BNB and ADA are tightening within triangle patterns, eyeing breakout levels. BNB offers steady upside; ADA promises higher swing potential.

Both Binance Coin (BNB) and Cardano (ADA) are tightening within triangular consolidation patterns, setting the stage for potential bullish breakouts.

While BNB’s technicals are backed by robust on‑chain fundamentals, ADA’s setup hinges on staking dynamics and chart structure. This comparison explores which coin has the stronger setup and upside potential.

BNB Technical & Fundamental Strength

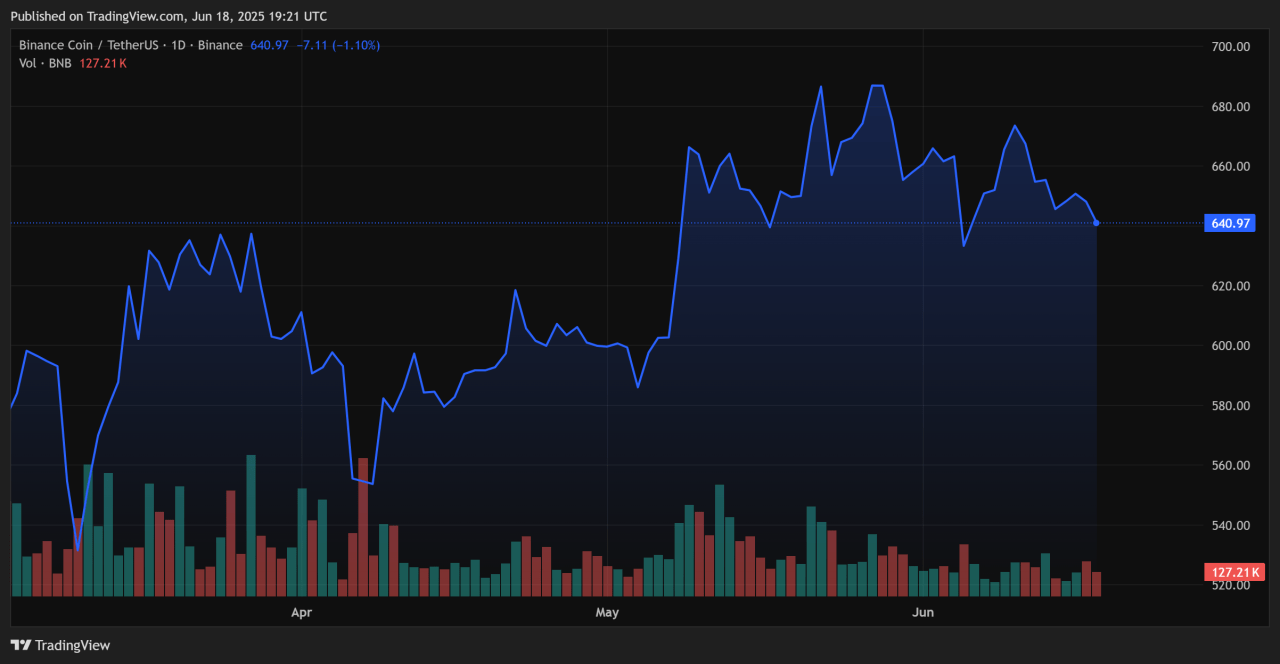

BNB is currently oscillating between $640–$659, with the $647 support level proving reliable over the past few days. On‑chain activity remains strong: the BNB Chain logged over $100 billion in DEX volume last month and saw $10 billion in daily activity.

Technically, BNB has completed a V-shaped recovery and is carving a symmetrical/ascending triangle between $634–$674 .

A break above the upper boundary (~$665–$674) could trigger a move toward the $700 psychological mark, with next targets in the $697–$700 zone. Support is well anchored by both the 50-day SMA (~$641) and 200-day SMA (~$618).

ADA Technical & Fundamental Drivers

ADA is squeezed in a symmetrical triangle with support at $0.59–$0.64 and resistance around $0.65–$0.68. A breakout above $0.64–$0.65 could propel ADA roughly +20–27%, targeting $0.79–$0.85, according to TradingView.

On‑chain and institutional signals are supportive: staking addresses surged past 1.3 million, and whales added 310 million ADA in early June. Meanwhile, Franklin Templeton recently began running Cardano nodes—heightening its institutional pedigree.

However, ADA derivatives data shows rising bearish sentiment, with open interest dropping ~7% and long/short ratio slipping below .

Comparative Outlook & Trading Triggers

- Pattern comparison: Both are winding down in triangle formations, but BNB displays strong on‑chain volume and clear SMA support. ADA depends more on on‑chain dynamics and staking.

- Breakout levels: For BNB, a decisive push above $665–$674 could unlock upside toward $700. For ADA, surpassing $0.65–$0.68 opens a path to $0.80–$0.85 (~+27%).

- Risk/reward: BNB looks steadier with 8–10% upside, ADA offers a larger swing (+20–27%) but comes with elevated short‑term derivatives and sentiment risk.

Conclusion

BNB’s breakout appears more structural—buoyed by ecosystem volume and macro clarity—while ADA offers asymmetric upside thanks to staking dynamics and institutional adoption.

Traders should monitor breakout candlestick volume: a BNB break above $665–$674 targets $700, while ADA over $0.65–$0.68 could aim for $0.80. Stop-losses are prudent (~$638 for BNB, ~$0.60 for ADA).

Ultimately, BNB offers steadier growth; ADA presents a higher‑beta swing play. Choose based on whether you prefer consistency or potential reward.

Our latest crypto alerts – instantly accessible

This is how we are guiding our premium members (log in required):

- The Alt Season Charts (June 15th)

- Another Test of 106.1k, Is This THE Big One? (June 8th)

- How Much Longer Do We Have To Wait For Alt Season 2025? (June 1st)

- The Bitcoin vs. Altcoin Divergence (May 24th)

- Is A Massive Breakout Coming? (May 17th)