Ether set a fresh record around $4,953 as institutional interest accelerated. ETF flows, staking, and on-chain activity point to a tighter tradable float.

Ether broke its 2021 peak, touching $4,953.76 on August 24, 2025, with market cap near $600B, according to data from CoinMarketCap. The breakout coincides with strong ETF participation and renewed institutional interest, keeping ETH in price discovery.

Here is why we think ETH is the best crypto to buy today.

Fresh ATF, ETFs And Institutional Flows

Ethereum’s prior high around $4,867 from November 2021 is now history, with the new peak printed at $4,953.76. ETF and ETP flows corroborate the move.

In the week to August 18, digital asset products attracted $3.75B, with ETH taking $2.87B, or 77%, lifting year-to-date ETH inflows to a record $11B.

One week later, the complex saw $1.43B in outflows, yet ETH registered a smaller $440M out, leaving month-to-date ETH net inflows close to $2.5B.

US spot Ether ETFs also snapped a four-day outflow streak with $287.6M of net inflows on Thursday. Standard Chartered lifted its year-end ETH target to $7,500.

ALSO READ: Where will Ethereum (ETH) Be in 5 years?

On-Chain Supply And Network Usage

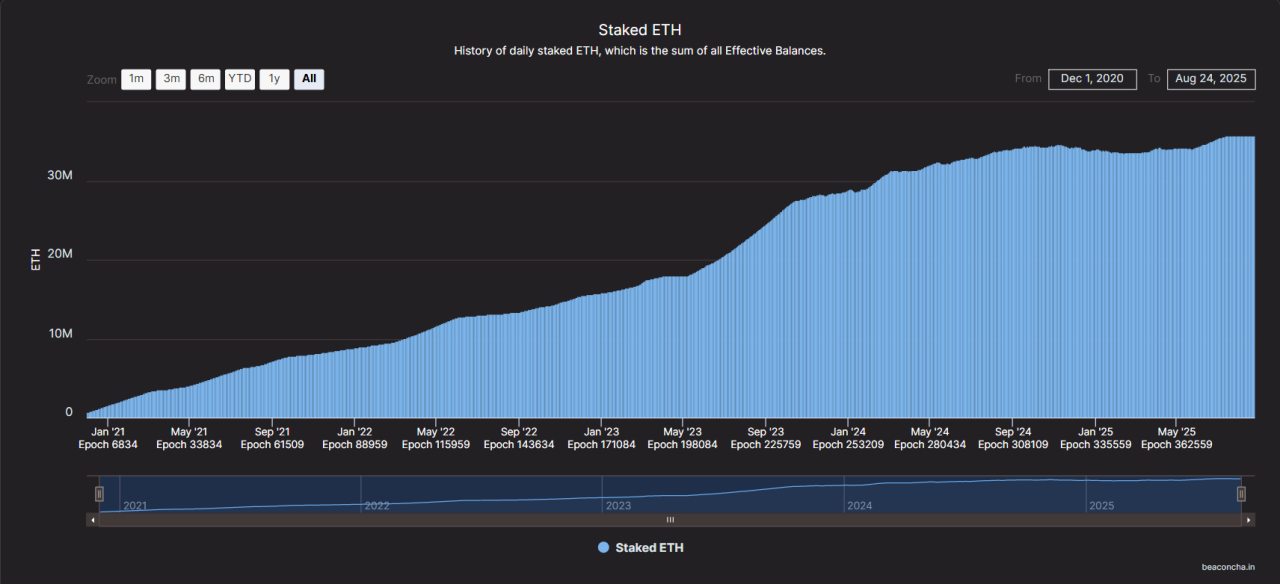

Staking continues to reduce liquid supply. Roughly 35.8M ETH is staked, equal to about 29.6% of supply, with an estimated reward rate near 1.9% today.

This staking footprint helps constrict the tradable float during price discovery. Activity has also stayed firm into the breakout.

Daily active addresses printed 584,921 on August 24, with recent sessions ranging roughly 585k to 690k, consistent with elevated on-chain engagement.

Together, a high staking ratio and persistent user activity provide a tangible foundation for the current move.

RECOMMENDED: Is It Still Worth Buying Ethereum In 2025?

Near-Term Setup, Levels And Risks

A round-number test around $5,000 is the next hurdle after the $4,945.60 print. Monday trade showed a pullback toward $4,611, highlighting the need to respect liquidity pockets.

Watch ETF flow volatility and macro rate expectations, which have recently swung asset prices and sentiment.

RECOMMENDED: How to Buy Ethereum (ETH) in 2025: A Step-by-Step Guide for Beginners

Conclusion

ETH’s breakout aligns with sizable ETF demand, sustained institutional allocations, constrained float, and healthy usage.

Treat $5,000 as a key decision area, size positions for ETF flow swings and macro sensitivity.

Don’t Miss the Next Big Move – Access Alerts Instantly

Join the original blockchain-investing research service — live since 2017. Our alerts come from a proprietary 15‑indicator methodology built over 15+ years of market experience. You’re following the service that identified major turning points through crypto winters and bull runs alike

Act now and see why thousands trust us to deliver signals before markets move.

This is how we are guiding our premium members (log in required):

- BTC Testing Long Term Trendline. Here Is Short and Long Term Guidance. (Aug 26th)

- Crypto – To Break Out Or Not To Break Out? (Aug 23rd)

- What Happened This Week? Leading Indicator Analysis and 7 Token Charts. (Aug 16th)

- Crypto Shows More Resilience Than Expected. A Bullish Impulse May Be Underway. (Aug 9th)

- Prepare To Buy The Dip In Crypto (Aug 2nd)

- Alt Season 2025 – Progress Update (July 26th)