Flare brings real utility to assets like XRP by giving them access to smart contracts. It also offers reliable data feeds and steady ecosystem growth.

Flare gives users a simple way to put non smart contract assets such as XRP and BTC to work in DeFi. It also offers reliable data feeds that help apps operate safely and accurately.

Because developers can use familiar EVM tools, more teams can build without learning a new system.

These make Flare useful for everyday crypto holders who want both stability and opportunity. Below are five reasons to buy Flare and add it to your portfolio.

Reasons To Invest In Flare

So, should you buy Flare? Here are some reasons you might consider adding it to your portfolio.

1. Flare Offers Reliable On-Chain Feeds

Flare puts high quality data at the center of its design. Its State Connector and FTSO systems verify real-world information so apps can use accurate price and state data without relying on a single source.

This reduces the chance of manipulated feeds and helps apps run more safely. Since many products such as trading apps, insurance tools, and cross-chain bridges depend on timely data, this structure keeps its value over time.

FTSO uses many independent providers and rewards them when they supply accurate information. Users and developers benefit from a more dependable data layer that makes the network stronger.

2. FAssets Let Non Smart Assets Join DeFi

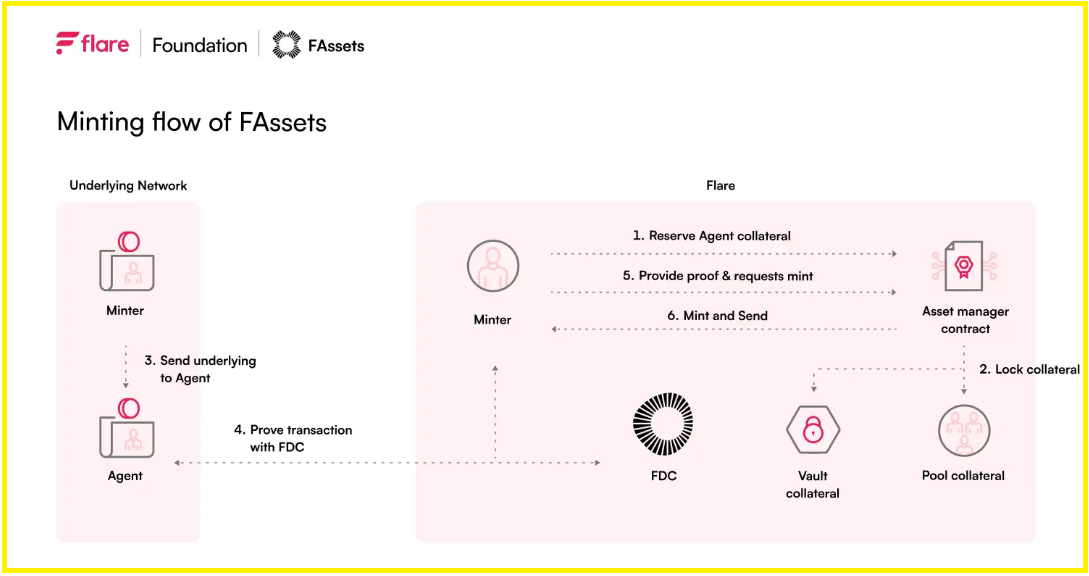

Flare makes it easy for tokens like XRP and BTC to take part in DeFi through FAssets. FXRP lets users mint an EVM-based version of XRP while keeping control of their main assets. This opens the door to lending, liquidity pools, and staking without moving away from the native chain.

Bridges and minting tools have already brought tens of millions of dollars in value into Flare-based apps. This shows real demand from holders who want to earn more from their assets.

The model extends to other major tokens that do not have built-in smart contracts. As more assets gain this option, the network gains more liquidity and real usage.

3. Credible Partners And Institutional Onboarding

Flare continues to attract well-known infrastructure partners, which makes building on the network much easier. Integrations with LayerZero, Ankr, QuickNode, and other providers give developers the tools they need for messaging, nodes, and indexing.

These connections speed up product launches and help teams focus on building useful apps. Institutional interest has started to grow as well, with early pilots testing staking, custody, and liquidity products.

When trusted infrastructure teams show support, it becomes easier for new developers and enterprises to get involved. This increases the chances that FLR will gain more real-world utility over time.

4. Growing TVL, Staking Flows And Active Holders

Flare is now showing clear signs of active use. Bridges have carried more than $50M worth of assets into the network. Users stake, mint FXRP, and provide liquidity, which creates real fees and activity rather than empty volume.

Growth in active holders and deployed contracts shows that developers and users continue to interact with the network. Metrics such as TVL, bridge volume, and staking activity are useful signals because they show how much value is actually being used on-chain.

These numbers help investors judge whether the network is gaining strength or slowing down.

5. EVM Compatibility And Composability Make Building Easy

Flare supports EVM, which means developers can use familiar tools from other chains. This lowers the barrier to entry and allows more teams to experiment with new ideas. Grants, SDKs, and integrations give builders additional support to test and deploy apps quickly.

Composability allows products to fit together smoothly. For example, once FXRP exists, any developer can build a lending pool or staking product around it. This stacking effect increases the usefulness of the entire network.

Over time, strong developer activity can create many independent sources of demand for FLR.

Conclusion

There are many reasons to buy Flare including its reliable data feeds, fAssets for major tokens, strong integrations, rising on-chain activity, and a developer-friendly design. These strengths give FLR lasting value if usage continues to grow.

That said, consider both the potential benefits and the risks that come with investing in Flare. Keep an eye on TVL, bridge flows, and FXRP adoption, since these metrics offer the clearest view of how the network is progressing.

Join eToro today and receive $10 in free crypto on your first deposit. Trade crypto, stocks, and ETFs with powerful tools and social investing features like CopyTrader™

Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here

Wondering which crypto to focus on right now?

Our premium members already know.

Since 2017, InvestingHaven’s blockchain research service has been guiding investors through both bull runs and crypto winters.

What makes it different?

-

Proprietary 15-indicator methodology developed over 15+ years of market research.

-

Proven track record of spotting major turning points before markets move.

-

Focused alerts on only the key crypto assets that matter — no noise, no distractions.

Thousands of readers rely on InvestingHaven to stay ahead of the crowd. Now it’s your turn.

Act today and join the original crypto research service — still live and stronger than ever since 2017.