Security, developer-focused tools, high-speed performance, token utility, and growing liquidity make StarkNet a practical option for investors looking to diversify.

StarkNet lets apps run on Ethereum using zero knowledge proofs, offering a faster and cheaper experience while keeping the security benefits of Ethereum. It has a total supply of 10 billion STRK tokens, and roughly 46% of that is currently in circulation.

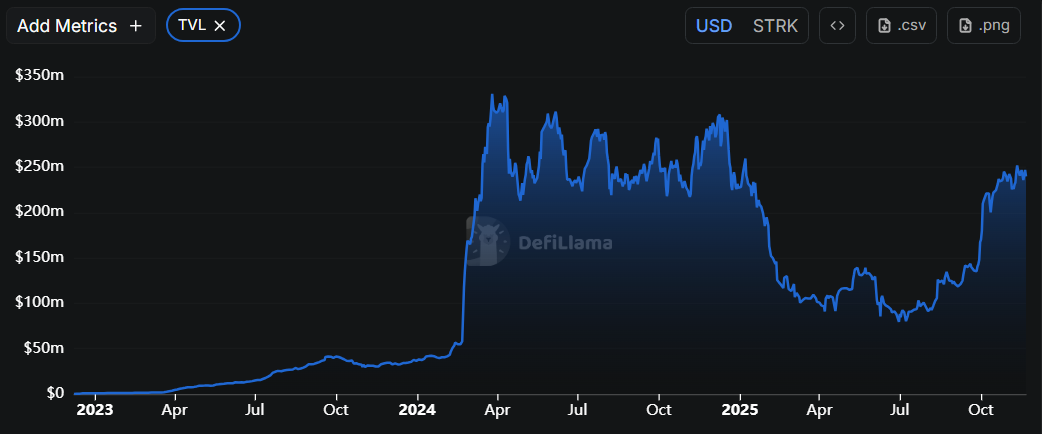

The ecosystem supports more than 80 projects across DeFi, gaming, and infrastructure, and total value locked (TVL) surged to more than $300 million in 2024.

Here are five reasons investors are buying StarkNet today.

Reasons to Buy Starknet

1. ZK Security, Ethereum Settlement, And Low Settlement Risk

StarkNet uses STARK proofs to confirm transactions off chain, then submits a validity proof to Ethereum to finalize results. This process ensures transactions are correct before they settle, reducing the chance of reversals.

Compared with systems that rely on challenge periods, this offers faster and cleaner finality. High-security applications such as decentralized exchanges tend to prefer this model, since it minimizes exposure to errors.

2. Developer Ecosystem, Cairo, And Practical Tooling

Cairo gives developers a way to write complex smart contracts that take advantage of ZK proof capabilities.

This helps teams build apps that are not possible on most other chains. The ecosystem has been growing steadily, bringing in developers working on DeFi products, gaming, infrastructure, and wallet solutions.

Tools have also improved, which reduces the learning curve for new teams. Developers usually stay where they can build faster and with fewer technical limits, and StarkNet fits that profile well.

3. Real Throughput And Low Average Fees

StarkNet has shown it can process peak loads above 2,600 transactions per second while keeping costs low. Most actions cost a fraction of a cent, even during busy periods.

In practice, this makes StarkNet suitable for frequent trading, microtransactions, and real-time operations such as on-chain gaming. High performance without high costs gives developers more freedom to build without optimizing every transaction.

When scaling becomes important industry-wide, platforms already achieving this tend to gain more relevance.

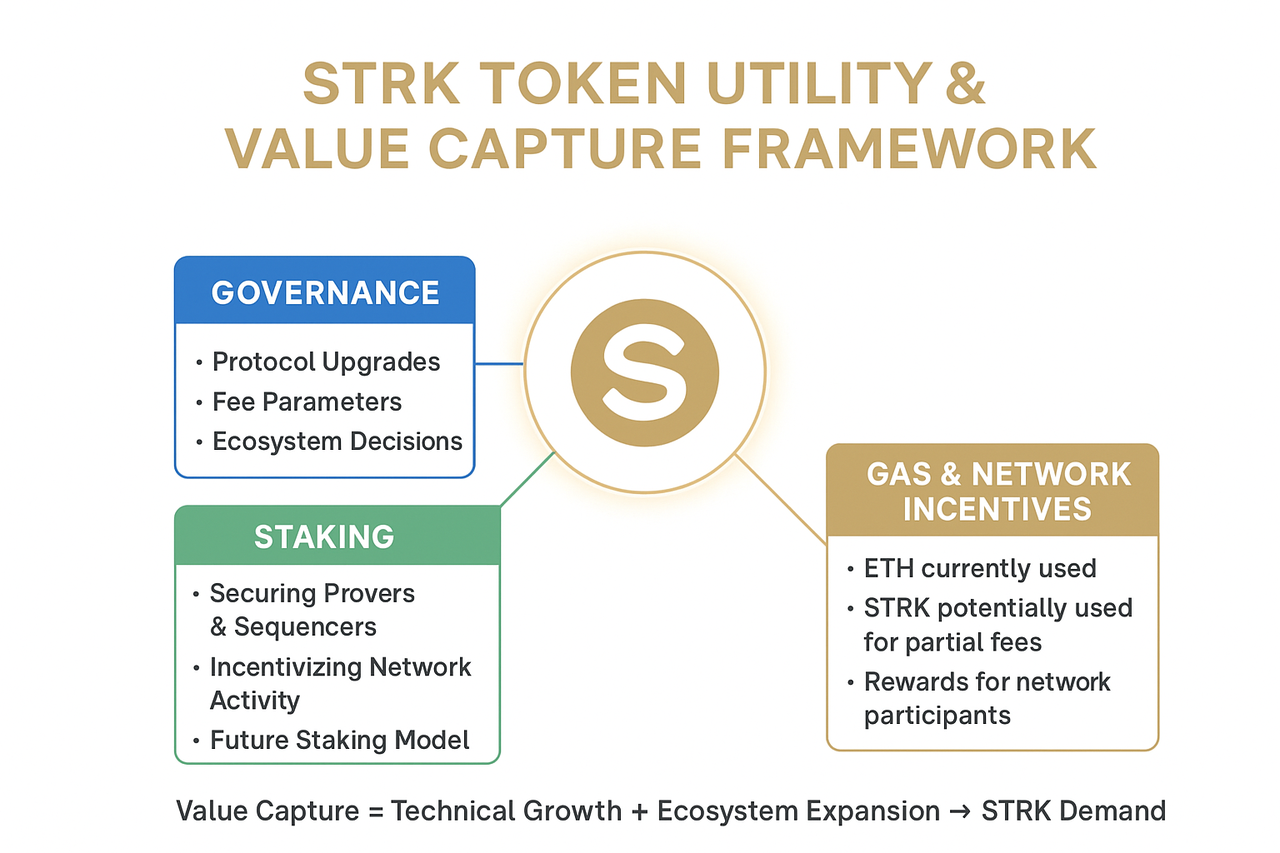

4. STRK Token Utility, Staking, And Emissions

STRK is used for governance decisions, staking, and incentives that help support development. Around 4.56 billion tokens are currently circulating, out of a total supply of 10 billion. Future unlocks will continue over time, so tracking release calendars is useful for monitoring supply changes.

Networks with strong participation in staking and governance often see healthier protocol evolution, which supports long-term users. Token emissions fund developer grants and on-chain programs, helping keep momentum in the ecosystem.

Well-structured token utility is important, and STRK has roles that extend beyond price movement. That practical use means it will stay relevant as the network expands.

5. Bridges, TVL, And Expanding Liquidity

StarkNet connects to other networks using bridges, supporting smoother flow of assets and broader liquidity access. Current total value locked is in the low hundreds of millions, showing active DeFi usage, stablecoin movement, and real transaction volume.

As users move assets in and out, liquidity pools grow stronger, and protocols often become more competitive. Cross-chain support also lowers barriers for users coming from other ecosystems.

Platforms that maintain real usage instead of temporary spikes tend to build more sustainable value. It is worth watching how TVL trends continue and which new integrations emerge, as growth across both areas can drive steady network usage.

Conclusion

StarkNet combines strong security, meaningful developer growth, high performance, practical token functions, and expanding liquidity. These features support recurring usage and may increase relevance as more apps move to scalable environments.

However, it is wise to track supply unlocks, bridge safety, and market conditions before making decisions. Anyone who wants to invest in STRK should review official token calendars and current network metrics.

Applying clear entry plans and reviewing progress over time can help make more informed choices around emerging technologies.

Join eToro today and receive $10 in free crypto on your first deposit. Trade crypto, stocks, and ETFs with powerful tools and social investing features like CopyTrader™

Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here

Wondering which crypto to focus on right now?

Our premium members already know.

Since 2017, InvestingHaven’s blockchain research service has been guiding investors through both bull runs and crypto winters.

What makes it different?

-

Proprietary 15-indicator methodology developed over 15+ years of market research.

-

Proven track record of spotting major turning points before markets move.

-

Focused alerts on only the key crypto assets that matter — no noise, no distractions.

Thousands of readers rely on InvestingHaven to stay ahead of the crowd. Now it’s your turn.

Act today and join the original crypto research service — still live and stronger than ever since 2017.