Several companies now control a huge share of corporate Bitcoin, giving them real influence over supply and price trends. From miners to tech firms, these holdings show how deeply Bitcoin has entered corporate finance.

More public companies are adding Bitcoin to their balance sheets, treating it as both an investment and a reserve asset.

For some, it’s a hedge against inflation. For others, it’s a business model that supports mining or financial services. These large holdings affect Bitcoin’s liquidity and can move the market when companies buy or sell.

This list looks at the biggest corporate Bitcoin holders right now, based on the most recent company reports and treasury trackers. You’ll see how each firm built its position, why it matters, and what it could mean for the wider Bitcoin market.

RELATED: 5 Major Companies Quietly Acquiring XRP

Here are the 10 big companies that hold the most Bitcoin.

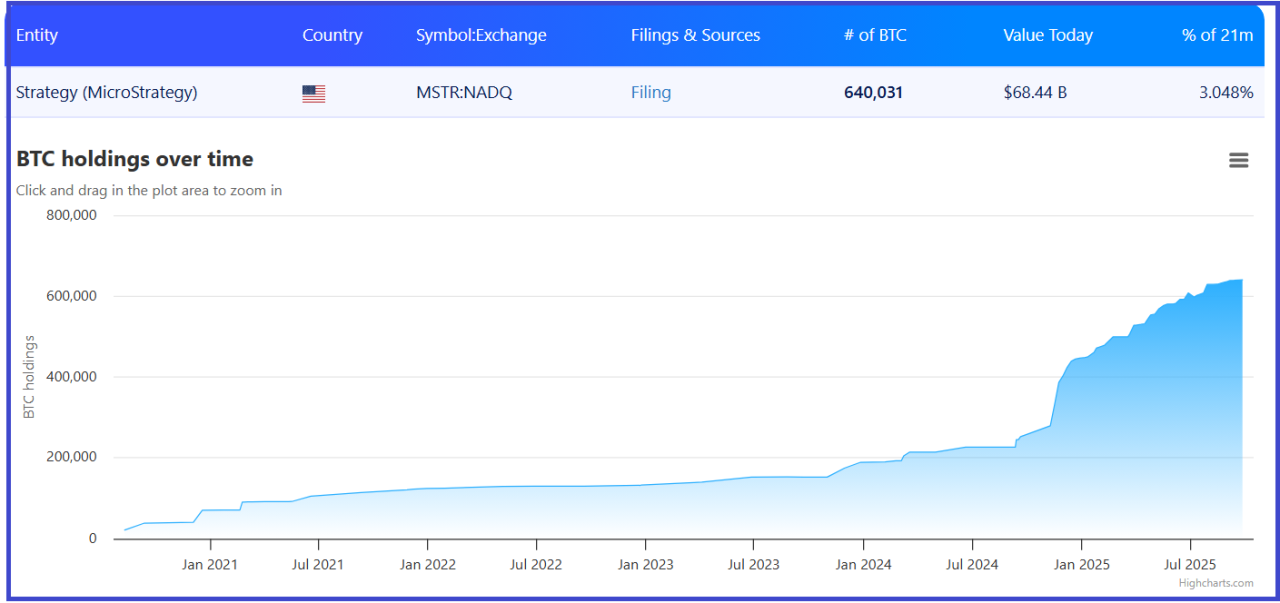

1. Strategy (Formerly MicroStrategy)

Strategy tops the list by a wide margin, holding about 640,250 BTC according to its latest update. The company has turned Bitcoin into its core business strategy, using stock and debt offerings to fund new purchases.

Its position is so large that its actions can sway market sentiment whenever it announces new buys or capital plans. While this approach has made Strategy’s stock closely tied to Bitcoin’s price, it also creates big risks if Bitcoin falls sharply.

RECOMMENDED: How These 3 Crypto Billionaires are Shaping the Market

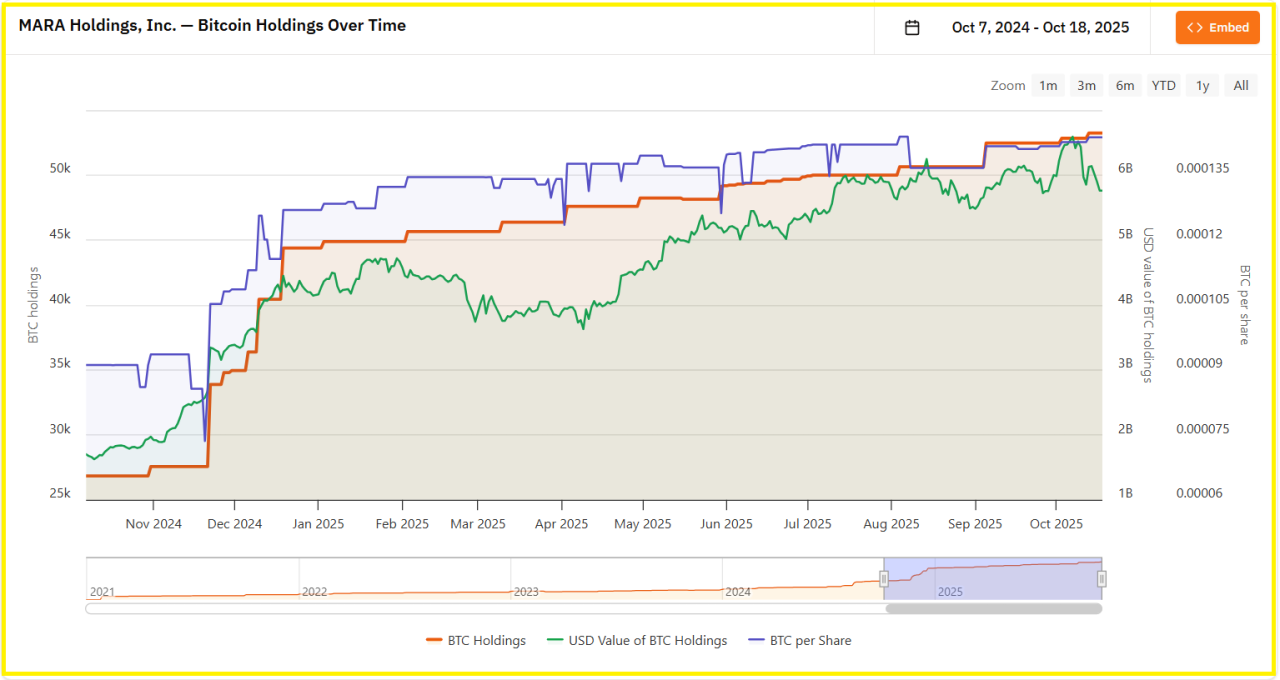

2. Marathon Digital

Marathon Digital is the largest public Bitcoin miner in the United States, holding around 52,850 BTC as of its September report. Unlike companies that buy Bitcoin outright, Marathon earns it through mining, then decides how much to keep or sell.

Its holdings rise or fall depending on production costs, energy prices, and expansion needs. When Bitcoin prices climb, Marathon tends to hold more.

When costs rise, it may sell part of its stack to fund new machines or pay bills. This makes Marathon’s treasury a live indicator of mining economics.

3. Twenty One

Twenty One, also known as XXI, was built around Bitcoin ownership. It holds roughly 43,500 BTC, according to recent filings. Unlike miners or exchanges, the company doesn’t produce or trade Bitcoin.

Instead, it raises funds through investors and uses that money to buy and hold Bitcoin directly.

This makes its share price move almost entirely with Bitcoin’s performance. For anyone watching corporate adoption, Twenty One stands out as a company that treats Bitcoin as both an asset and its core business identity.

4. Metaplanet

Metaplanet has become one of Asia’s fastest-growing corporate Bitcoin holders, now controlling about 30,800 BTC after a series of big purchases. Once a traditional firm with no crypto focus, it shifted to a Bitcoin-based treasury strategy in just a few months.

This move shows how interest in Bitcoin is spreading beyond the U.S. and Europe. In Japan, Metaplanet’s bold shift has sparked conversations about how local rules and taxes might shape future corporate adoption.

Its aggressive accumulation reflects growing confidence in Bitcoin as a long-term store of value.

RECOMMENDED: U.S. Fed Could Soon Become A Buyer Of Bitcoin: Find Out More

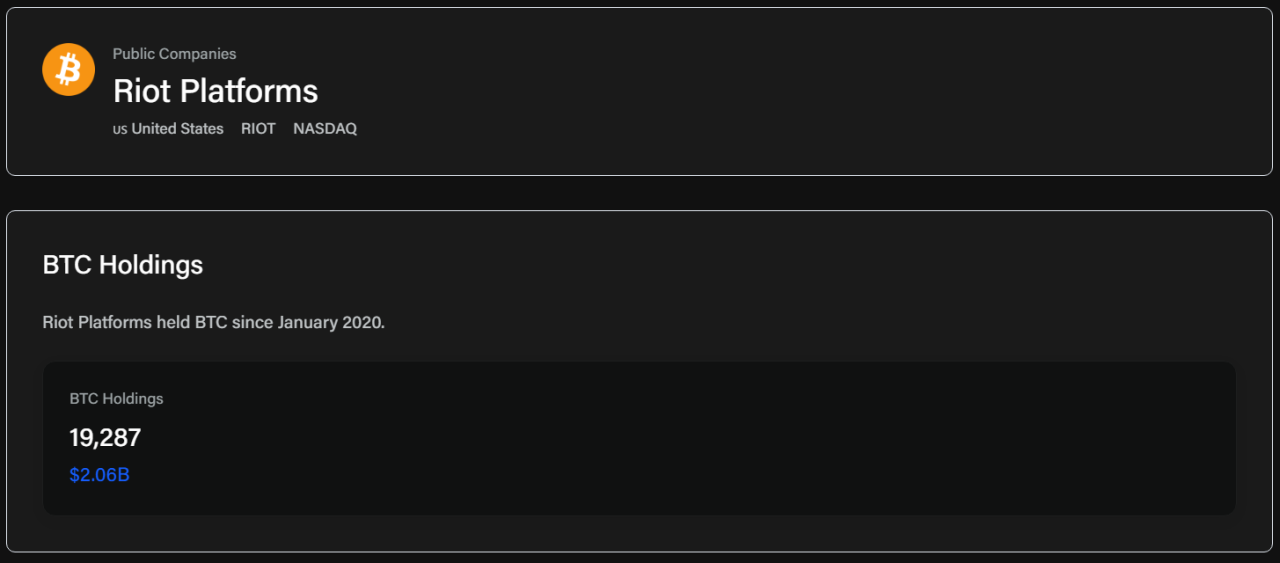

5. Riot Platforms

Riot Platforms holds around 19,287 BTC, based on recent company disclosures. As a major Bitcoin miner, Riot regularly earns new coins and decides how much to sell or keep. This balance changes with electricity costs, mining rewards, and company goals.

Holding more Bitcoin during bull markets and selling some during downturns helps it manage cash flow. Riot’s approach shows how mining firms can build large Bitcoin reserves while staying flexible in a fast-changing market.

6. CleanSpark

CleanSpark holds about 13,000 BTC, according to its latest production and treasury reports. The company mines new coins and keeps a large portion instead of selling them right away.

This shows confidence in Bitcoin’s long-term value but also increases exposure to price drops. CleanSpark’s monthly updates make it easy to track how much Bitcoin it mines, sells, or holds.

This gives investors a clear picture of how the company balances short-term cash needs with long-term asset growth.

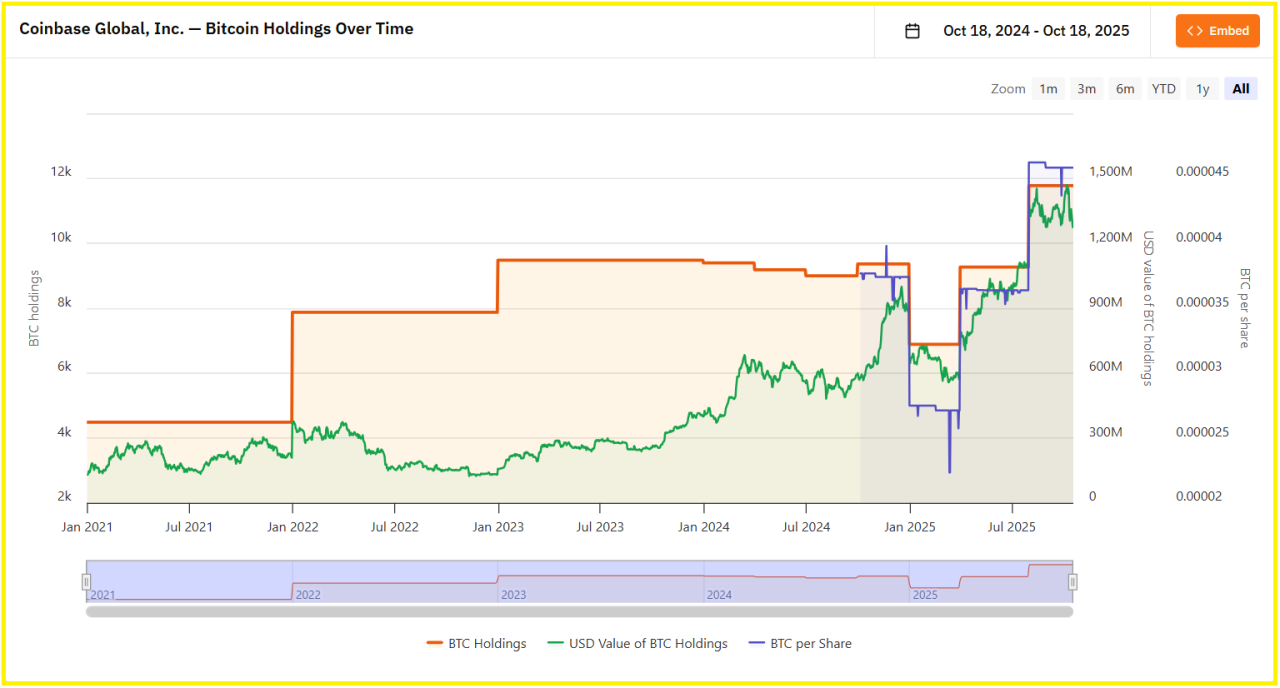

7. Coinbase

Coinbase, one of the largest crypto exchanges, holds about 11,700 to 11,800 BTC for corporate purposes, separate from customer assets. These holdings serve as part of the company’s treasury and trading inventory.

Unlike miners, Coinbase uses Bitcoin mainly to support business operations and liquidity on its platform. The company’s filings show how these holdings change over time. This helps analysts see whether Coinbase is adding to or trimming its corporate exposure as market conditions shift.

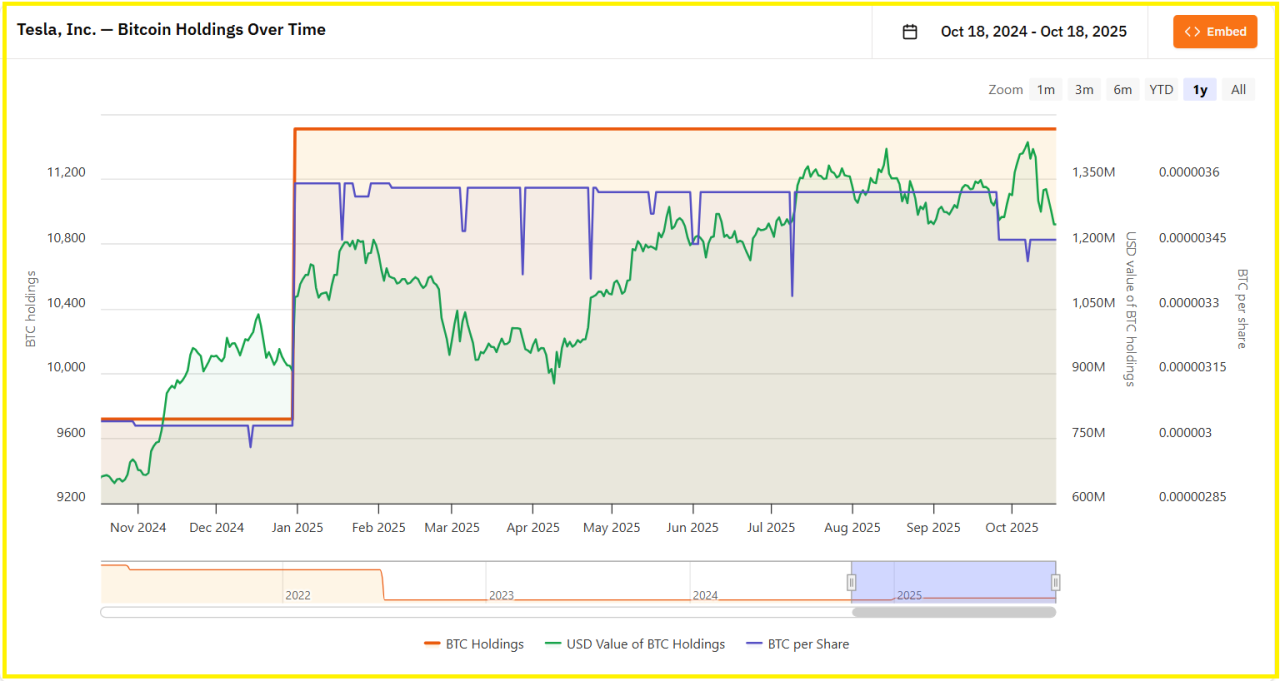

8. Tesla

Tesla’s balance sheet includes around 11,500 BTC, based on public filings and treasury trackers. The company bought Bitcoin as a treasury investment but later sold part of it.

Even though Tesla’s position is smaller today, its move into BTC brought global attention to corporate Bitcoin adoption.

Tesla’s example shows that traditional firms can use Bitcoin as a reserve asset, though it also highlights how price swings can affect earnings and investor sentiment.

RECOMMENDED: Will Bitcoin Ever Hit $1 Million?

9. Hut 8

Hut 8, a major Canadian mining company, holds about 10,667 BTC. Like other miners, it keeps a portion of the Bitcoin it mines, adding to its long-term reserves.

Because it operates in Canada, Hut 8 gives a useful view of how miners outside the U.S. handle their holdings. The company’s reports on production, energy costs, and sales help investors understand how much of its mined Bitcoin may eventually return to the market.

10. Galaxy Digital

Galaxy Digital owns roughly 6,894 BTC across its trading and investment activities. As a financial services company, it holds Bitcoin both as part of its treasury and for market operations.

Unlike miners or treasury-only firms, Galaxy actively trades and manages its holdings to serve clients and capture market opportunities. Its quarterly updates show how much Bitcoin it keeps and how trading performance changes with market conditions.

Conclusion

Corporate Bitcoin holdings are shaping how the market behaves. One company dominates the list, while miners, exchanges, and financial firms hold smaller but still significant amounts. Each group plays a different role. Miners create new supply and decide whether to sell or hold.

Exchanges use Bitcoin to support trading activity, while treasury-focused companies buy and store it for the long term. Together, these firms influence Bitcoin’s liquidity and price movements.

Join eToro today and receive $10 in free crypto on your first deposit. Trade crypto, stocks, and ETFs with powerful tools and social investing features like CopyTrader™

Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here