A $500 buy nets about 604 ADA at $0.8279. Delegated staking returns around 2.45% and about $12 per year, paid on-chain.

Cardano offers large-cap Layer-1 exposure while being one of the best crypto under $1. We are going to show exactly what $500 buys, the expected on-chain yield, and concrete upgrades that could affect value over the next 12 months.

We use live price and network metrics to calculate holdings and staking income.

RELATED: Best Cheap Crypto to Buy Now: Why Cardano (ADA) Stands Out

What $500 in Cardano Buys You Today

At the current price of $0.8279, a $500 purchase converts to 603.92 ADA. That is 500 ÷ 0.8279, a round figure of about 604 ADA. Delegating on-chain at a typical network reward of 2.45% APY yields roughly 14.80 ADA in a year, about $12.25 annually.

Cardano ranks among top cryptos by market cap, roughly $29.6B, so a $500 order should avoid meaningful slippage. CoinMarketCap lists ADA in the top 10 with daily volume near $856M. On DEXes slippage can be higher, but centralized exchanges will handle this buy easily.

ALSO READ: Cardano Weekly Prediction: Will ADA Climb Past $1.00?

Why ADA Has Upside

Cardano has measurable protocol work that affects short and medium-term demand. IOG lists continued development on Mithril for fast sync and Hydra for scaling, which lower node costs and improve throughput.

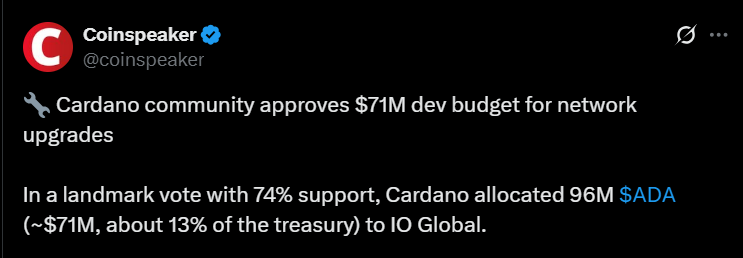

The Cardano community approved a 96M ADA allocation, roughly $71M, for a 12-month upgrade plan, funding core improvements and dApp support.

Developer programs and the upcoming Cardano Summit create event-driven opportunities for increased on-chain activity and deployments.

Mithril reduces sync overhead and Hydra expands transaction capacity via state channels, both making the chain easier to run and use. Project Catalyst and grant programs keep funding builders that can raise real usage and fee-bearing activity over time.

Combined, these upgrades and funding can improve utility, possibly attracting institutional interest soon, making ADA the best crypto to buy.

RECOMMENDED: 5 Reasons To Buy Cardano

Short-Term Catalysts And Key Risks

Near-term catalysts include milestone releases and institutional interest that can lift flows. Primary risks are range-bound price action between established support and resistance levels, low daily volumes, and Layer-1 competition.

Allocate only funds you can hold through volatility and set clear stop or take-profit levels.

Conclusion

A $500 investment in crypto buys about 604 ADA today, yields roughly $12/year by staking, and offers measured upside with clear risks.

Don’t Miss the Next Big Move – Access Alerts Instantly

Join the original blockchain-investing research service — live since 2017. Our alerts come from a proprietary 15‑indicator methodology built over 15+ years of market experience. You’re following the service that identified major turning points through crypto winters and bull runs alike

Act now and see why thousands trust us to deliver signals before markets move.

This is how we are guiding our premium members (log in required):

- BTC Testing Long Term Trendline. Here Is Short and Long Term Guidance. (Aug 26th)

- Crypto – To Break Out Or Not To Break Out? (Aug 23rd)

- What Happened This Week? Leading Indicator Analysis and 7 Token Charts. (Aug 16th)

- Crypto Shows More Resilience Than Expected. A Bullish Impulse May Be Underway. (Aug 9th)

- Prepare To Buy The Dip In Crypto (Aug 2nd)

- Alt Season 2025 – Progress Update (July 26th)