Arbitrum holds more user funds, while Optimism shows faster ecosystem growth. Both benefit from lower fees after Ethereum’s latest upgrade.

In October 2025, Arbitrum remains the largest Layer 2 network on Ethereum when it comes to locked capital. It currently holds about $3.85B in total value locked (TVL), compared to Optimism’s $338.99M.

These numbers highlight where users and liquidity providers are choosing to place their assets as the L2 race continues to heat up.

Let’s look at a quick Arbitrum vs Optimism comparison to help you choose between the two.

TVL And Liquidity: Who Is Locking More Capital?

Arbitrum’s TVL currently stands at around $3.85B; almost six times more than Optimism. Its strong position comes from major decentralized exchanges, lending platforms, and derivatives protocols that attract large trading volumes and stablecoin pools.

Optimism’s TVL at $338.99M, while smaller, includes a higher share of native liquidity — capital that originates within its ecosystem rather than bridged from Ethereum. This type of liquidity tends to stay longer and supports protocol stability.

The growing share of native assets on Optimism shows deeper developer activity and stronger long-term participation.

RECOMMENDED: Polygon (MATIC) vs Arbitrum (ARB): Which Will Break Out?

User Activity And Transactions: Are Users Following The Liquidity?

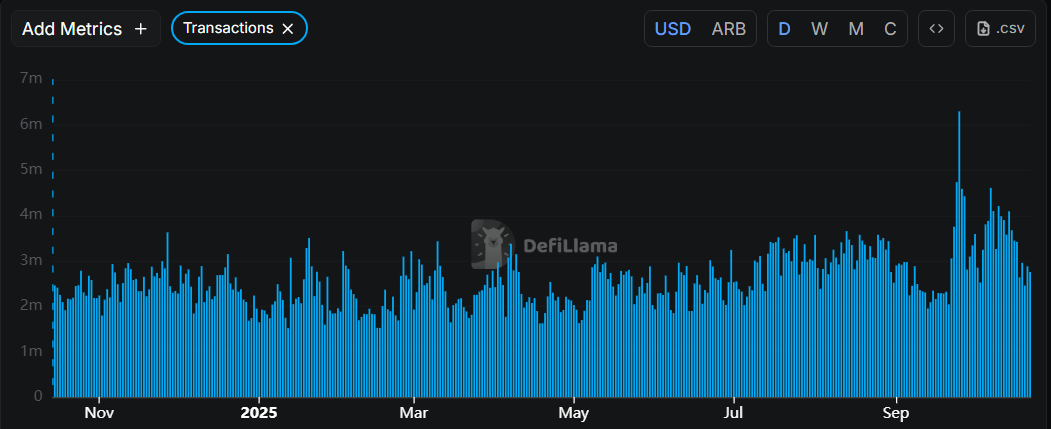

Arbitrum continues to lead in user engagement. It records hundreds of thousands of daily active wallets and over 2.6 million transactions in recent 24-hour periods. This suggests more trading, lending, and DeFi activity on its network.

Optimism shows steady user numbers and active development, but transaction counts remain lower overall.

After Ethereum’s EIP-4844 upgrade, both networks saw transaction fees drop by roughly 90%, making activity cheaper and faster. Arbitrum’s higher traffic reflects strong DeFi participation, while Optimism’s steady pace shows a focus on building sustainable growth.

RECOMMENDED: Top 3 Layer‑2 Cryptos Investors Are Accumulating Now

Short-Term Catalysts And Ecosystem Signals

Optimism’s Superchain initiative continues to expand, linking multiple rollups under its technology stack. Arbitrum is also seeing new protocol launches and steady inflows of TVL.

Key factors to track include daily transaction growth, token unlocks, and migrations of major DeFi projects to either chain.

ALSO READ: Top 3 Cryptos That Could Outperform If Bitcoin Pulls Back

Conclusion

Arbitrum leads in both TVL and user activity, showing stronger liquidity depth and broader adoption. Optimism, however, is catching up through developer expansion and Superchain integrations. Both remain essential players in Ethereum’s scaling ecosystem.

Join eToro today and receive $10 in free crypto on your first deposit. Trade crypto, stocks, and ETFs with powerful tools and social investing features like CopyTrader™

Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here

Wondering which crypto to focus on right now?

Our premium members already know.

Since 2017, InvestingHaven’s blockchain research service has been guiding investors through both bull runs and crypto winters.

What makes it different?

-

Proprietary 15-indicator methodology developed over 15+ years of market research.

-

Proven track record of spotting major turning points before markets move.

-

Focused alerts on only the key crypto assets that matter — no noise, no distractions.

Thousands of readers rely on InvestingHaven to stay ahead of the crowd. Now it’s your turn.

👉 Act today and join the original crypto research service — still live and stronger than ever since 2017.

This is how we are guiding our premium members (log in required):

- The Ongoing Test Of Bitcoin’s 200 dma Will Be Decisive For The Outcome In Crypto Markets (Oct 20th)

- From Failed Breakout to Consolidation: How to Think About Yesterday’s Flash Crash (Oct 12th)

- ATH in BTC = Alt Season 2025 Catalyst? (Oct 5th)

- Crypto Consolidation: When Will Bullish Momentum Return? (Sept 28)

- Is Meme Season Underway? (Sept 19th)

- Alt Season Is Brewing, In Silence. These 3 Charts Tell The Crypto 2025 Story. (Sept 10th)

- Is A Trendless Crypto Market Good or Bad? The Current and Emerging Winners Look Awesome. (Sept 7th)