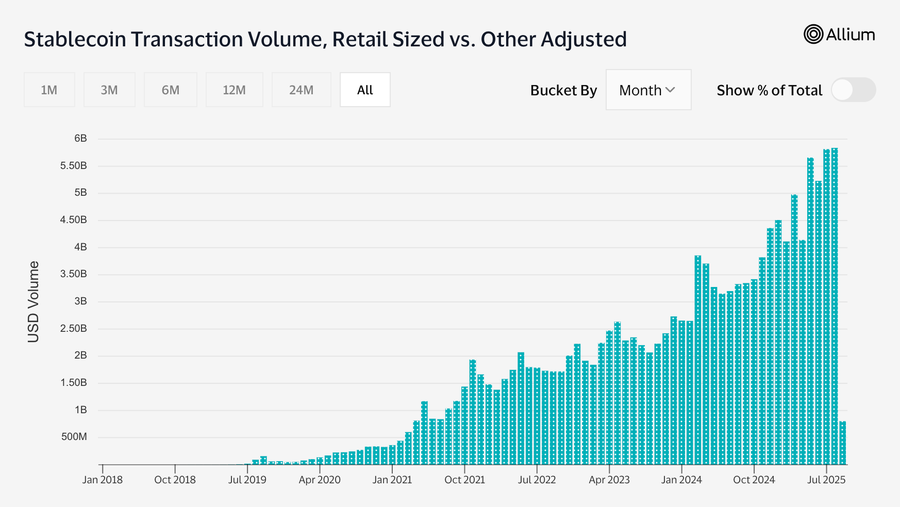

Ray Youssef says retail stablecoin transfers under $250 reached $5.84B in August. He adds Ethereum-based stablecoins total $165B.

Ray Youssef, CEO of NoOnes, says stablecoins have “cemented themselves as the backbone of digital money.”

He reports retail transfers under $250 reached $5.84B in August, and he frames that statistic as proof that stablecoins now serve everyday payments and remittances in several emerging economies, including Nigeria, India, and Bangladesh.

RELATED: Former CFTC Chairman: Stablecoins Will Replace Failed Currencies

Record Retail Activity And On-Chain Supply

Youssef places the $5.84B figure at the center of his argument, calling August’s sub-$250 transfers proof of retail demand.

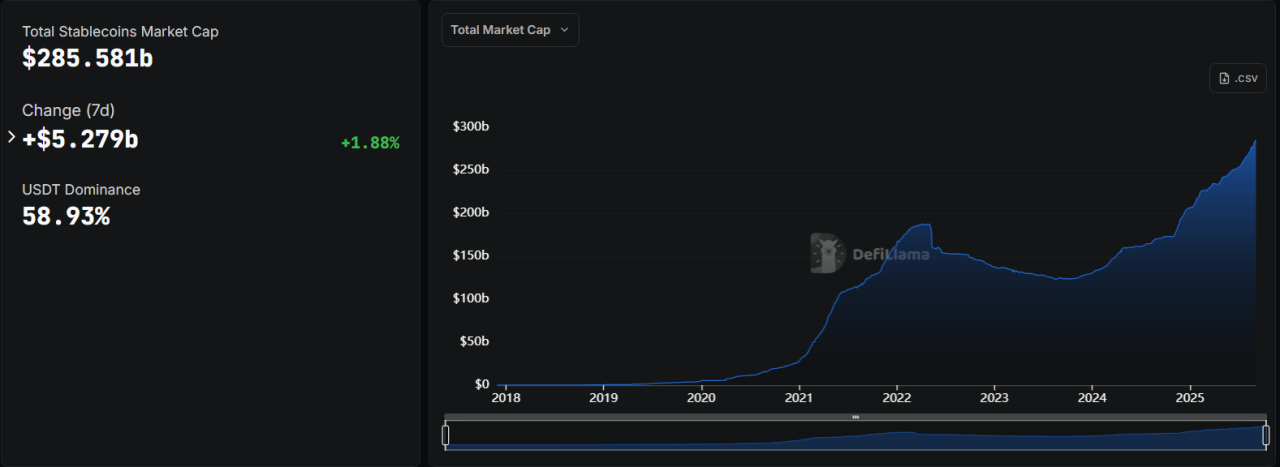

He also notes that stablecoins on Ethereum rose to $165B in circulation, which he interprets as expanding on-chain liquidity. He emphasizes both metrics as direct evidence that major rails carry real transaction volume.

Youssef adds that the total stablecoin market has swelled toward $300B, a scale he says validates stablecoins as a widely used payment layer rather than a niche trading tool. He cites on-chain data and issuer reports as sources.

RECOMMENDED: Stablecoins Take Center Stage: What New Global Rules Could Mean for Your Wallet

Everyday Use: Remittances, Microtransactions, Payroll

Youssef frames adoption as practical, not speculative. He highlights users in Nigeria, India, and Bangladesh who use stablecoins for remittances, payroll, and merchant receipts, saying necessity and fast low-cost transfers explain the shift.

He cites microtransactions and salary payments as everyday examples.

To support that claim he points to survey snapshots showing high uptake, including reports that 70% of respondents in emerging markets increased stablecoin use and over 75% expect further growth, figures he uses to illustrate real consumer behavior.

He ties these numbers directly to real-world payment substitution today.

RECOMMENDED: 5 Of The Hottest Crypto Right Now

Issuer Liquidity And Institutional Backing

Youssef points to issuer actions as additional evidence. He cites liquidity injections from major issuers such as Tether and notes Tether allocated part of its holdings into Bitcoin and other assets.

He frames those moves as increasing confidence in stablecoin liquidity and linking stablecoins to broader institutional flows, a point he uses to explain growing market trust in recent months.

RECOMMENDED: Bitcoin News: ETFs and Central Bank Crypto Reserves Are Altering Liquidity Dynamics

Conclusion

Youssef’s conclusion is direct. Given $5.84B retail transfers, $165B on-chain supply, and issuer liquidity moves, he says stablecoins are scaling adoption and on track to mainstream payment use by 2026.

Don’t Miss the Next Big Move – Access Alerts Instantly

Join the original blockchain-investing research service — live since 2017. Our alerts come from a proprietary 15‑indicator methodology built over 15+ years of market experience. You’re following the service that identified major turning points through crypto winters and bull runs alike

Act now and see why thousands trust us to deliver signals before markets move.

This is how we are guiding our premium members (log in required):

- Is A Trendless Crypto Market Good or Bad? The Current and Emerging Winners Look Awesome. (Sept 7th)

- BTC Testing Long Term Trendline. Here Is Short and Long Term Guidance. (Aug 26th)

- Crypto – To Break Out Or Not To Break Out? (Aug 23rd)

- What Happened This Week? Leading Indicator Analysis and 7 Token Charts. (Aug 16th)

- Crypto Shows More Resilience Than Expected. A Bullish Impulse May Be Underway. (Aug 9th)

- Prepare To Buy The Dip In Crypto (Aug 2nd)

- Alt Season 2025 – Progress Update (July 26th)