Enterprise-focused design, fast settlement, low fees, strong developer support, and staking rewards makes XDC a cryptocurrency to considering buying.

XDC Network focuses on solving real business problems, especially in trade finance and tokenizing real-world assets.

The chain gives companies tools they actually use, such as private transactions, quick finality, and low fees.

These features help move genuine economic activity on-chain, not just speculative trading.

But is XDC a good buy right now? Let’s look at five reasons to consider buying XDC.

Join eToro today and receive $10 in free crypto on your first deposit. Trade crypto, stocks, and ETFs with powerful tools and social investing features like CopyTrader™

Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here

Reasons to Buy XDC Today

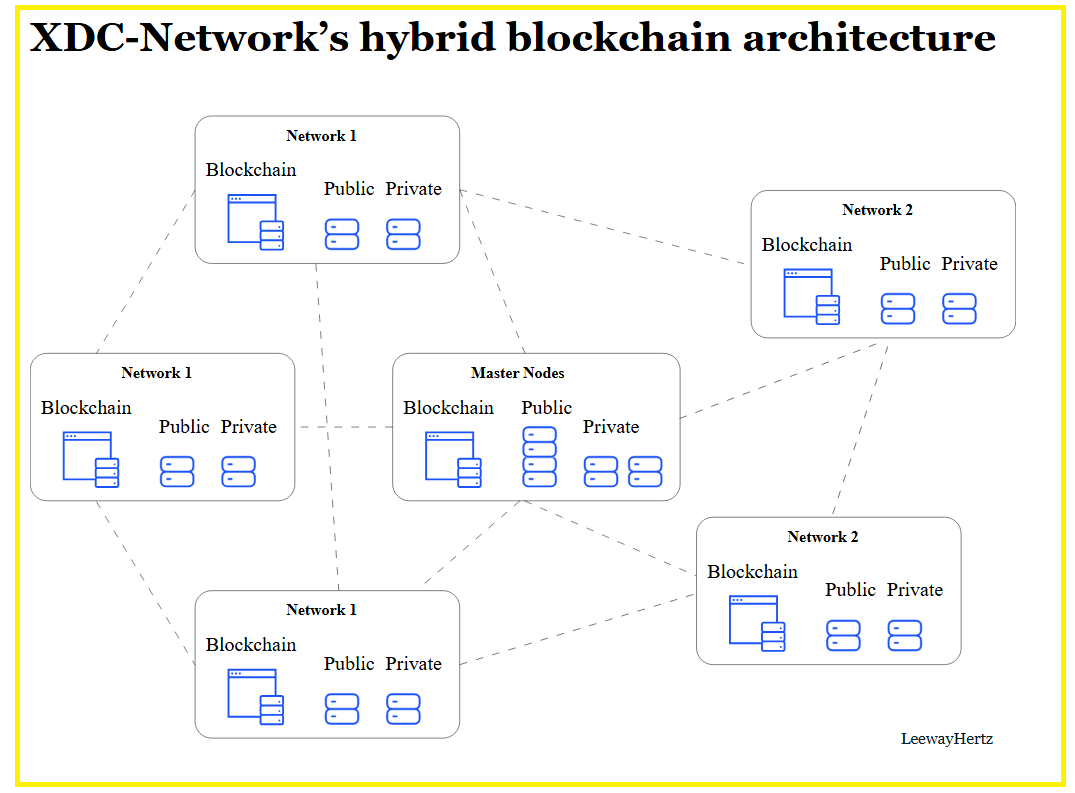

1. Enterprise-Grade Hybrid Architecture

XDC uses a hybrid model that lets businesses keep sensitive information off the public chain while still using on-chain settlement.

This design matches the needs of banks, exporters, importers, and large firms that handle confidential documents every day.

XDC 2.0 improves this setup by strengthening finality and making block confirmations faster, which helps institutions trust the network for legal and accounting workflows.

This approach lowers the barrier for companies that want the benefits of blockchain without exposing private data.

Because the design fits how regulated organizations already operate, it creates a long-term path for steady usage and real transaction volume.

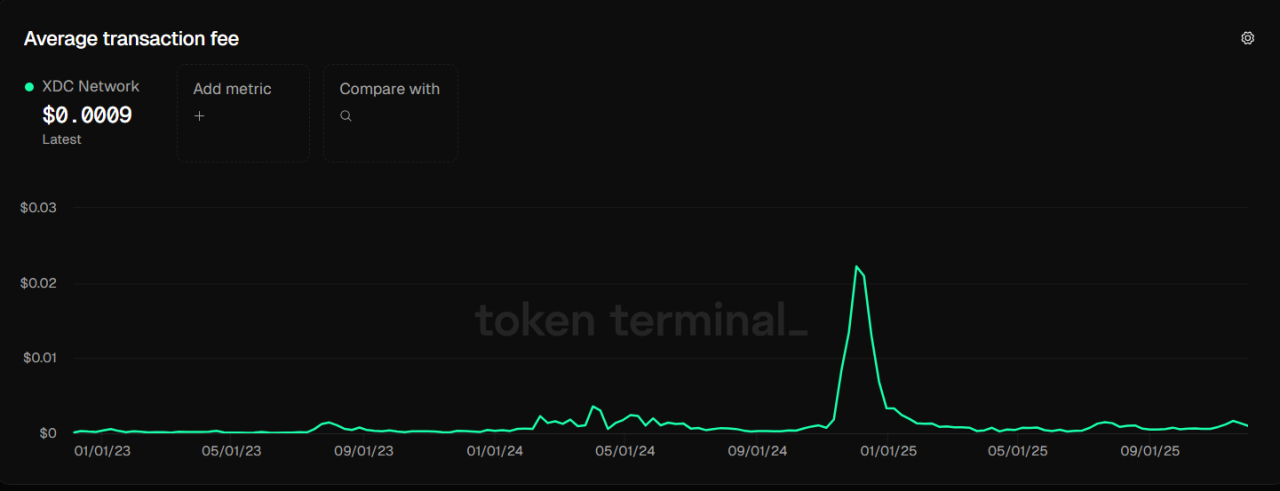

2. High Throughput, Fast Finality And Low Fees

The network uses a delegated proof of stake model that targets more than 2,000 transactions per second, with block times of a few seconds.

This level of performance lets XDC handle payments, document transfers, and tokenized assets without slowing down.

Gas fees stay very low, often costing only fractions of a cent, which makes operating costs easier to manage for businesses.

For applications tied to real finance, stable fees and quick settlement are important because they help companies run predictable operations.

That is why these performance numbers give XDC an advantage in long-term adoption and daily on-chain activity.

3. EVM Compatibility And Developer Portability

XDC supports the Ethereum Virtual Machine, so developers who already use Solidity can build or migrate their apps with minimal changes.

This lowers both development time and cost. The team also keeps the EVM environment updated, including work on compatibility with fee and gas improvements seen on other chains.

This makes it easier for custodians, wallets, and cross-chain services to integrate with XDC. A network that maintains strong tooling remains useful for builders and avoids falling behind as standards evolve.

For teams choosing a chain for reliable development, smooth migration and reliable maintenance make XDC a practical option that reduces friction.

4. Real-World Adoption, Trade Finance And RWA Tokenization

XDC’s most visible adoption comes from trade finance platforms like TradeFinex, which use the network to tokenize invoices, guarantees, and receivables.

These instruments link directly to real cash flows, such as a business receiving early payment for completed work.

Tokenization helps lenders and funders access new markets with more transparency and faster settlement.

By connecting on-chain assets to real economic activity, the network creates recurring demand for transactions and custody services.

This real-world usage gives XDC a stronger foundation than chains that rely only on speculative apps.

It shows that the network can support long-term value tied to practical business needs.

5. Staking, Masternodes And Aligned Incentives For Holders

XDC secures its network through masternodes and delegated staking.

Running a masternode requires a large stake of 10 million XDC, which encourages long-term commitment and makes it costly for anyone to act against the network.

Both masternode operators and delegators earn staking rewards, giving holders a reason to stay involved rather than simply trade.

This structure supports steady participation and helps align network security with token holders’ interests.

For investors who like combining yield with long-term exposure, the staking and masternode setup is a good reason to consider investing in XDC.

It adds a practical benefit beyond price movement.

Conclusion

XDC brings together enterprise-focused design, strong performance, developer-friendly tools, real usage in trade finance, and staking rewards that support active participation. T

hese strengths create solid reasons to buy XDC as part of a broader portfolio.

Before investing, review adoption data, upgrade progress, and market trends, and remember that crypto carries risk.

Any position should match your personal strategy and comfort with price volatility.

Join eToro today and receive $10 in free crypto on your first deposit. Trade crypto, stocks, and ETFs with powerful tools and social investing features like CopyTrader™

Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here

Wondering which crypto to focus on right now?

Our premium members already know.

Since 2017, InvestingHaven’s blockchain research service has been guiding investors through both bull runs and crypto winters.

What makes it different?

-

Proprietary 15-indicator methodology developed over 15+ years of market research.

-

Proven track record of spotting major turning points before markets move.

-

Focused alerts on only the key crypto assets that matter — no noise, no distractions.

Thousands of readers rely on InvestingHaven to stay ahead of the crowd. Now it’s your turn.

Act today and join the original crypto research service — still live and stronger than ever since 2017.

What Our Readers Say

“I got to tell you, you guys and your charting and your predictions are AMAZING! I don't know how people can even give you a hard time when you make pullback predictions. Markets cannot go up forever!”

“I LOVE how you talk about the ‘buy the dips’ times vs the ‘sell for profit’ times to get more free coins. You have been right sooo many times — it’s actually amazing!”

— Newsletter Subscriber

“Your team puts a huge amount of work into the newsletters and the analyses. You’ve been doing this for so many years already, and the passion is still there. Respect.”

“Because of your research, I’ve become a much more patient investor. And ‘more patient’ basically means ‘better.’ Over the past few years, my capital has often just stayed unused rather than constantly invested — and it has paid off.”

“Now that my perspective is strictly long term, I have far more peace in my life. Nothing is more stressful than constantly wondering what your crypto might do the next day. After seeing firsthand that long-term investing outperforms trading, the difference is night and day.”

— Crypto Research Subscriber

“As a faithful follower, I really miss the commentaries — the wisdom, the thoughts, the analysis. Truly appreciate the knowledge you share.”

— Long-Time Follower