Stacks connects Bitcoin’s security with smart contracts, rewards holders in Bitcoin, and supports safer, practical apps with a growing ecosystem.

Stacks is a project that expands what Bitcoin can do. It adds smart contracts and decentralized apps while keeping Bitcoin as the settlement layer. This means developers can build new tools and services without giving up Bitcoin’s security. For investors, it offers a rare mix of innovation and reliability.

Below, we will look at five key reasons to buy Stacks (STX) and add it to your crypto portfolio.

1. Built on Bitcoin: Security First for Smart Contracts

Stacks operates alongside Bitcoin, using it as the final settlement layer for all transactions. This setup gives apps built on Stacks the same security that protects Bitcoin itself. Instead of starting a new blockchain from scratch, Stacks connects directly to the most secure network in the world.

This connection lowers the risk of data loss or manipulation because every transaction eventually settles on Bitcoin. For developers and users, that trust is essential. It means apps on Stacks can last as long as Bitcoin exists.

This makes Stacks a strong option for projects that need permanent records, like identity systems, digital collectibles, and financial contracts.

RECOMMENDED: Stacks (STX) Price Prediction 2025 – 2030

2. Earn Bitcoin Through Stacking

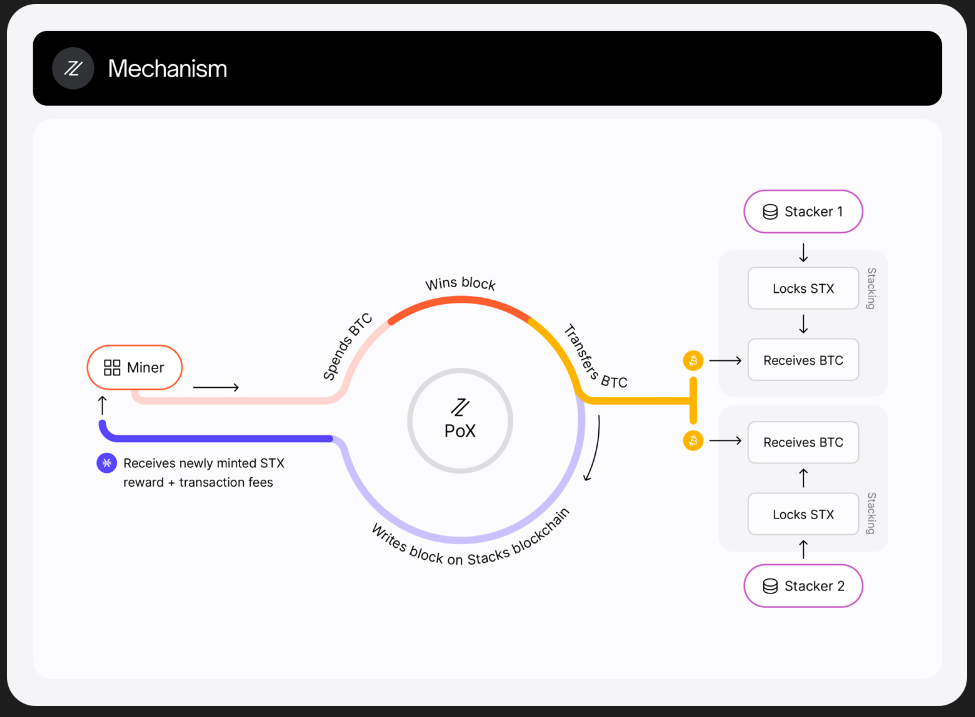

Stacks uses a unique system called Proof of Transfer (PoX). Here’s how it works: miners spend Bitcoin to create new STX blocks, and STX holders who lock their tokens in a process called “stacking” earn rewards in Bitcoin.

This means investors can earn real BTC, not just more tokens. It’s a practical way to generate Bitcoin income without trading or complex setups. Stacking also locks up part of the circulating STX supply, which helps balance market activity.

The rewards come directly from the network’s operations, not from speculation, giving STX a real financial use case tied to Bitcoin’s value.

3. Clarity: Safer and Easier Smart Contracts

Stacks uses its own programming language called Clarity. It’s designed to make smart contracts transparent and predictable. Unlike some languages where code behavior can be uncertain, Clarity lets developers know exactly how a contract will behave before deployment.

This approach reduces common bugs and exploits that have caused losses in other networks. For users and businesses, this adds confidence that their funds and data are safe.

Clear, testable contracts also make it easier for companies to audit and approve blockchain-based systems. That safety focus gives Stacks a long-term advantage as blockchain adoption grows.

4. A Growing Ecosystem of Apps and Tools

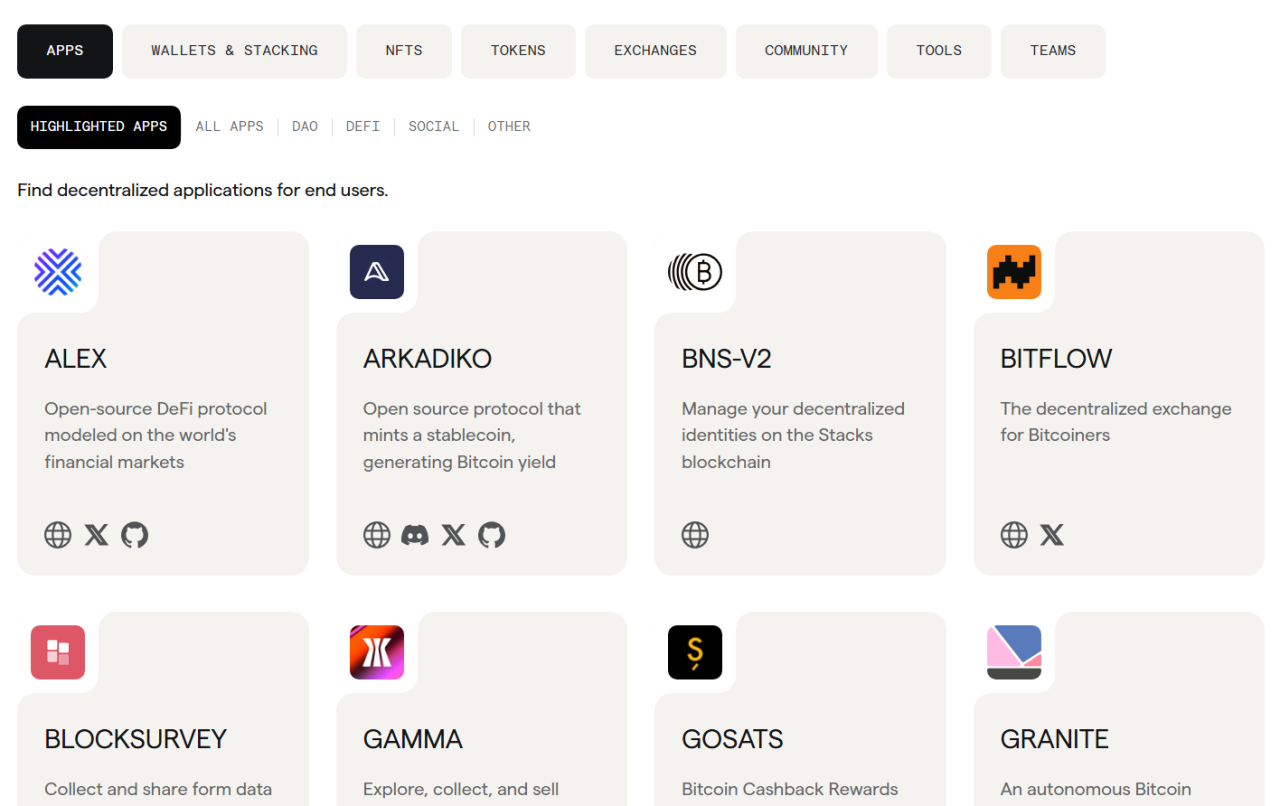

Stacks has developed a healthy ecosystem that includes wallets, NFT marketplaces, and early DeFi projects. Developer tools like those from Hiro make it easier to build and test apps quickly. These tools include clear documentation, SDKs, and debugging features that speed up development.

As more apps launch, network activity increases, creating more demand for STX. Users can interact with apps, trade NFTs, or join stacking pools through user-friendly wallets. This real activity helps keep the network relevant and useful.

The Stacks community also supports innovation through grants and hackathons, which encourages developers to keep building.

RECOMMENDED: Can Stacks (STX) Ever Rise To $66?

5. Real Utility and Economic Value

Another reason to invest in STX is that it is not just a token for trading. It has several real functions within the network. It pays transaction fees, locks up for stacking rewards, and gives holders a voice in network decisions. This combination supports a strong long-term economy around STX.

Stacks is also developing features like sBTC, which will allow users to move Bitcoin into smart contracts safely. This connection between Bitcoin and Stacks could open a wider range of decentralized finance options. As usage grows, so does the value of STX, because every transaction and stacking cycle depends on it.

Conclusion

Stacks combines Bitcoin’s unmatched security with the flexibility of smart contracts. It allows users to earn Bitcoin, build reliable apps, and use a token with clear economic purpose.

With a growing ecosystem and strong foundations, Stacks offers investors and developers a way to bring new ideas to Bitcoin – securely and sustainably.

Join eToro today and receive $10 in free crypto on your first deposit. Trade crypto, stocks, and ETFs with powerful tools and social investing features like CopyTrader™

Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here

Wondering which crypto to focus on right now?

Our premium members already know.

Since 2017, InvestingHaven’s blockchain research service has been guiding investors through both bull runs and crypto winters.

What makes it different?

-

Proprietary 15-indicator methodology developed over 15+ years of market research.

-

Proven track record of spotting major turning points before markets move.

-

Focused alerts on only the key crypto assets that matter — no noise, no distractions.

Thousands of readers rely on InvestingHaven to stay ahead of the crowd. Now it’s your turn.

👉 Act today and join the original crypto research service — still live and stronger than ever since 2017.

This is how we are guiding our premium members (log in required):

- ATH in BTC = Alt Season 2025 Catalyst? (Oct 5th)

- Crypto Consolidation: When Will Bullish Momentum Return? (Sept 28)

- Is Meme Season Underway? (Sept 19th)

- Alt Season Is Brewing, In Silence. These 3 Charts Tell The Crypto 2025 Story. (Sept 10th)

- Is A Trendless Crypto Market Good or Bad? The Current and Emerging Winners Look Awesome. (Sept 7th)

- BTC Testing Long Term Trendline. Here Is Short and Long Term Guidance. (Aug 26th)

- Crypto – To Break Out Or Not To Break Out? (Aug 23rd)