Fast settlement and built-in order books improve on-chain trading. Clear tokenomics, broad access, and early tokenized asset activity support steady, long-term demand.

Sei is a Layer 1 blockchain designed to make on-chain trading fast and easy to use. It aims to give traders and everyday users an experience that feels instant, reliable, and simple to navigate.

Because the chain focuses on speed, predictable performance, and clean design, builders can create apps without fighting slow settlement or inconsistent execution.

Below are five straightforward reasons to buy SEI today.

Top Reasons To Buy SEI Today

If you are looking to invest in SEI but are not sure whether it is the right choice for your portfolio, the reasons below might help you decide.

1. Ultra-Fast Layer 1 Architecture Built For Trading

Sei focuses on low latency and high throughput so trading apps can run smoothly. The network reports finality speeds below 400ms, which helps orders settle before prices shift. When trades settle quickly, users avoid many timing issues that slow chains often create.

Market makers also prefer predictable execution because it helps them keep spreads tight and manage risk.

For everyday users, this means trades feel instant and apps stay responsive even when the network is active. That reliability is especially important for exchanges and lending apps that need consistent block times to function well.

2. Native Order Matching And Exchange-Grade Features

Sei includes a built-in order-matching engine that supports on-chain order books and single-block trade execution. Instead of relying on off-chain systems or complex smart-contract workarounds, exchanges can plug directly into these features at protocol level.

This gives users access to limit orders, market orders, and more consistent execution.

Because the protocol handles matching, developers avoid building heavy infrastructure on their own. Liquidity stays unified, and traders get a smoother experience with less slippage and fewer failed transactions.

This approach mirrors how traditional exchanges operate, but it keeps everything transparent and on-chain.

3. Clear Tokenomics And Practical Staking Utility

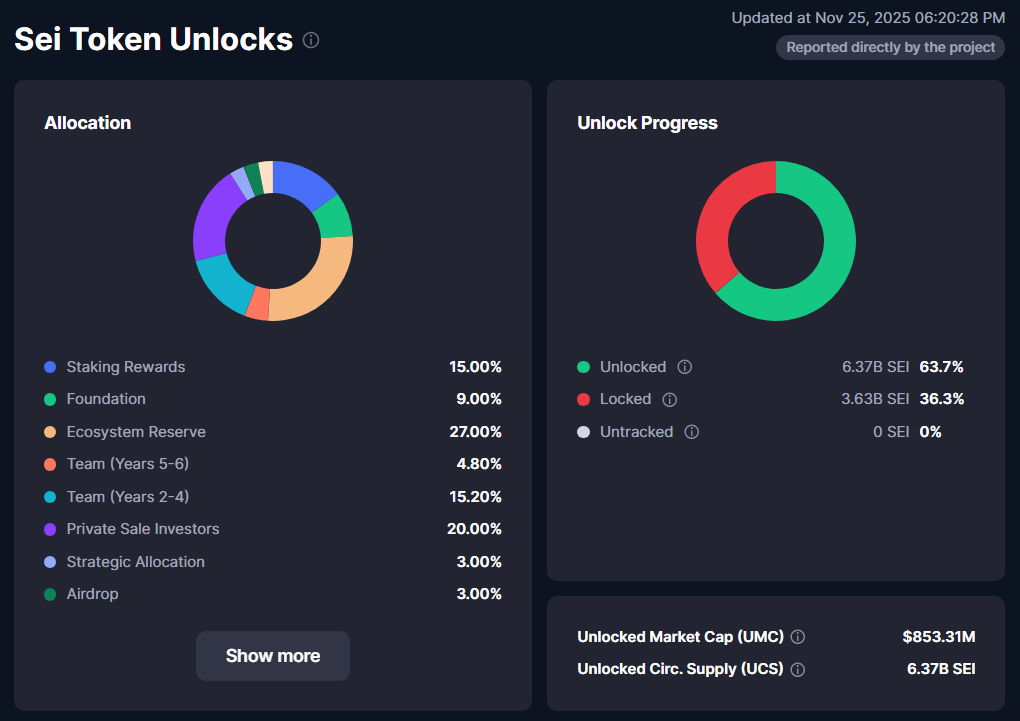

SEI has a maximum supply of 10 billion tokens, with about 6.37 billion already in circulation. A fixed supply helps users understand long-term dilution and evaluate future demand. The token is used for gas fees and staking under delegated proof of stake, which supports network security.

Staking rewards vary by validator and market conditions, but many platforms list annual returns in the 4 to 6% range. For long-term holders, this provides a simple way to earn yield while helping secure the chain.

Because staking ties directly to network activity and governance, demand for SEI grows as more apps launch and more users transact on the chain.

RECOMMENDED: The 4 Top Emerging Cryptos in 2025

4. Wide Exchange Listings And Regulated Investment Access

SEI is listed on major global exchanges, which makes buying, selling, and holding the token much easier. Strong exchange support improves liquidity and gives users simple entry points without extra steps or special wallets.

For traditional investors, regulated options exist as well. CoinShares launched a physical SEI ETP with a 2% staking yield and no management fees. Products like this open the door for funds and regulated institutions that prefer familiar investment wrappers.

When tokens gain more regulated channels and deeper liquidity, market stability usually improves. This creates a healthier environment for long-term holders and strengthens overall demand for SEI.

5. Developer Momentum And Real-World Asset Tokenization

Developer activity on Sei continues to grow. Builders release tools, analytics, and liquidity systems that support trading, lending, automation, and other advanced use cases. This activity strengthens the ecosystem and increases real usage of the token.

Sei is also seeing early movement in real-world asset tokenization. Securitize and its partners have announced tokenized fund offerings on Sei, bringing regulated financial products on-chain.

These projects help institutions test on-chain settlement, transparency, and compliance while keeping user experience smooth. As more assets and apps launch on Sei, demand for SEI naturally increases.

Conclusion

Before you add SEI to your portfolio, check current market conditions, circulating supply, and network activity.

If you want exposure to a fast Layer 1 built for trading, with native order types, staking rewards, regulated access, and early tokenized asset projects, SEI offers a simple and clear case for long-term interest.

Always diversify and research carefully.

Join eToro today and receive $10 in free crypto on your first deposit. Trade crypto, stocks, and ETFs with powerful tools and social investing features like CopyTrader™

Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here

Wondering which crypto to focus on right now?

Our premium members already know.

Since 2017, InvestingHaven’s blockchain research service has been guiding investors through both bull runs and crypto winters.

What makes it different?

-

Proprietary 15-indicator methodology developed over 15+ years of market research.

-

Proven track record of spotting major turning points before markets move.

-

Focused alerts on only the key crypto assets that matter — no noise, no distractions.

Thousands of readers rely on InvestingHaven to stay ahead of the crowd. Now it’s your turn.

Act today and join the original crypto research service — still live and stronger than ever since 2017.

- Why This Bounce Matters (30 Crypto Charts) (Nov 23rd)

- What’s Going On With Bitcoin & Alts?(Nov 16th)

- This Is What We Want To See The Next 72 Hours(Nov 9th)

- The Next 2 To 3 Weeks …(Nov 2nd)

- A Successful Test of Bitcoin’s 200 dma? (Oct 26th)

What Our Readers Say

“I got to tell you, you guys and your charting and your predictions are AMAZING! I don't know how people can even give you a hard time when you make pullback predictions. Markets cannot go up forever!”

“I LOVE how you talk about the ‘buy the dips’ times vs the ‘sell for profit’ times to get more free coins. You have been right sooo many times — it’s actually amazing!”

— Newsletter Subscriber

“Your team puts a huge amount of work into the newsletters and the analyses. You’ve been doing this for so many years already, and the passion is still there. Respect.”

“Because of your research, I’ve become a much more patient investor. And ‘more patient’ basically means ‘better.’ Over the past few years, my capital has often just stayed unused rather than constantly invested — and it has paid off.”

“Now that my perspective is strictly long term, I have far more peace in my life. Nothing is more stressful than constantly wondering what your crypto might do the next day. After seeing firsthand that long-term investing outperforms trading, the difference is night and day.”

— Crypto Research Subscriber

“As a faithful follower, I really miss the commentaries — the wisdom, the thoughts, the analysis. Truly appreciate the knowledge you share.”

— Long-Time Follower