We evaluated top crypto exchanges to decide on the 10 best crypto exchanges for 2025, using a data-driven methodology, focusing on fees and token variety, security and regulation, and platform capabilities. Our analysis highlights leaders like eToro for ease, Binance for advanced trading, and Kraken for institutional security.

Crypto’s momentum hasn’t slowed in 2025. Bitcoin is floating between $105K–$111K, propelled by healthy inflows—thanks largely to U.S. spot ETFs and rising institutional interest—and the global market cap has stabilized around $3.3 trillion.

Meanwhile, significant regulatory progress—like the EU’s MiCA framework in December 2024 and the U.S. President signing the Strategic Bitcoin Reserve executive order in March 2025—has brought much-needed clarity.

In this regard, crypto exchanges are no longer just trading platforms—they’ve become full-fledged financial hubs with features like staking, copy trading, DeFi tools, tokenized assets, and high-grade custody.

We take a detailed look at the 10 best exchanges of 2025, ranking them based on real-world data—security, fees, liquidity, regulation, asset range, and feature depth—to help you choose the perfect platform based on your goals, whether you’re a casual investor, trader, institution, or DeFi enthusiast.

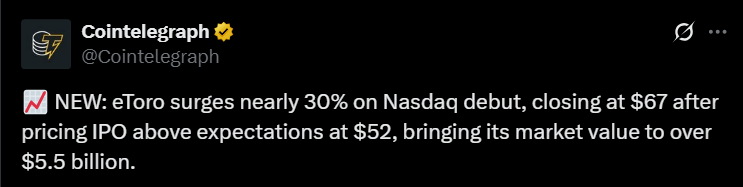

1. eToro – Best Overall Crypto Exchange

eToro is a multi-asset brokerage founded in 2007 and headquartered in Tel Aviv, Israel. It boasted 38 million registered users, 3.5 million funded accounts, and $16.6 billion AUM by the end of 2024.

The platform combines stocks, ETFs, forex, and cryptocurrency—now offering 130+ crypto tokens globally, with futures in Europe and options in the UK added in Q1 2025. In May 2025, eToro went public on Nasdaq with a valuation around $5.6 billion.

The platform is heavily regulated: it holds FCA, CySEC, ASIC, FinCEN, FSRA, and other regional licenses.

It uses segregated custodial accounts, SSL encryption, SOC 2 Type II certification, and mandatory 2FA to secure user assets. eToro also offers educational tools like eToro Academy and a demo account to help users build confidence.

Why we chose it

We selected eToro as our gateway platform because it delivers a rare balance of simplicity, social trading, and strong regulation. Its transparent fees, integrated asset classes, and global compliance make it ideal for users starting their crypto journey.

Pros

- User‑friendly for beginners

- CopyTrader lets users mirror top investors

- Broad multi‑asset access

- Robust global regulatory framework

Cons

- ~1% crypto fee plus 2% external wallet transfer

- Limited U.S. token selection post-SEC settlement

- Spread costs can exceed centralized exchanges

2. Binance – Best Crypto Exchange for Advanced Traders

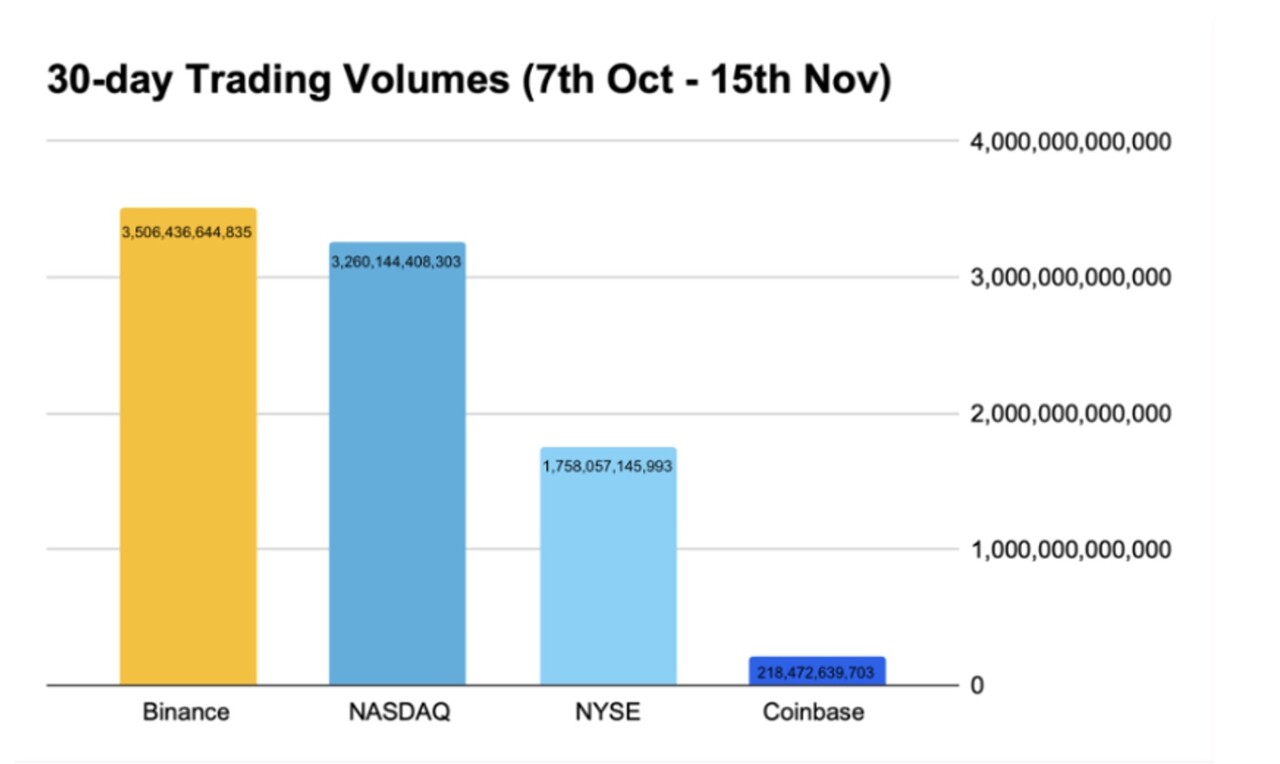

Binance is the world’s largest crypto exchange with more than 250 million users and $100 trillion in lifetime trading volume as of 2024.

It offers a full suite: spot, margin, futures, staking, DeFi, and NFTs, supporting hundreds of tokens. Binance prevented $2.4 billion in fraud and $4.2 billion in scam losses for users in the first half of 2024, handling more than 1.2 million related attempts.

The company operates under 21 international licenses and employs over 650 compliance professionals.

Security infrastructure includes hybrid AI/manual risk monitoring, 24/7 alerts, cooldown periods, and recovery of over $73 million misdirected funds.

Why we chose it

We found that Binance offers deep liquidity, ultra-low fees, and institutional-grade infrastructure—perfect for traders ready to scale.

Pros

- Highly competitive fees (~0.1%, cheaper with BNB)

- Massive liquidity and extensive token support

- Advanced features: futures, margin, API access

- Strong security, dynamic risk engine, global licenses

Cons

- Regulatory scrutiny in several jurisdictions (U.S., France, Nigeria)

- Complex interface for casual users

- Reputation impacted by past AML and legal controversies

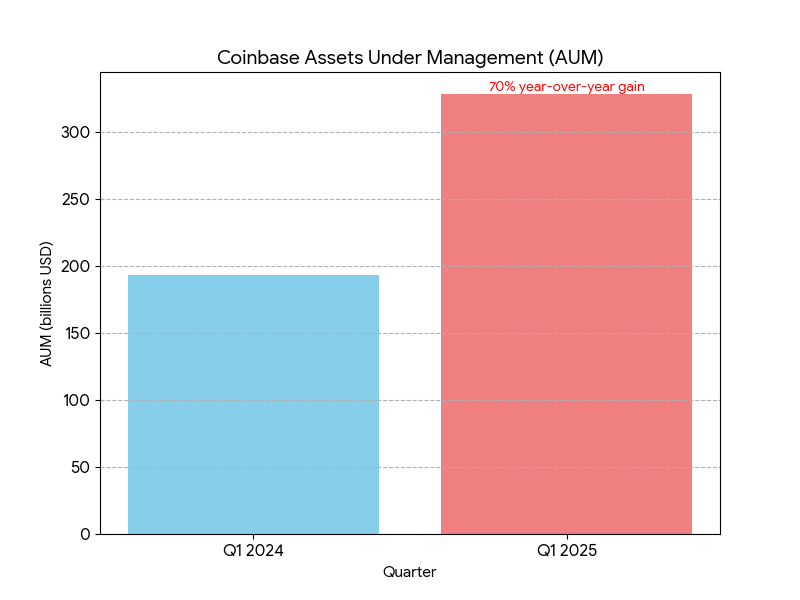

3. Coinbase – Best Crypto Exchange for U.S. Trust & Institutional Reach

Coinbase commands over 108 million users and held approximately $404 billion in assets by the end of 2024, including nearly 12% of all Bitcoin and 11% of staked Ether globally.

As the largest U.S.-based exchange, it stands out with institutional-focused services like Coinbase Prime and Custody, offering insurance-backed cold storage (98% of funds offline), staking support across eight assets, and a trusted infrastructure servicing nine of the 11 approved U.S. spot Bitcoin ETFs.

In Q1 2025, Coinbase reported $328 billion AUM, up from $193 billion a year earlier—a 70% year-over-year gain.

Like all major exchanges, it has faced incidents—most recently a 2025 data breach affecting fewer than 1% of users—and regulatory scrutiny, including an SEC probe into past “verified user” metrics and a $50 million NYDFS settlement in 2023.

It remains a publicly traded S&P 500 company and continues global expansion, adding features like its Layer 2 network “Base,” a native NFT marketplace, and the Coinbase Card debit solution.

Why we chose it

Coinbase boasts robust U.S. regulation, institutional-grade services, and a smooth retail interface—making it a dependable choice for users who prioritize trust, compliance, and diversified crypto utility.

Pros

- Heavy regulation and broad U.S. compliance

- Top-tier security: 98% cold storage, insurance coverage

- Institutional products: Custody, Prime, ETF integrations

- Wide staking (8 cryptos), NFT marketplace, Layer 2 support

Cons

- Higher fees for retail, especially on Basic tier

- Occasional data breaches and internal threats

- Customer service and account handling issues reported

4. Kraken – Best Crypto Exchange for Security-Conscious Traders & Institutions

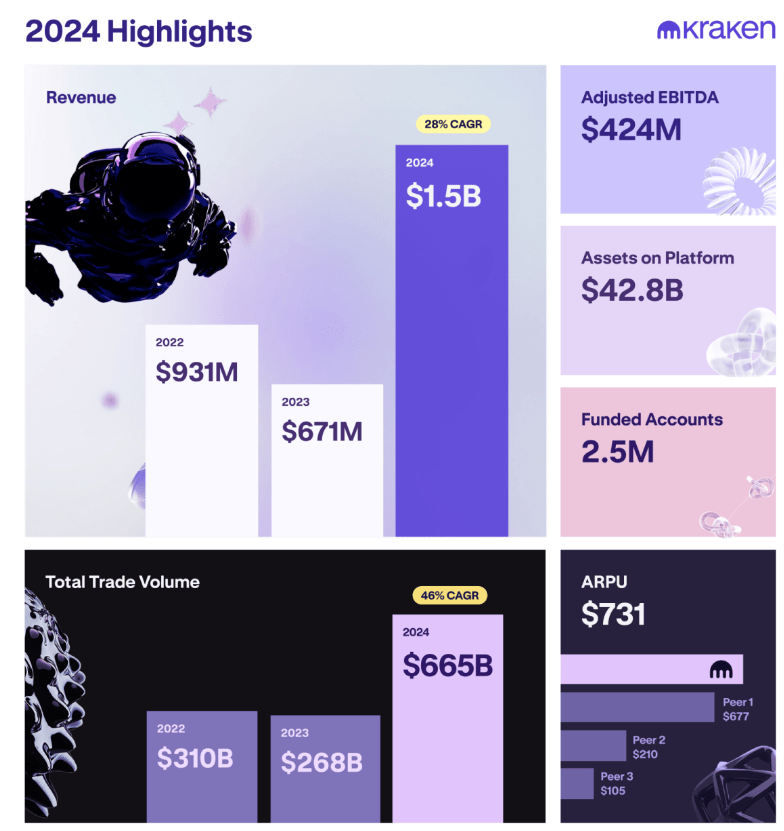

Kraken supports 2.5 million funded accounts with $42.8 billion in client assets and $1.5 billion in revenue in 2024—revenues that grew 128% YoY to $665 billion in trading volume.

Known for its security-first approach, Kraken stores 95% of user assets in geo-distributed cold storage, fortified by DDoS defenses, encryption, bug bounty programs, and regular audits under ISO 27001 and SOC 2.

It holds licenses spanning FinCEN, FINTRAC, FCA, AMF, AUSTRAC, and Wyoming’s SPDI charter, enabling Kraken Bank to offer fully backed fiat custodial accounts, debit cards, and salary services.

Why we chose it

We like Kraken for its elite security and transparency—its attestations, institutional custody services, and regulatory coverage make it a steadfast choice for traders and institutions seeking rock-solid infrastructure.

Pros

- Industry-leading security, no major hacks

- Cold-storage with extensive audit certifications

- Competitive fee tiers: as low as 0% maker, 0.10% taker for high volume

- Institutional-grade services and SPDI license

Cons

- Higher instant-buy fees (up to 1.5%)

- Interface complexity can overwhelm newcomers

- Mixed customer support experiences reported

5. Crypto.com – Best Crypto Ecosystem & Security Leader

Crypto.com has grown to over 100 million users and supports 400+ cryptocurrencies. It’s more than just an exchange: users access an embedded ecosystem including a Visa/ Mastercard debit card, DeFi and self‑custody wallets, NFT marketplace, lending, staking, and stock/ETF trading in select regions.

Its roadmap in Q1 2025 introduced institutional custody, stablecoin launches, and AI trading tools, alongside expansion in banking services like multi‑currency accounts and yield-bearing cash.

Security is a cornerstone: Crypto.com underwent SOC 2 Type II audits, introduced hardware-token/passkey authentication, and retains cold storage for most assets, biometric 2FA, whitelisting, proof-of-reserves, and a bug‑bounty program.

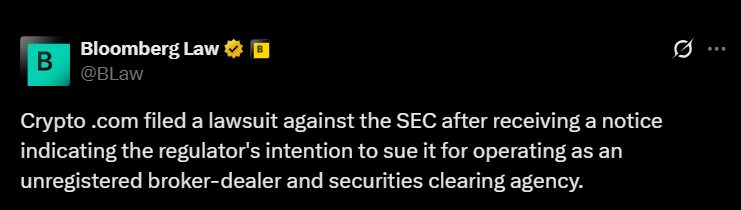

It holds global licenses—including MiCA CASP in Malta, PSP in Bahrain, VASP in Ireland, MAS in Singapore, and MSBs in the U.S.—and carried FDIC coverage on fiat balances, plus $750 million in crypto insurance. Still, it faces regulatory pressures, culminating in a lawsuit against the SEC over unregistered token sales.

Why we chose it

Crypto.com showcases a maturing crypto ecosystem that bridges trading, payments, DeFi, and traditional finance—all under one umbrella. It pairs user convenience with institutional-grade security and compliance, making it a top pick for users seeking broad utility and trust.

Pros

- Rich ecosystem: trading, debit cards, staking, DeFi, NFT, lending

- Industrial-grade security: SOC 2 audits, cold storage, hardware-token auth

- Global regulatory reach: licenses across major markets

- Strong insurance coverage and proof-of-reserves

Cons

- Regulatory litigation with the SEC over token sales

- U.S. service limitations post-Wells Notice

- Platform complexity might overwhelm casual users

6. Gemini – Best Crypto Exchange for Institutional Security & Compliance

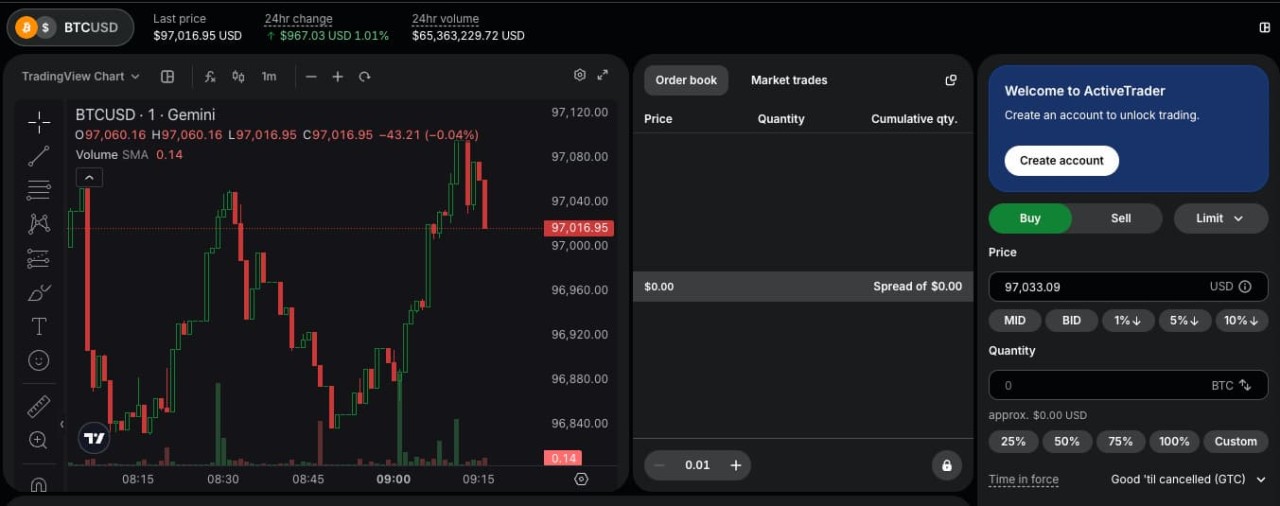

Gemini operates in over 60 countries, offering trading and custody for 150+ cryptocurrencies, including its own U.S.-pegged stablecoin (Gemini Dollar).

It provides tiered service levels—from mobile retail to Gemini Active Trader and institutional custody—protected by insured hot wallets, offline cold storage, and FDIC‑insured bank partnerships.

Its institutional infrastructure includes Gemini Custody and Clearing, servicing hedge funds and ETFs with segregated accounts and banking-grade compliance .

Gemini is regulated under NYDFS, enabling it to hold crypto as trust assets; it offers insurance coverage of $200 million against hot-wallet theft or employee misconduct.

Although it ended its Earn interest program in 2023 amid legal entanglements, the platform continues to enhance features such as Active Trader, stablecoin issuance, and a U.S. payment app .

Why we chose it

Gemini made it to the list because of its compliance and security. Its NYDFS regulation, custody-grade offerings, and dual-layer insurance provide peace of mind for institutional and risk-conscious users.

Pros

- NYDFS-regulated and fiduciary-level custody

- $200 million insurance for hot wallets

- Segregated institutional and Active Trader features

- Stablecoin (GUSD) and payment app integration

Cons

- No margin, futures, or shorting options

- Higher trading fees on retail tiers

- Discontinued Earn program limits yield products

7. Bybit – Best Crypto Exchange for Derivatives & Crisis Response

Bybit, founded in 2018 and headquartered in Dubai (operating from Singapore), quickly became the world’s second-largest crypto exchange by volume.

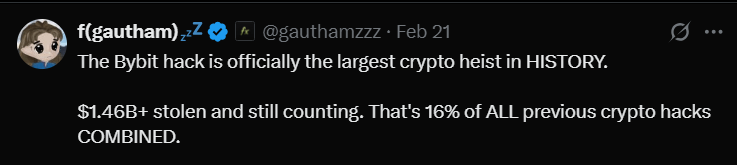

It offers derivatives-first services—spot, futures, margin, P2P—alongside strong API support for advanced traders. However, in February 2025, Bybit was struck by the largest crypto hack ever, losing $1.5 billion in Ethereum from a cold wallet breach.

Within 72 hours, it replenished customer reserves to $14 billion through internal funds and inter-exchange loans, showcasing resilience and crisis management. As of early 2025, Bybit’s market share dropped from ~12% to 8% in spot volume but has stabilized at $14 billion in client assets.

Why we chose it

We chose Bybit for its derivatives expertise, massive scale, and demonstrated ability to manage extreme operational risk.

Pros

- Leading futures/derivatives liquidity

- Rapid crisis response with inter-exchange support

- Strong API and P2P integration

Cons

- Massive $1.5 b hack exposed cold storage risks

- U.S. users are blocked; regulatory ambiguity remains

8. Bitget – Best for Copy Trading & Diversified Utility

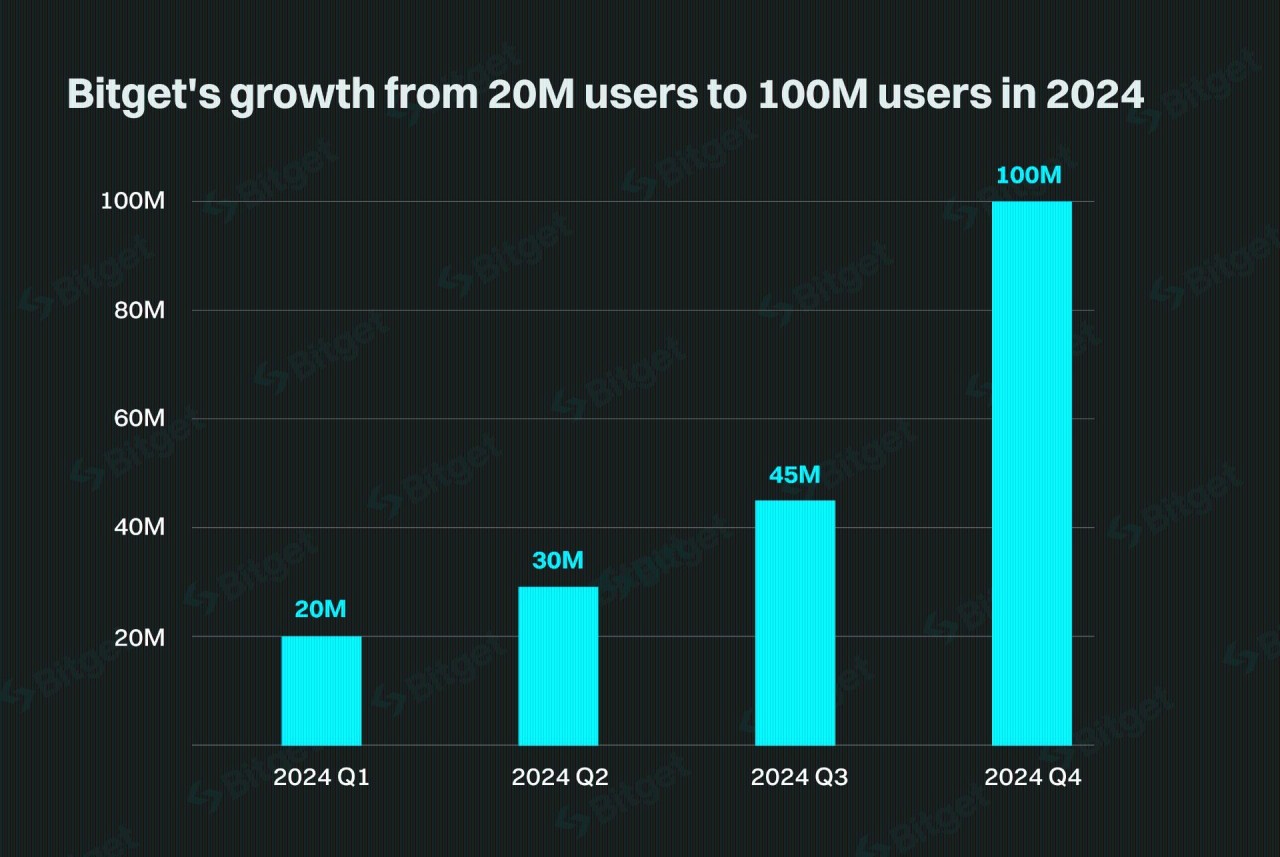

Bitget has become a top exchange, now serving over 100 million users and featuring more than 800 coins and 919 trading pairs.

It pioneered copy trading, with 190,000+ master traders and 800,000+ copiers, and added features like trading bots, grid and portfolio automation, DeFi yield, NFT menus, and API access.

Q4 2024 saw dramatic expansion: 400% user growth, spot volume tripling to $600 billion, daily trading hitting $20 billion, and Bitget achieving the 4th-largest global volume (~4% market share).

Security is emphasized via a $570 m protection fund, 186% reserve ratio, cold storage, multi-layered SSL, 2FA, address whitelisting, proof-of-reserves, and no reported hacks.

Why we chose it

We selected Bitget as the standout copy trading and automation hub, balancing innovation, security, and low fees for traders seeking social and passive income strategies.

Pros

- Industry-leading copy trading and bots

- Wide coin selection (800+ assets) and competitive fees (0.1% spot; 0.02/0.06% futures)

- Robust security: cold storage, multi-sig, protection fund, SSL

- Explosive growth—100m users, 4% market share

Cons

- Less liquidity than Binance

- Regulatory status unclear in markets like the U.S.

9. OKX – Best Crypto Exchange for Transparency & Reliability

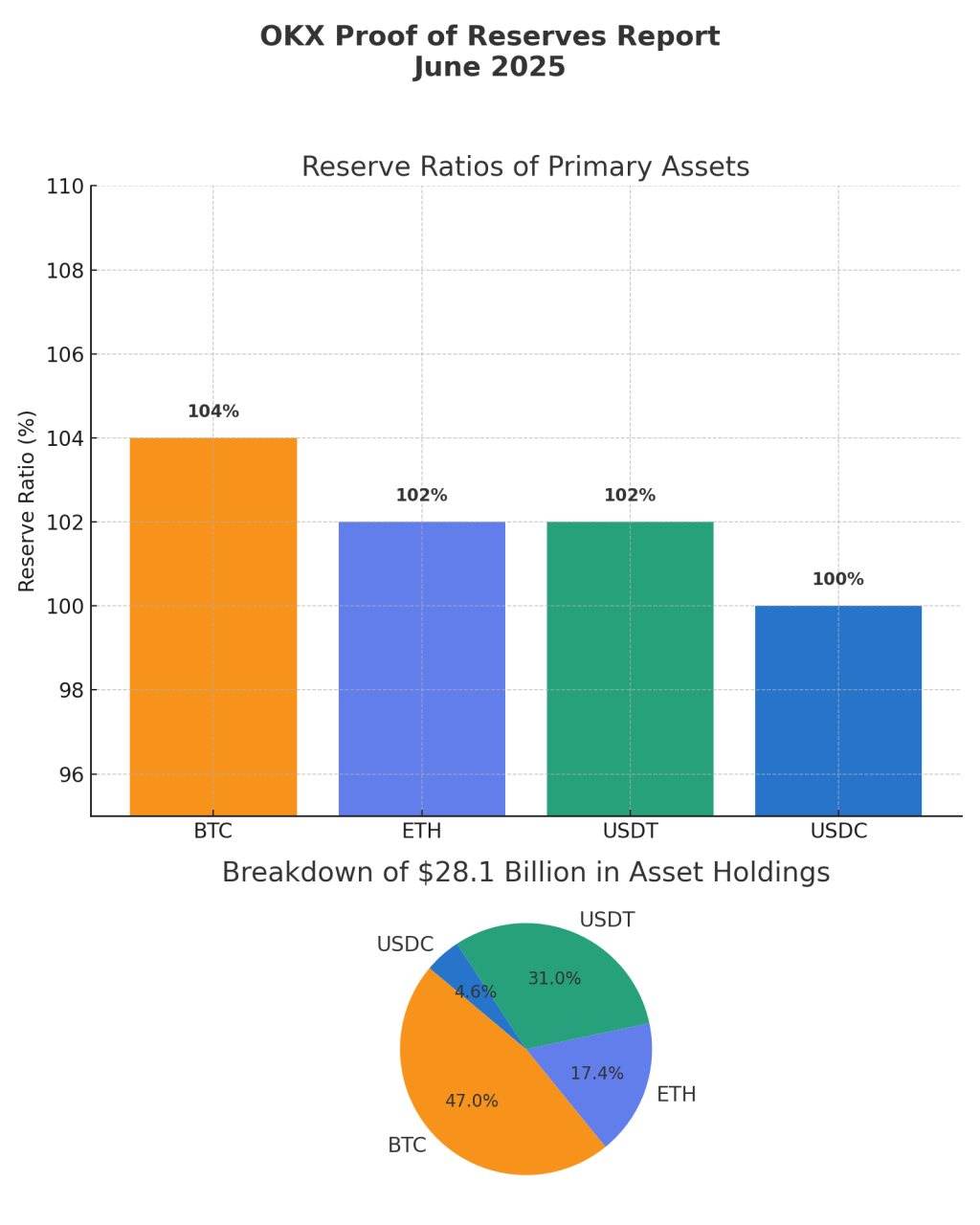

OKX, launched in 2018 and now operating globally (recently relaunching in the U.S. in April 2025), emphasizes reliability through rigorous proof-of-reserves (PoR) protocols.

As of February 2025, its 28th consecutive PoR report—audited by Hacken—confirms $28.1 billion in user-backed assets, with 1:1 or greater coverage across 22 major tokens like BTC (104%), ETH (102%), USDT (102%), and USDC (100%).

This marks a 59% YoY increase in reserves, and earlier audits reveal a consistent pattern of excess backing—e.g., $24.6 billion and 100%+ coverage in March 2025.

Security extends beyond custody. OKX Protect—an AI-powered educational hub—promotes best practices like 2FA, whitelisting, and device monitoring.

PoR verifies over 650,000 wallet addresses using zk‑STARK proofs, optimized for both cryptographic rigor and usability (file size reduced from 2.55 GB to 598 KB). Alongside this, the multi-billion-dollar insurance fund and global compliance (licensing in Dubai, Malta, Singapore, Bahamas, and recent U.S. operations) reinforce operational resilience.

Why we chose it

OKX sets the transparency standard with monthly, independently verified proof-of-reserves, advanced educational security features, and global regulatory licenses—offering peace of mind for users who care about solvency and institutional-grade reliability.

Pros

- Monthly third-party audited PoR with full token coverage (22 assets)

- Asset backing of $28 b+, well above user deposits

- zk‑STARK-powered proofs; optimized for size & verification

- Global licenses and substantial insurance protection

- AI-enhanced user security tools via OKX Protect

Cons

- Interface may be overwhelming for beginners

- Some services unavailable in all jurisdictions due to regulatory variance

- No derivatives like futures/margin in certain regions

10. KuCoin – Best Crypto Exchange for Altcoin Variety

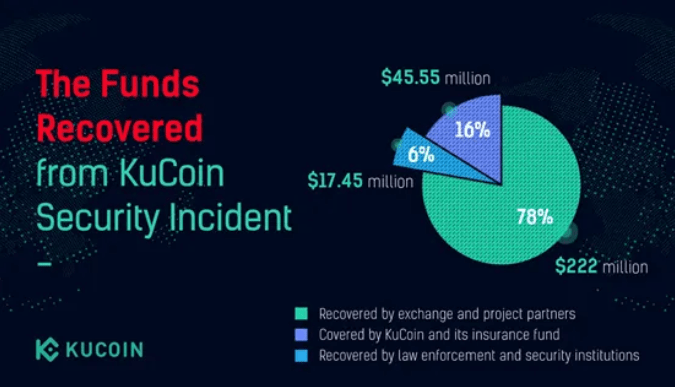

KuCoin is a major player in altcoin trading, listing 700–900+ tokens across 800+ markets. While it suffered a large hack in 2020, it recovered over 84% of stolen funds through collaborations with partners and insurance—$45 million was covered by reserves.

Its growth continued post-2021, and in January 2025 KuCoin settled U.S. legal cases by paying ~$300 million and exiting U.S. markets for two years . Notably, KuCoin still issues monthly PoR proof reports; its 26th report in January 2025 confirmed fully reserved holdings.

The platform supports a wide range of services—spot, margin, futures, bots, staking, P2P, OTC—and runs its own token KCS with fee and reward incentives. It also has an active bug-bounty program and multi-sig cold storage systems .

Why we chose it

Kucoin caught our attention for its altcoin discovery and early-stage tokens. Its massive token library, combined with innovative tools and incentives, makes it the premier destination for traders seeking variety beyond mainstream assets.

Pros

- 700–900+ tokens listed; one of the widest selections in crypto

- Full Proof-of-Reserves and monthly transparency reports

- Recovered from major hack with insurance and partner reimbursements

- Supports diverse features: bots, staking, futures, P2P, OTC

- Incentivized via native KCS token with fee discounts

Cons

- Not available to U.S. users due to legal restrictions

- Regulatory challenges, including recent $300 million settlement

- Past breach raises concerns for security-conscious users

How We Chose the Best Crypto Exchanges

When selecting the best crypto exchanges, we applied a rigorous, multi-factor methodology designed to assess platforms holistically across three core pillars—fees & coin offering, security & regulation, and platform capabilities—while integrating quantitative data and expert benchmarks.

Fees & Coin Offering

Transactions fees, spanning maker/taker, deposit, and withdrawal charges, were scored following the Bitcoin Wisdom framework, where fee competitiveness accounts for up to 17% of overall ranking. We compared standard and VIP tiers, factored in spread costs, and assessed how fee structures impact both occasional investors and active traders.

Coin support was analyzed using a scale inspired by CoinSutra, where asset variety—including stablecoins, DeFi tokens, futures, and niche altcoins—comprised roughly 10% of total scoring importance . Platforms with 700–900+ tokens (e.g., KuCoin, OKX) received top marks for offering exploration and investment diversity at scale.

Security & Regulation

We prioritized institutional-grade safeguards—cold storage ratios, insurance coverage, proof-of-reserves, multi-factor authentication, and vulnerability disclosure policies—as decisive factors in trustworthiness. Exchanges that publish third-party attestations or PoR, such as Binance, OKX, Kraken, and KuCoin, gained higher credibility ratings.

Regulatory examination also included licensing (e.g., FCA, NYDFS, MiCA, FinCEN); we penalized platforms with significant enforcement history or suspicious legal standing. Secure custody models and resilient fund-control measures held paramount importance in selecting exchanges fit for risk-aware users.

Platform Capabilities

We evaluated user experience and tools through a multi-point checklist: trading types supported (spot, margin, derivatives, staking, P2P, DeFi), API accessibility, mobile app quality, charting tools, and customer support responsiveness.

Institutional-grade services like OTC desks, custody accounts, programmable bots, and social features (copy trading, bots) further enhanced scores.

Exchanges delivering comprehensive, polished toolsets—such as Binance, Coinbase, OKX—were prioritized for users spanning beginners to high-frequency traders. Ease of navigation, educational material, and support infrastructure were assessed based on expert reviews and user feedback.

Conclusion

Our list of the best crypto exchanges was designed to cater to a diverse range of use cases—ranging from eToro’s beginner-friendly, multi-asset environment to Binance’s deep-liquidity and institutional-grade platform, and from Coinbase’s U.S. regulatory trust to Kraken’s security-first architecture.

Platforms like Crypto.com, Gemini, Bybit, Bitget, OKX, and KuCoin further tailor experiences around comprehensive ecosystems, compliance rigor, derivatives innovation, social trading tools, transparency, and altcoin breadth. Ultimately, selecting an exchange means balancing features, fees, and trust to suit your investment goals and risk tolerance.

Our latest crypto alerts – instantly accessible

This is how we are guiding our premium members (log in required):