A $10,000 Bitcoin investment in June 2024 is now worth around $16,000, reflecting a strong 60% annual gain. This surge was driven by ETF inflows and resilient market sentiment.

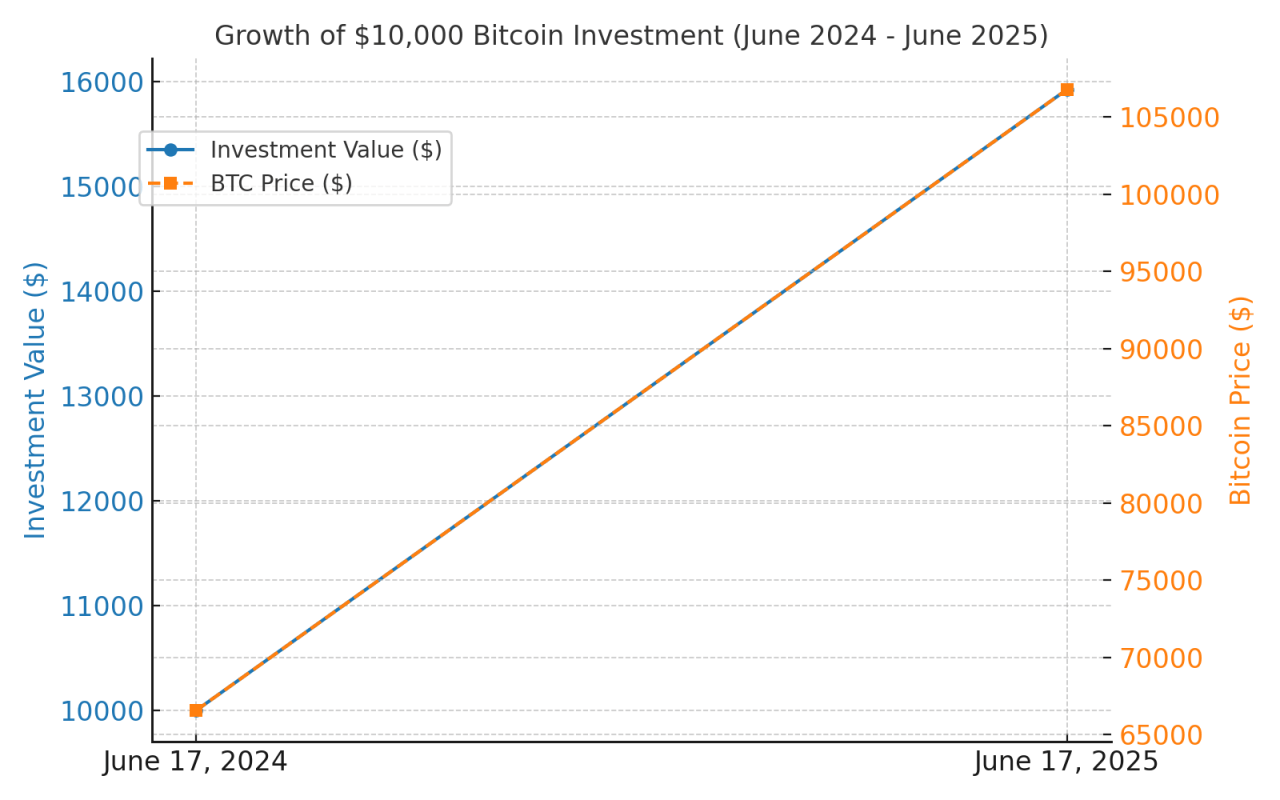

Imagine investing $10,000 in Bitcoin on June 17, 2024, when BTC closed at $66,532. Fast forward to June 17, 2025, and Bitcoin trades around $106, 800, according to CoinMarketCap data. This means your original investment isn’t just intact—it’s up nearly 60%.

Let’s explore the numbers, the market forces behind the surge, and what that means for investors.

Price Performance & Return on Investment

A year ago, your $10,000 would have bought approximately 0.1502 BTC ($10,000 ÷ $66,532). With BTC now hovering above $106,800, that holding is worth slightly over $16,000, generating a profit of about $6,000, or a return of roughly 60%.

That outpaces most major asset classes over the same period—by comparison, the S&P 500 returned closer to 10–15%, while gold saw far more modest gains.

Market Drivers Behind the Rally

Several powerful forces propelled Bitcoin’s rise. First, the April 2024 halving, which cut new Bitcoin issuance, tightened supply just as demand from institutions surged. Spot-BTC ETFs launched earlier this year, attracting billions of dollars in inflows, boosting prices .

Additionally, despite global uncertainties—like geopolitical tensions—Bitcoin demonstrated surprising resilience. It briefly dropped amid Israel‑Iran conflict worries in early June but quickly rebounded above $107,000, showing investor confidence.

Net Gains and Key Considerations

By today, your $10,000 has grown to approximately $16,000, netting a gain of around $6,000. That performance is exceptional, yet it’s important to note that entry timing played a significant role: summer 2024 was a relatively subdued period for Bitcoin. Holding costs—like trading fees, taxes on capital gains, or custody fees—could reduce net returns.

Finally, the path hasn’t been smooth: BTC has fluctuated between $103,000 and $108,000 in recent weeks, reflecting its volatility .

Conclusion

In short, a $10,000 Bitcoin investment made one year ago would today be worth around $16,000, reflecting an impressive ~60% gain. The drivers behind this rally include supply constraints, institutional demand, and a strong macro backdrop.

Of course, these gains accompany risk—volatile swings, timing sensitivity, and costs remain critical considerations. Bitcoin has outperformed traditional assets dramatically, but the journey for investors remains anything but risk-free.

Our latest crypto alerts – instantly accessible

This is how we are guiding our premium members (log in required):

- The Alt Season Charts (June 15th)

- Another Test of 106.1k, Is This THE Big One? (June 8th)

- How Much Longer Do We Have To Wait For Alt Season 2025? (June 1st)

- The Bitcoin vs. Altcoin Divergence (May 24th)

- Is A Massive Breakout Coming? (May 17th)

- Top Altcoin Picks in the Strongest Emerging Narrative (May 9th)

- Bitcoin’s Must-Watch Chart Structure, What It Means For Top Altcoins (May 6th)