Injective has a finance-ready chain with clear utility. Its strong fee capture, active staking, and cross-chain access makes it a worthy investment.

Injective is a layer one blockchain designed for decentralized trading.

It focuses on speed, predictable fees, and tools that help people build markets for spot trading, perpetuals, and other financial products.

INJ, the network token, plays a central role by handling governance, staking, and protocol fees.

Is Injective a good investment? Here are five reasons people are buying INJ.

Join eToro today and receive $10 in free crypto on your first deposit. Trade crypto, stocks, and ETFs with powerful tools and social investing features like CopyTrader™

Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here

RECOMMENDED: 3 High-Growth Crypto Coins That Could Be Better Than XRP

Top Reasons To Buy INJ Today

1. Purpose-Built Infrastructure For DeFi And Derivatives

Injective was created for one thing; on-chain trading that feels as fast and smooth as centralized platforms.

It uses an orderbook system, which traders prefer because it offers clearer pricing and better control.

The chain finalizes transactions quickly, keeps costs low, and supports high-frequency interactions.

This makes it suitable for advanced markets such as perpetual contracts and prediction markets.

Developers who build trading tools can rely on consistent execution, which is something general-purpose blockchains struggle to match.

Because Injective focuses on this single area, it delivers performance that traders can actually feel when they use it.

2. Strong Tokenomics

INJ supports voting, staking, and a unique burn system that reduces supply over time.

The protocol collects fees from markets built on Injective and uses part of those fees in weekly auctions that buy and burn INJ.

The burn size depends on real activity, so higher usage reduces supply at a faster rate. This gives INJ a practical relationship to the network’s performance.

Holders can also stake their tokens to secure the chain and earn rewards. When you combine governance, staking, and deflation, you get a token with clear economic support.

3. Real, Measurable Ecosystem Activity

Injective has consistent activity on-chain, which shows that people actually use the platform.

Recent data lists roughly $19 million in bridged TVL and regular trading flows that include more than $30 million in daily perpetual volumes.

These numbers reflect an ecosystem that is small enough to grow but active enough to prove demand.

Every trade produces fees, which then feed the burn auctions and staking rewards.

Even with moderate TVL, derivatives trading can move large amounts of value. This creates ongoing usage that supports the token and the protocol.

4. Active Staking And Community Governance

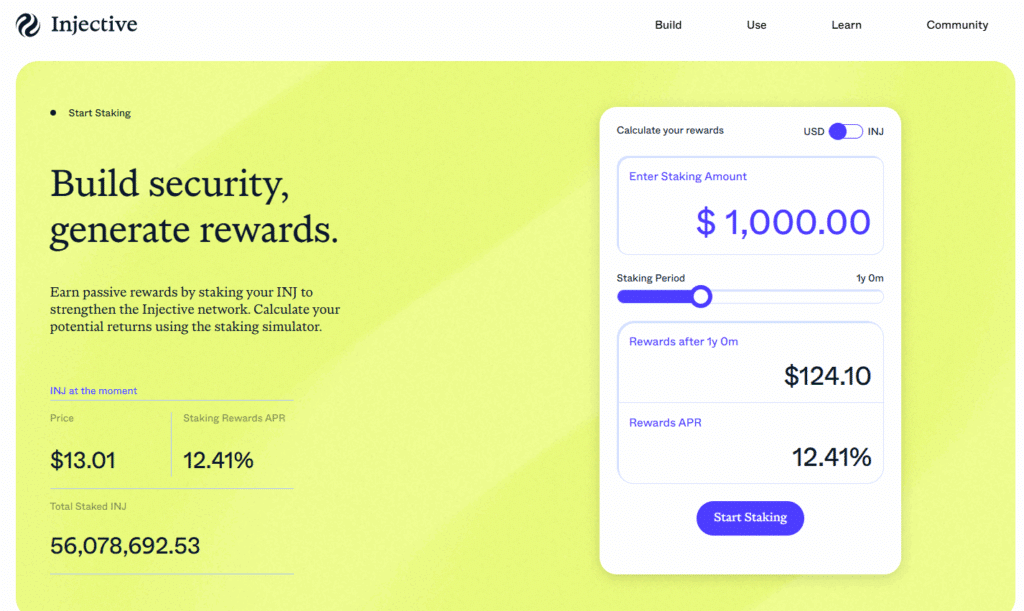

Injective’s staking participation is strong, with roughly 56.7 million INJ locked.

This represents a majority of the available supply and shows real involvement from holders.

High staking strengthens network security and reduces the number of tokens available to sell.

Staking INJ also increases voter participation because stakers can vote on proposals that guide the protocol.

A distributed validator set reduces centralization risks, while steady governance activity shows that the community takes part in shaping upgrades.

This level of participation helps the network stay stable and predictable which is important if you intend to invest in INJ for the long-term.

5. Interoperability And Developer Momentum

Injective works with Cosmos IBC, which makes it easy to move assets across different chains within the ecosystem.

Developers can also use Ethereum-compatible tools to build apps, which lowers the barrier for teams that already understand Solidity and EVM-style development.

These choices increase the number of potential integrations and attract projects that want cross-chain access.

For users, this means more markets and better liquidity. As more builders use Injective’s toolkits to launch trading platforms, the network gains activity that supports long-term growth.

Interoperability gives Injective a broader reach and makes it more useful in a multi-chain future.

Conclusion

Injective stands out because it focuses on one clear goal of delivering high-quality on-chain trading.

Its tokenomics support long-term holders through governance rights, staking rewards, and regular burn events tied to actual usage.

The network shows real activity with measurable trading volume, which supports the economic loop behind INJ.

Strong staking participation adds stability, while interoperability opens the door to more users and developers.

As with any crypto investment, it is important to weigh the strengths of the project against market risks.

If you prefer platforms with real utility and clear value flows, Injective might be a good addition to your crypto portfolio.

Join eToro today and receive $10 in free crypto on your first deposit. Trade crypto, stocks, and ETFs with powerful tools and social investing features like CopyTrader™

Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here

Wondering which crypto to focus on right now?

Our premium members already know.

Since 2017, InvestingHaven’s blockchain research service has been guiding investors through both bull runs and crypto winters.

What makes it different?

-

Proprietary 15-indicator methodology developed over 15+ years of market research.

-

Proven track record of spotting major turning points before markets move.

-

Focused alerts on only the key crypto assets that matter — no noise, no distractions.

Thousands of readers rely on InvestingHaven to stay ahead of the crowd. Now it’s your turn.

Act today and join the original crypto research service — still live and stronger than ever since 2017.

What Our Readers Say

“I got to tell you, you guys and your charting and your predictions are AMAZING! I don't know how people can even give you a hard time when you make pullback predictions. Markets cannot go up forever!”

“I LOVE how you talk about the ‘buy the dips’ times vs the ‘sell for profit’ times to get more free coins. You have been right sooo many times — it’s actually amazing!”

— Newsletter Subscriber

“Your team puts a huge amount of work into the newsletters and the analyses. You’ve been doing this for so many years already, and the passion is still there. Respect.”

“Because of your research, I’ve become a much more patient investor. And ‘more patient’ basically means ‘better.’ Over the past few years, my capital has often just stayed unused rather than constantly invested — and it has paid off.”

“Now that my perspective is strictly long term, I have far more peace in my life. Nothing is more stressful than constantly wondering what your crypto might do the next day. After seeing firsthand that long-term investing outperforms trading, the difference is night and day.”

— Crypto Research Subscriber

“As a faithful follower, I really miss the commentaries — the wisdom, the thoughts, the analysis. Truly appreciate the knowledge you share.”

— Long-Time Follower