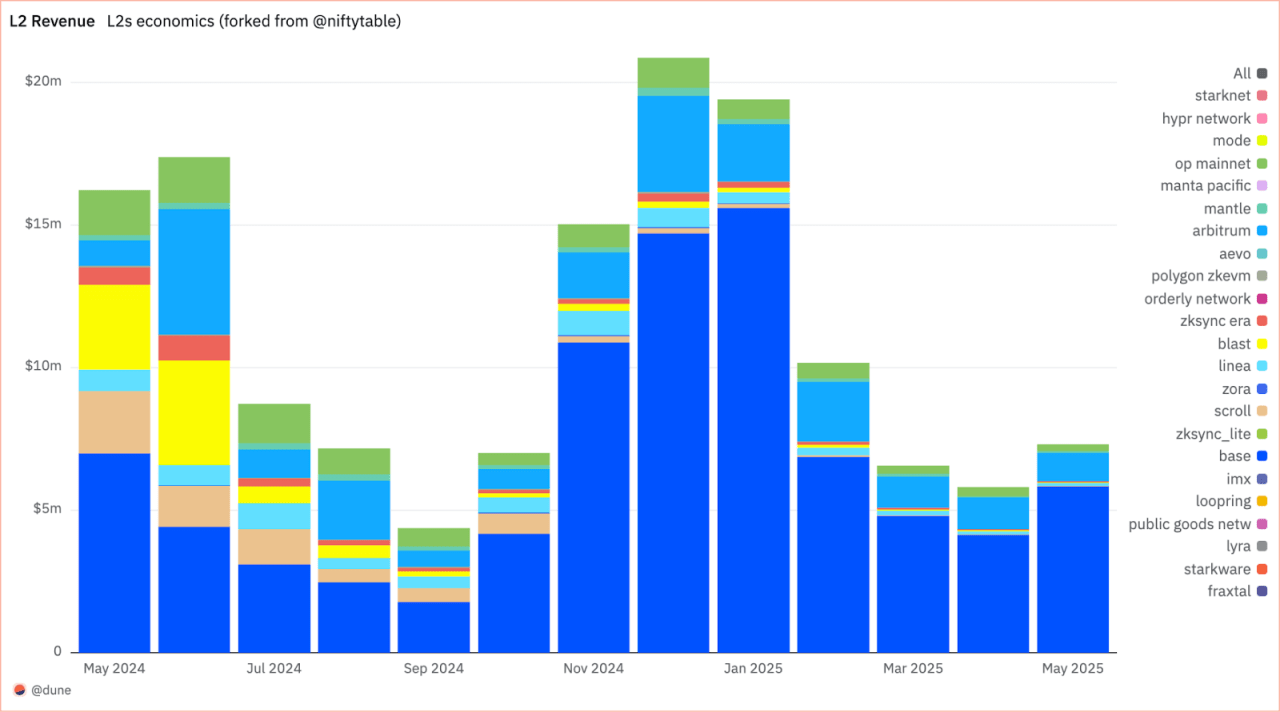

Ethereum’s ongoing upgrades are laying the foundation for mass-scale utility. The Dencun upgrade launched in March 2024 introduced “blobs,” a data compression innovation that cut gas fees on Layer 2s by 80–99%.

Platforms like Arbitrum, Base, and Optimism became dramatically cheaper and faster, pushing over 85% of Ethereum’s transaction volume to Layer 2 networks.

As of May 2025, Layer 2s generated $5.8 million in fees in a single month, setting a pace for over $70 million annually, according to a report by Dune Analytics.

Meanwhile, Ethereum wallet activity continues to rise; 127 million active addresses, up 22% year-over-year, and adding roughly 350,000 new wallets weekly.

Gas fees are also down, averaging $3.78, compared to nearly $6 in 2024. That’s not just cost efficiency, it’s improved user experience.

With more affordable DeFi, rising NFT activity, and booming L2 ecosystems, Ethereum has become the most scalable and user-friendly smart contract platform in crypto.

4. Stablecoin Strength and Regulatory Momentum

Ethereum remains the dominant stablecoin platform, hosting more than 50% of all circulating stablecoins like USDC and USDT (OKX). These digital dollars fuel DeFi, remittances, payments, and trading—core pillars of the crypto economy.

Adoption is speeding up across traditional finance. PayPal, Visa, Mastercard, and Shopify have all integrated stablecoin payments through Ethereum.

At the policy level, legislation like the GENIUS Act and CLARITY Act are gaining traction in the U.S., providing regulatory clarity and opening doors for institutional use.

Bank of America estimates it could take 3–5 years to fully roll out stablecoin infrastructure globally, and Ethereum is already the frontrunner. As regulation tightens and major companies shift toward blockchain-based finance, Ethereum’s network utility and long-term relevance continue to grow.

5. Strong Price Forecasts and Future Valuation

Ethereum isn’t just thriving today, it’s also one of the most promising long-term plays in crypto. Analysts at EMJ Capital are forecasting a bull cycle target of $10,000 to $15,000, with long-run potential reaching as high as $1.5 million per ETH based on network valuation and global financial integration.

Founder Eric Jackson highlights staking ETFs as the next major driver, offering 3.5% institutional yield while reducing available supply – possibly well before October 2025. Most base-case models are already projecting Ethereum to reach $10,000 in the coming cycle.

With a current market cap of around $380 billion, Ethereum already rivals companies like Johnson & Johnson, yet it still has vast room to grow. If it becomes the foundational layer for DeFi, digital identity, tokenized assets, and global payments, a multi-trillion-dollar valuation doesn’t seem far-fetched.

Conclusion

Ethereum stands at the center of a massive financial transformation. From growing institutional inflows and lucrative staking yields to major protocol upgrades and stablecoin leadership, all signs point to a promising future.

It’s rare to see fundamentals, technology, and regulation align this well in crypto. While volatility is always a risk, the structure supporting Ethereum’s growth looks solid.

If you’re looking to invest in the future of decentralized finance, smart contracts, and programmable money, Ethereum is one of the best crypto to buy today.

Our latest crypto alerts – instantly accessible

This is how we are guiding our premium members (log in required):

- Is Alt Season 2025 Here? (July 15th)

- Alts Breakout Happening Now. These Are Price Time Combinations To Watch. (July 11th)

- Crypto Charts Are Improving, Just Have A Look At These 3 Leading Indicators (July 6th)

- Alt Season 2025: The Animals Are Back, This May Be A Very Bullish Signal (June 29)

- BTC And Altcoins About To Hit Big Support Areas (June 22)

- The Alt Season Charts (June 15th)

- Another Test of 106.1k, Is This THE Big One? (June 8th)