Uniswap’s UNI token gives holders real influence over the world’s leading decentralized exchange. Its strong market share, large treasury, and evolving product support makes it one of the best tokens to buy today.

Uniswap is one of the biggest decentralized exchanges (DEXs) in crypto, allowing anyone to trade tokens directly from their wallets. Its native token, UNI, gives holders the right to vote on how the platform develops, how funds are spent, and what future features to prioritize.

We are going to share five key reasons to buy uniswap. These include Uniswap’s market dominance, governance power, revenue potential, token structure, and product growth.

RECOMMENDED: Uniswap (UNI) Vs Aave (AAVE): Who Leads The Next DeFi Surge?

1. Buy Uniswap – Understand its Market Position, Liquidity, and Trading value

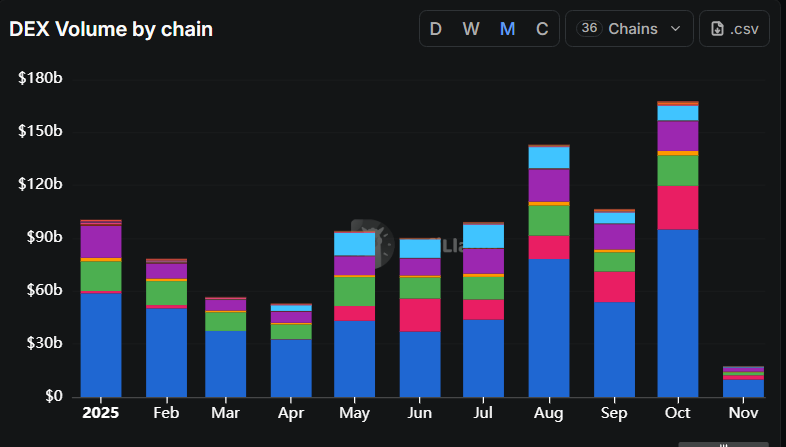

Uniswap continues to lead the DEX market. It consistently ranks among the top exchanges by both trading volume and number of supported tokens. In October 2025, Uniswap handled around $170 billion in monthly trading volume, showing how heavily it’s used across multiple blockchains.

This scale gives Uniswap deep liquidity, meaning users can trade large amounts with minimal price impact. High activity attracts more traders and developers, which strengthens the platform even further.

If you are looking to invest in UNI, this is important because a vibrant exchange gives the token long-term relevance and a stable foundation for future growth.

2. Real Governance, Real Influence Over Protocol Direction

Holding UNI means owning a voice in one of crypto’s most important protocols. UNI holders can vote on proposals that shape Uniswap’s direction, such as how the treasury funds are used or whether Uniswap trading fees should be shared with the community.

This structure turns Uniswap into a true community-led protocol. Active governance participation ensures decisions come from those who use and support the network. Over time, this system can create better alignment between the protocol’s success and the interests of its token holders.

RECOMMENDED: Prediction: $1,000 Investing in Uniswap Could Be Worth What in a Year?

3. Clear Paths To Value Capture Through Fees And Treasury Actions

Uniswap’s governance system also allows UNI holders to decide how revenue is handled. One major topic has been the “fee switch,” a proposal that would direct part of trading fees to the DAO or potentially to UNI holders.

Although not yet fully implemented, this idea remains active within governance discussions. The DAO already controls hundreds of millions of dollars in assets, allowing it to fund projects, grants, and liquidity programs.

If the community activates the fee switch or similar mechanisms in the future, UNI could gain a direct link to protocol earnings, creating another layer of long-term value.

4. Tokenomics And A Large DAO Treasury

UNI has a fixed supply of 1 billion tokens, which helps prevent dilution over time. The Uniswap DAO also manages one of the largest treasuries in decentralized finance, estimated at several billion dollars depending on market conditions.

This treasury acts as a financial backbone for the protocol. It funds ecosystem growth, developer grants, research, and emergency support during volatile markets.

The combination of limited supply and a well-funded DAO provides long-term sustainability, making Uniswap less dependent on external investors or short-term market cycles.

Product Innovation, V4 And Multi-Chain Expansion

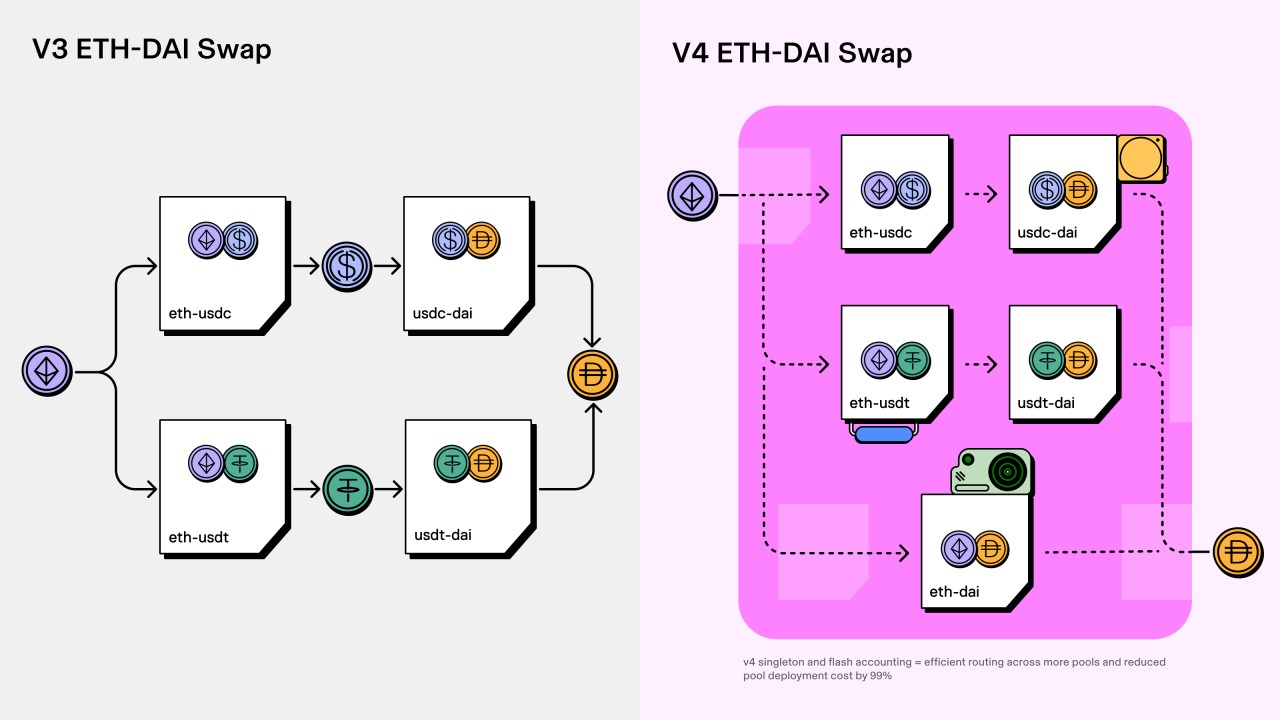

Uniswap has evolved through several versions, each improving efficiency, flexibility, and cost. Version 4 (v4), launched in 2024, introduced “hooks,” a modular system that lets developers build custom trading tools directly into the protocol.

Uniswap has also expanded across major blockchains and Layer 2 networks, such as Arbitrum, Optimism, and Polygon. This cross-chain approach ensures users can access Uniswap’s services wherever liquidity is growing.

Such adaptability makes Uniswap one of the few crypto projects with a clear plan for future scalability and relevance.

Conclusion

Uniswap’s market leadership, active governance, revenue potential, solid tokenomics, and constant innovation make it a compelling token for anyone looking for new tokens for their portfolio. For investors exploring opportunities to buy Uniswap (UNI), these strengths highlight why it continues to stand out among decentralized exchange projects.

As with any crypto asset, there are risks—especially around regulation and market cycles—but Uniswap’s foundation remains strong. UNI gives holders not just a token, but a stake in the continued evolution of decentralized trading.

Join eToro today and receive $10 in free crypto on your first deposit. Trade crypto, stocks, and ETFs with powerful tools and social investing features like CopyTrader™

Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here