Institutional inflows, regulatory momentum, corporate adoption, macro conditions, and scarcity make Bitcoin a compelling buy today.

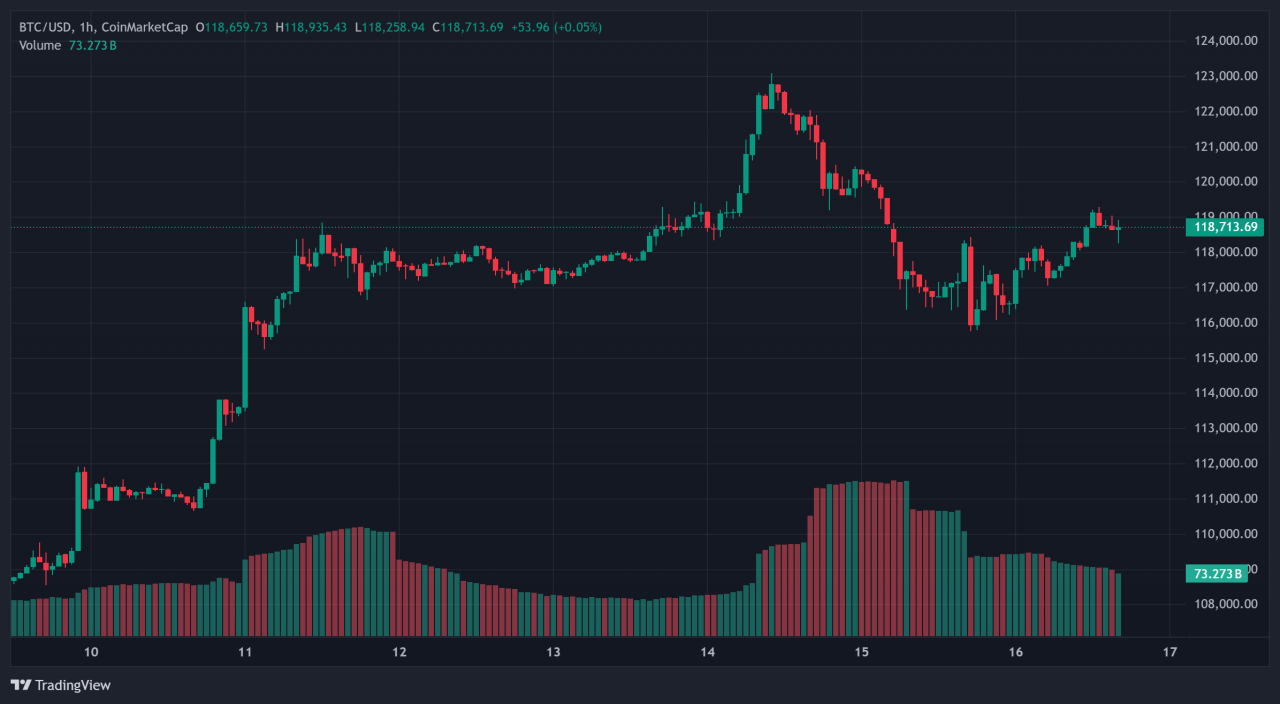

Bitcoin is in the spotlight again, trading above $118,000 as of July 16, 2025—up from around $105K at the start of the month. The rally is largely driven by massive institutional inflows and favorable policy moves.

This surge highlights Bitcoin’s evolving role as a mainstream asset, not merely another speculative bet.

That said, here are five reasons you should buy Bitcoin today.

1. Institutional Inflows & ETFs

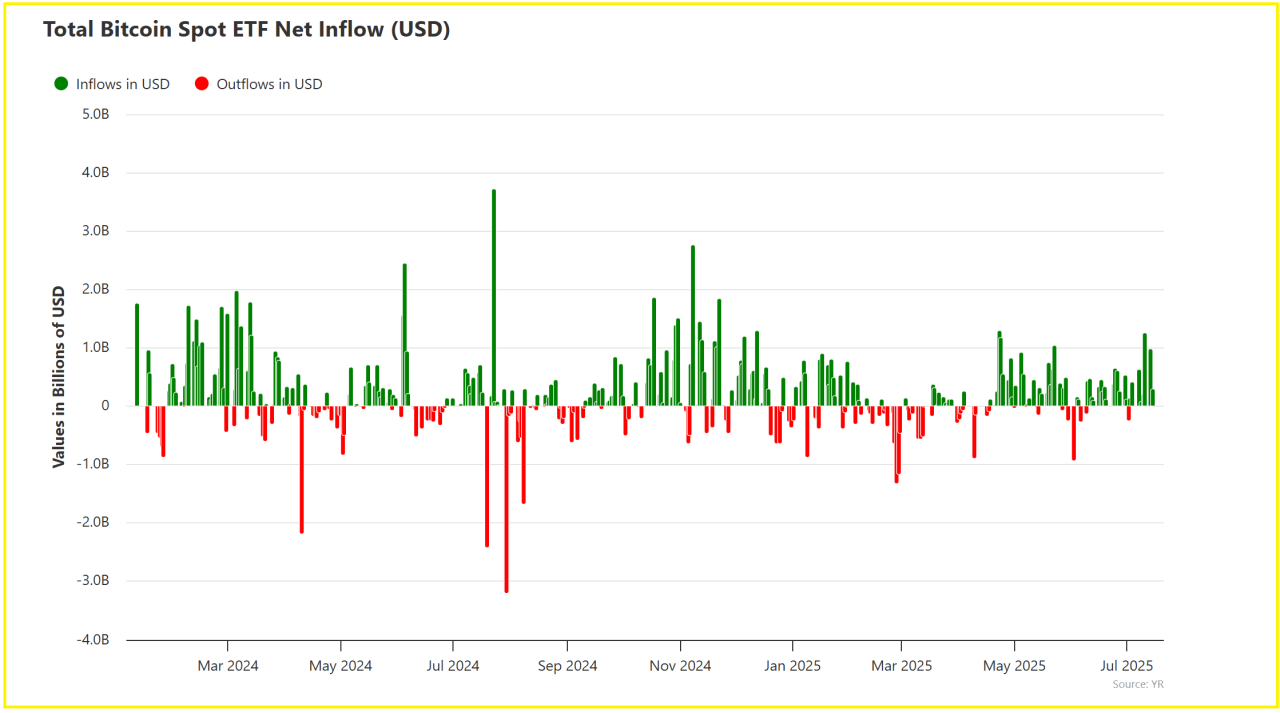

Since their launch in January 2024, spot Bitcoin ETFs have attracted an astounding $52 billion in inflows, with $14.8 billion pouring in during 2025 and over $4 billion just in July. BlackRock’s IBIT alone holds more than $83 billion in BTC, cementing its place as the fastest-growing ETF in history.

These are not small retail trades; the flow includes $1.18 billion in a single day and $403 million over nine consecutive days.

This demand pushes prices to record highs and reflects confidence among “whales” and institutional players. Crucially, ETF structures mandate buying the underlying asset, which translates to direct BTC support, not just paper exposure.

2. Pro‑Crypto Regulation & Strategic Bitcoin Reserve

The U.S. has made significant strides in crypto regulation, especially during the so-called “Crypto Week” in Washington. On March 6, 2025, the White House issued an Executive Order to create a Strategic Bitcoin Reserve.

This mandates that seized Bitcoins, about 200,000 BTC (worth ~$17 billion), be retained and held as a national asset, a sort of “digital Fort Knox”.

That same order also set up a U.S. Digital Asset Stockpile for other cryptocurrencies and directed federal agencies to audit and report holdings to a new Presidential Working Group on Digital Asset Markets.

These coordinated efforts provide clarity and legitimacy, reducing regulatory uncertainty and encouraging institutional participation.

Moreover, Trump’s early 2025 executive order featuring EO 14178 revoked prior restrictions on CBDCs and officially charged regulators to propose a comprehensive digital-assets framework within 180 days.

Together, these moves are laying a policy foundation that positions Bitcoin as a strategically significant asset in the U.S. financial system.

3. Corporate Treasury Adoption

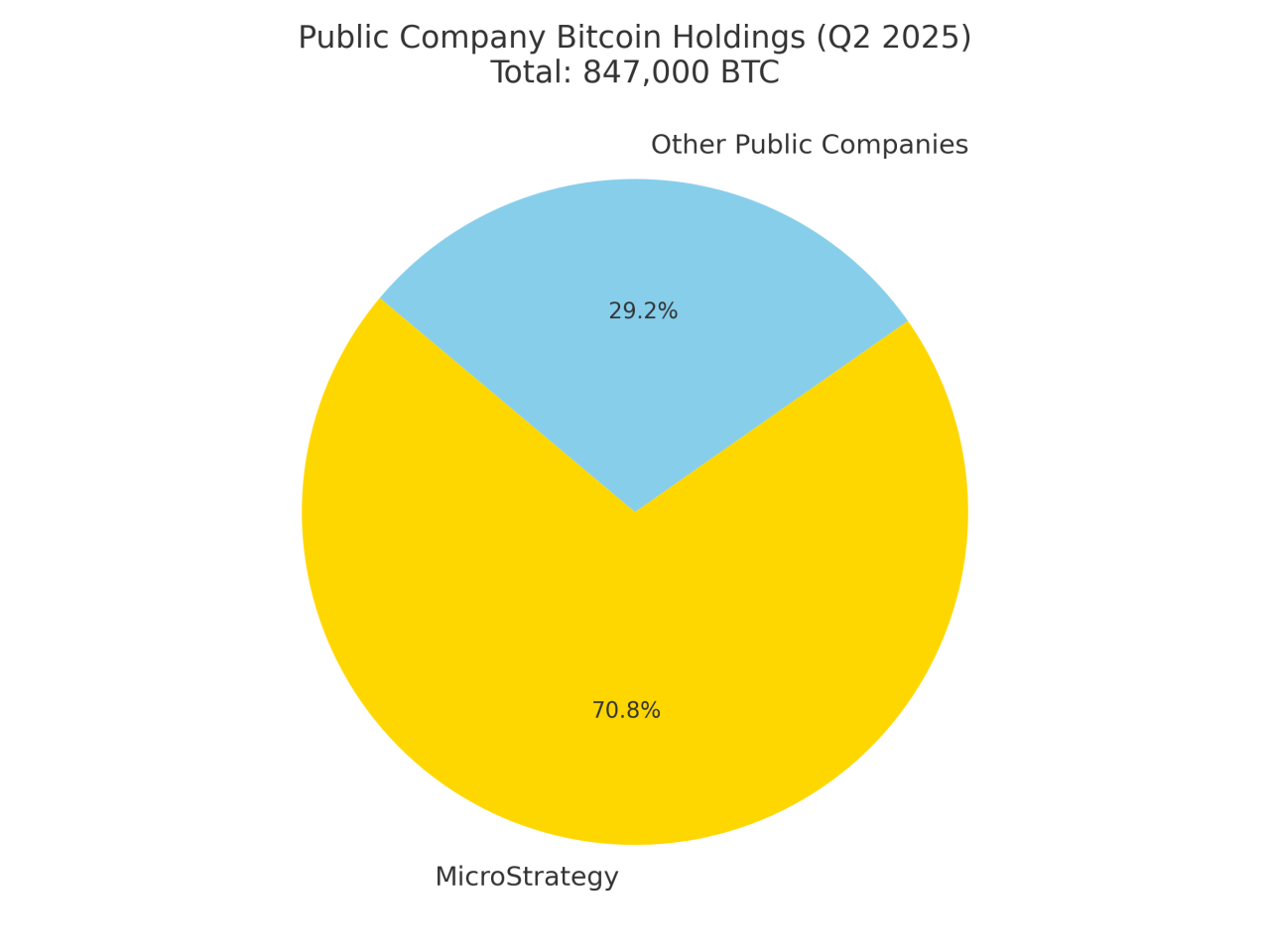

Corporate adoption of Bitcoin isn’t limited to MicroStrategy. As of Q2 2025, 135 publicly traded companies – including Tesla, GameStop, and Metaplanet – hold a combined 847,000 BTC, accounting for roughly 4% of total supply.

In June alone, 26 new companies began accumulating Bitcoin, signifying that treasurers view it increasingly as a strategic reserve rather than speculation.

MicroStrategy (rebranded as Strategy) remains the leader with over 600,000 BTC, a stock of more than $73 billion worth, added via $472 million in fresh purchases in July .

While short-seller Jim Chanos has criticized MicroStrategy’s valuation, its first-mover advantage and sizable balance sheet continue to attract investor attention.

This momentum shows that buying bitcoin today isn’t just a cautionary strategy, it’s becoming oligopolistic corporate finance. Companies see BTC not just as a hedge, but as an inflation-proof bank treasury alternative amid macro uncertainty.

4. Macro Environment & Inflation Hedge

Expectations for Federal Reserve rate cuts in 2025 are creating a weakening environment for the U.S. dollar. When the Fed hinted at cutting rates in June, Bitcoin rallied near $108,000 within hours.

Additional macro pressures – tariffs, trade tensions, and geopolitical risks – strengthen Bitcoin’s case as a decentralized macro hedge. Cointelegraph notes that such instability often accelerates BTC investment due to its lack of ties to fiat or policy decisions.

Though some academic voices challenge Bitcoin’s inflation-hedge credentials, the real-world trend speaks volumes. With actual funds flowing into spot ETFs, Bitcoin is increasingly being used as a strategic defense in a volatile economic environment.

5. Supply Scarcity & Network Utility

Bitcoin’s supply is fundamentally capped at 21 million, and by May 2025 over 93.3% has already been mined. What’s more, a significant share (estimates suggest 3–3.8 million BTC) is permanently lost, pushing actual circulating supply even lower.

Meanwhile, growth in layer‑2 utility enhances Bitcoin’s day‑to‑day relevance. The Lightning Network’s public capacity recently peaked at 14,350 BTC, with institutional uptake boosting transactional utility.

For individuals and businesses, Lightning offers fast, low-cost payments; suitable for micropayments, remittances, and real-world commerce.

The shrinking supply and rising utility makes Bitcoin not just a digital gold play, but a leveraged bet on global adoption and a future where digital, decentralized money plays a mainstream role.

Conclusion

From substantial institutional Bitcoin ETF inflows to government-level legitimacy, from corporate treasury strategies to macro hedging and supply scarcity – today the case to buy bitcoin is stronger than ever.

With over $52 billion ETF inflows, 135+ public firms holding nearly 847,000 BTC, and built-in supply caps fueling scarcity, Bitcoin stands out as a uniquely potent investment.

However, remember BTC remains volatile. Smart investors should consider dollar-cost averaging, maintain a modest allocation (1–5%), and monitor macro signals. If you’re searching for reasons to invest in Bitcoin in 2025, this convergence of financial trends makes now a logical entry point.

Our latest crypto alerts – instantly accessible

This is how we are guiding our premium members (log in required):

- Is Alt Season 2025 Here? (July 15th)

- Alts Breakout Happening Now. These Are Price Time Combinations To Watch. (July 11th)

- Crypto Charts Are Improving, Just Have A Look At These 3 Leading Indicators (July 6th)

- Alt Season 2025: The Animals Are Back, This May Be A Very Bullish Signal (June 29)

- BTC And Altcoins About To Hit Big Support Areas (June 22)

- The Alt Season Charts (June 15th)

- Another Test of 106.1k, Is This THE Big One? (June 8th)

- Bitcoin BTC Price Predictions

- 15 Cryptocurrency Forecasts 2025

- Best Crypto To Invest $10,000 Right Now: XRP, ETH Or Bitcoin?

- How Institutional Inflows & Regulatory Clarity Are Fuelling Bitcoin As A Macro Asset

- Which Cryptocurrency Is More Likely To Be A Millionaire Maker: XRP vs Bitcoin?

- Bitcoin Hits Record High – Is It Too Late To Invest?